3 Reasons to Add Live Oak (LOB) Stock to Your Portfolio Now

Live Oak Bancshares, Inc. LOB stock is well-poised to gain from its strong fundamentals, decent loan and deposit balances, and diversified fee-income sources.

The Zacks Consensus Estimate for Live Oak's earnings has been revised 19.7% and 9.1% upward for 2023 and 2024, respectively, over the past 30 days. This shows that analysts are optimistic regarding the company’s earnings prospects. LOB currently sports a Zacks Rank #1 (Strong Buy).

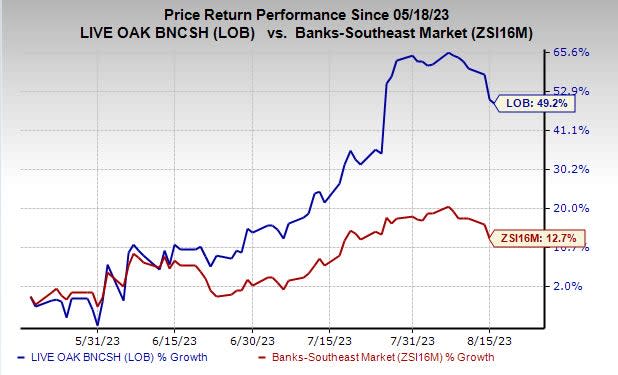

Over the past three months, shares of the company have gained 49.2% compared with the industry's upside of 12.7%.

Image Source: Zacks Investment Research

A few aspects, which make the company an attractive investment option right now, are mentioned below.

Earnings Growth: In the past three to five years, Live Oak has witnessed an earnings per share gain of 50.5%, which is significantly higher than the industry’s growth of 10.2%. The momentum is expected to continue in the near term. Though the bank’s earnings are projected to decline at a rate of 62.8% this year, it is likely to witness a rise of 80.2% in 2024.

Revenue Strength: LOB’s net revenues witnessed a compound annual growth rate of 40.6% over the last three years (2019-2022). The improvement was backed by decent loan and deposit balances and diversified fee income sources. While sales are expected to decline 21.4% in 2023, it is anticipated to rise 20.8% in 2024.

Strong Leverage: Live Oak’s debt/equity ratio is 0.00 compared with the industry average of 0.30, displaying no debt burden relative to the industry. It highlights the financial stability of the company, even in an unstable economic environment.

Other Bank Stocks Worth a Look

A couple of other top-ranked stocks from the banking space are Bank7 BSVN and First Community Bancshares FCBC.

The Zacks Consensus Estimate for Bank7's current-year earnings has been revised 7.4% upward over the past 30 days. Its shares have gained 11.5% in the past three months. Currently, BSVN sports a Zacks Rank #1.

First Community carries a Zacks Rank #2 (Buy) at present. Earnings estimates for 2023 have been revised 1.1% upward over the past 60 days. In the past three months, FCBC shares have rallied 24.2%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Community Bancshares, Inc. (FCBC) : Free Stock Analysis Report

Live Oak Bancshares, Inc. (LOB) : Free Stock Analysis Report

Bank7 Corp. (BSVN) : Free Stock Analysis Report