3 Reasons to Hold Veeva Systems (VEEV) Stock in Your Portfolio

Veeva Systems Inc. VEEV is well-poised for growth in the coming quarters, courtesy of its strong product portfolio. The optimism led by a solid second-quarter fiscal 2024 performance and strategic deals are expected to contribute further. Stiff competition and data security threats persist.

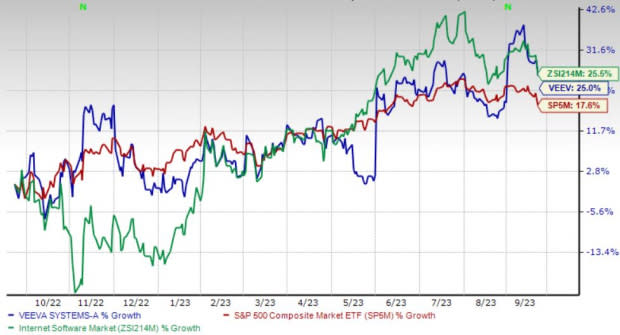

Over the past year, this Zacks Rank #3 (Hold) stock has gained 24.9% compared with 25.4% growth of the industry and a 17.5% rise of the S&P 500 Composite.

The renowned provider of cloud-based software applications and data solutions for the life sciences industry has a market capitalization of $32.65 billion. The company projects 24.5% growth for the next five years and expects to maintain its strong performance. It has delivered an earnings surprise of 9.9% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strong Product Portfolio: We are optimistic about Veeva Systems’ unique solutions, which include Veeva Vault, Veeva CRM (customer relationship management), Veeva Network and Veeva OpenData.

In September, Veeva Systems announced Veeva Study Portal, a free cloud application to simplify research site access to sponsor technologies. The same month, the company announced Veeva Vault Batch Release, a new cloud application that will enable faster, more confident Good Manufacturing Processes release and market-ship decisions.

Strategic Deals: We are upbeat about Veeva Systems’ inking of a slew of notable deals. In August, the company announced that Civica Rx had adopted Veeva Vault LIMS to optimize quality control.

In July, Veeva Systems announced that Merck KGaA, Darmstadt, Germany, was using Veeva Vault MedInquiry as its global medical information management system.

Strong Q2 Results: Veeva Systems’ solid second-quarter fiscal 2024 results buoy optimism. The company saw an uptick in the overall top and bottom lines and robust performances by both segments during the quarter. The company continued to benefit from its flagship Vault platform. Veeva Systems’ continued strength in its Commercial Solutions with new small-sized to mid-sized customer additions and strong win rates in core Veeva CRM were also seen.

Downsides

Data Security Threats: Veeva Systems’ solutions involve the storage and transmission of its customers’ proprietary information and personal information of medical professionals, patients and clinical trial participants, and other sensitive information. Unauthorized access or other security breaches or incidents could damage the company’s reputation. The company may be unable to adequately anticipate security threats or implement adequate preventative measures, in part, because the techniques used to obtain unauthorized access or sabotage systems change frequently and are becoming increasingly sophisticated and complex, and generally are not identified until they are launched against a target.

Stiff Competition: Veeva Systems operates in a highly competitive market. In new sales cycles within the company’s largest product categories, it competes with other cloud-based solutions from providers that make applications for the life sciences industry. The company’s Commercial Cloud and Veeva Vault application suites also compete to replace client-server-based legacy solutions offered by large companies and other smaller application providers.

Estimate Trend

Veeva Systems is witnessing a positive estimate revision trend for fiscal 2024. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 1.9% north to $4.66.

The Zacks Consensus Estimate for the company’s third-quarter fiscal 2024 revenues is pegged at $616.1 million, suggesting an 11.5% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, HealthEquity, Inc. HQY and Integer Holdings Corporation ITGR.

DaVita, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 12.7%. DVA’s earnings surpassed estimates in three of the trailing four quarters and missed once, with an average surprise of 21.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita has gained 18.6% against the industry’s 2.1% decline over the past year.

HealthEquity, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 23.5%. HQY’s earnings surpassed estimates in all the trailing four quarters, with an average of 13%.

HealthEquity has gained 0.6% against the industry’s 5.9% decline over the past year.

Integer Holdings, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 12.1%. ITGR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 8.4%.

Integer Holdings has gained 27.4% compared with the industry’s 1.7% rise over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report