3 Reasons to Hold Inspire Medical (INSP) Stock in Your Portfolio

Inspire Medical Systems, Inc. INSP is well-poised for growth in the coming quarters, courtesy of its focus on research and development (R&D). The optimism led by a solid third-quarter 2023 performance and its global presence are expected to contribute further. However, concerns regarding overdependence on the Inspire system and stiff competition persist.

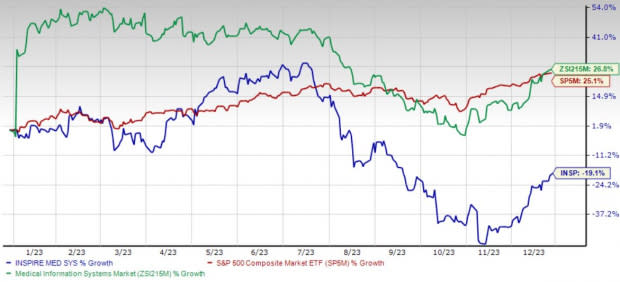

Over the past year, this Zacks Rank #3 (Hold) stock has lost 19.1% against a 26.8% rise of the industry and 25.1% growth of the S&P 500.

The renowned medical technology company focused on obstructive sleep apnea (OSA) has a market capitalization of $6.02 billion. The company projects 50% growth for 2024 and expects to maintain its strong performance. Inspire Medical has delivered an earnings surprise of 51.9% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Focus on R&D: Inspire Medical’s foundational commitment to driving innovation and improving patient lives fuels its continuous product development, raising our optimism. Per management, the company intends to invest in existing and next-generation technologies to further improve its products and clinical outcomes, optimize patient acceptance and comfort and broaden the patient population that can benefit from Inspire therapy.

Global Presence: Inspire Medical’s management is currently planning to continue to expand the size and geographic scope of the company’s direct sales organization to generate future revenue growth. This looks promising for the stock.

During the three months ended Sep 30, 2023, Inspire Medical created 13 new U.S. sales territories. During that same period, it also activated 62 new centers, bringing the total to 1,107 U.S. medical centers implanting Inspire therapy as of Sep 30, 2023.

Strong Q3 Results: Inspire Medical’s solid third-quarter 2023 results buoy our optimism. The company recorded a robust improvement in the top line and strength in year-over-year geographic results. Activation of new U.S. centers and the creation of new U.S. sales territories were also recorded during the reported quarter.

Downsides

Overdependence on Inspire System: Sales of Inspire Medical’s Inspire system accounted for primarily all its revenues for the past few years. Its ability to execute its growth strategy and become profitable will, therefore, depend upon the adoption of Inspire therapy to treat moderate-to-severe OSA in patients who are unable to use or get consistent benefits from continuous positive airway pressure. Management cannot ensure that the company’s Inspire therapy will achieve or maintain broad market acceptance among physicians and patients.

Stiff Competition: The medical technology industry is highly competitive, subject to change and significantly affected by new product introductions and other activities of industry participants. Inspire Medical’s competitors have historically dedicated and will continue to dedicate significant resources to promote their products or develop new products or methods to treat moderate to severe OSA. The company considers its primary competition to be other neurostimulation technologies designed to treat OSA.

Estimate Trend

Inspire Medical has been witnessing a positive estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for its loss per share has narrowed from $1.76 to $1.48.

The Zacks Consensus Estimate for the company’s fourth-quarter 2023 revenues is pegged at $177.4 million, suggesting a 28.7% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 17.3%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 36.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 39.9% compared with the industry’s 9.5% rise in the past year.

HealthEquity, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 27.5%. HQY’s earnings surpassed estimates in each of the trailing four quarters, with the average being 16.5%.

HealthEquity has gained 7.6% against the industry’s 6% decline over the past year.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15.8%. ITGR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 11.9%.

Integer Holdings’ shares have rallied 46.4% compared with the industry’s 4.5% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

Inspire Medical Systems, Inc. (INSP) : Free Stock Analysis Report