3 Reasons to Hold QuidelOrtho (QDEL) Stock in Your Portfolio

QuidelOrtho Corporation QDEL is well-poised for growth in the coming quarters, courtesy of its strong product portfolio. The optimism led by a solid second-quarter 2023 performance and its continued spending on research and development (R&D) are expected to contribute further. However, headwinds due to data security threats and overdependence on diagnostic tests persist.

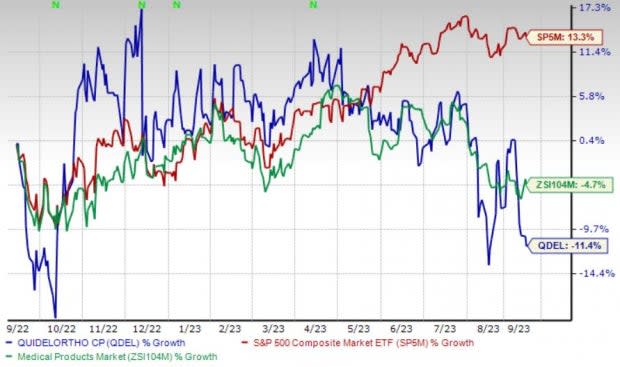

Over the past year, this Zacks Rank #3 (Hold) stock has lost 11.5% compared with a 4.7% decline of the industry. The S&P 500 has witnessed 13.3% growth in the said time frame.

The renowned rapid diagnostic testing solutions provider has a market capitalization of $4.92 billion. QuidelOrtho projects 9.4% growth for 2024 and expects to maintain its strong performance. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 66.7%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Product Portfolio: We are upbeat about QuidelOrtho’s current product clientele. It sells its products directly to end users and distributors for professional use in physician offices and hospitals, among others, as well as for individual, non-professional, over-the-counter use. QuidelOrtho’s diagnostic testing solutions include the Sofia and Sofia 2 Analyzers, QuickVue, and InflammaDry and AdenoPlus products.

On the second quarter of 2023 earnings call in August, QuidelOrtho’s management confirmed that Sofia’s non COVID-19 pull-through continued to increase.

Continued Spend on R&D: QuidelOrtho’s long-term growth and profitability will depend, in part, on its ability to retain and grow its current customers and attract new customers by developing and delivering new and improved products and services that meet customers’ needs and expectations. As a result, QuidelOrtho’s management expects to continue to maintain its emphasis on R&D investments for longer-term growth, including its next-generation platforms and assays, as well as additional assays to be launched on its current platforms.

Strong Q2 Results: QuidelOrtho’s robust second-quarter 2023 results buoy optimism. The company recorded an uptick in its overall top line and Non-Respiratory revenues. Robust revenues from its Labs segment and Other region were also recorded. The company also saw solid revenues from its Instrument revenue category. QuidelOrtho also witnessed a growth in its integrated installed base and automation during the quarter.

Downsides

Data Security Threats: QuidelOrtho utilizes complex information technology systems to transmit and store information, including proprietary information, to support its business and process. In future, these systems may prove inadequate to its business needs and necessary upgrades may not operate as designed, resulting in high costs or disruptions in portions of the company’s business.

Overdependence on Diagnostic Tests: A significant percentage of QuidelOrtho’s revenues comes from the sale of COVID-19 and influenza tests and these are expected to remain a significant portion of the company’s total revenues for at least in the near future. As a result, if sales or revenues of COVID-19 or influenza tests fall for any reason, the company’s operating results will be affected.

Estimate Trend

QuidelOrtho is witnessing a negative estimate revision trend for 2023. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 4.8% south to $5.01.

The Zacks Consensus Estimate for the company’s third-quarter 2023 revenues is pegged at $650.1 million, suggesting a 17.1% decline from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita has gained 6.9% against the industry’s 8.4% decline over the past year.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has lost 0.9% compared with the industry’s 11.5% decline over the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 28.3% against the industry’s 2.9% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

QuidelOrtho Corporation (QDEL) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report