3 Reasons to Buy Teladoc Stock Like There's No Tomorrow

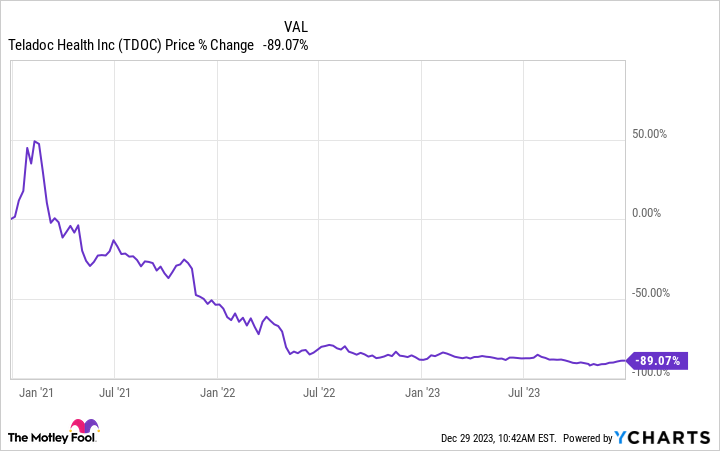

Telehealth leader Teladoc Health (NYSE: TDOC) is suffering the same fate as many other so-called "pandemic stocks." Since the health crisis is largely in the rear-view mirror (even if COVID itself is not), the traction that the company gained from it has faded -- and then some. Teladoc shares are down by 89% in the past three years, and are trading well below where they were before the pandemic began.

Still, there remain excellent reasons to invest in Teladoc, particularly for investors willing to hold its shares for a while. Let's consider just three.

1. Teladoc is building a moat

Despite Teladoc's share price declines of the past few years, the kinds of services it provides have continued gaining traction with the public. Telemedicine wasn't just some convenient pandemic trend; the industry is projected to expand through the end of the decade and likely beyond. Of course, this alone doesn't mean Teladoc will be one of the winners in the field, but the good news is the company is building a competitive advantage powered by network effects.

Teladoc ended the third quarter with 90.2 million U.S. integrated care members, an increase of 10% year over year. The company also had 459,000 members for its BetterHelp therapy service and 1.1 million within its chronic care program. The more that members join its platform, the more attractive it becomes to physicians and health systems, and vice versa. This factor could help Teladoc remain a relevant player in the telehealth industry.

2. Gross margins are strong

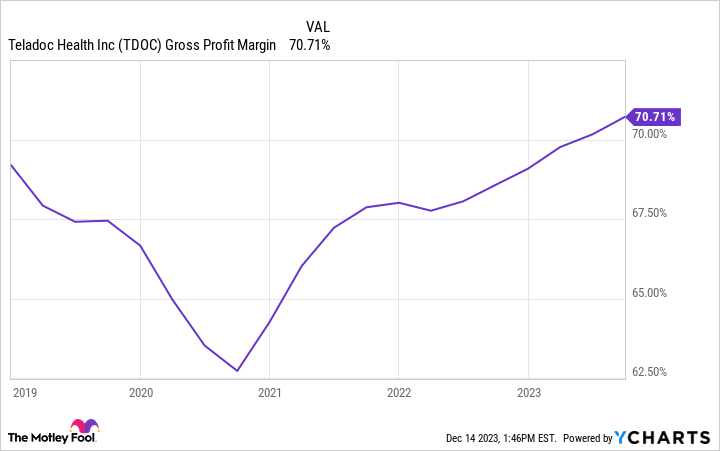

One of the problems with Teladoc's business is that it isn't profitable yet, although it is improving on that front. In the first nine months of 2023, the company's net loss of $1.17 per share was miles better than the net loss of $61.09 per share reported in the year-ago period. Despite the red ink on the bottom line, Teladoc's gross margins are generally high.

Through Sept. 30, it registered an adjusted gross margin of 70.8%, up from the 68.6% recorded in the comparable period of the previous year. Teladoc's margins have generally been in this range.

That naturally raises the question of why the company isn't profitable yet. The answer is that it has had to spend a lot of money on advertising and marketing. In addition, over the past two years, some went into ramping up its BetterHelp service. The company argued last year that it had a lower yield on advertising spending than it expected for its therapy platform, partly because the field was becoming increasingly competitive.

The good news is that once BetterHelp gains prominence and becomes better established, there will be less of a need for aggressive advertising campaigns. That also applies to the rest of Teladoc's business. The company should then benefit from its strong gross margins and begin turning in profits.

3. The price looks right

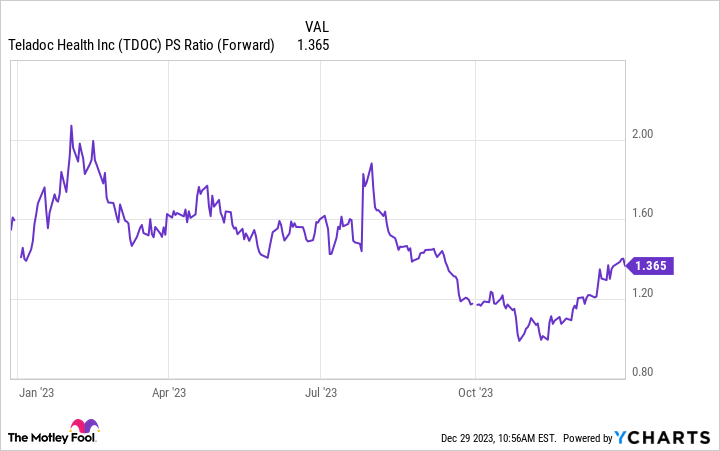

Teladoc's shares arguably rose too fast in the first year or so of the pandemic. The stock became wildly overvalued and was due for a correction. But the reverse now seems true. The sell-off has gone too far, and Teladoc's shares look undervalued. The stock trades today at a forward price-to-sales of just about 1.4.

For context, the undervalued range for that metric generally starts under 2. Sure, Teladoc's revenue isn't growing as fast as it once was, but those comparisons are a bit unfair to the company. While it remains unprofitable, that should change in time. In my view, Teladoc is a screaming buy at current levels, especially for investors who plan on staying the course and holding shares for the long term.

This stock may not double overnight -- it could remain volatile through much of 2024. But it looks likely to reward patient investors, which is an excellent reason to buy its shares now.

Should you invest $1,000 in Teladoc Health right now?

Before you buy stock in Teladoc Health, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Teladoc Health wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Prosper Junior Bakiny has positions in Teladoc Health. The Motley Fool has positions in and recommends Teladoc Health. The Motley Fool has a disclosure policy.

3 Reasons to Buy Teladoc Stock Like There's No Tomorrow was originally published by The Motley Fool