3 Reasons to Retain Inogen (INGN) Stock in Your Portfolio

Inogen, Inc. INGN is well-poised for growth in the coming quarters, courtesy of high prospects in the portable oxygen concentrator (POC) space. The optimism, led by solid fourth-quarter 2023 performance and a strong product portfolio, looks promising. However, issues like stiff competition and forex volatility are major downsides.

In the past six months, the Zacks Rank #3 (Hold) stock has gained 48.6% compared with 16.7% growth of the industry. The S&P 500 rose 20.5% during the same time frame.

The renowned provider of POCs has a market capitalization of $218.9 million. The company projects 37.3% growth for 2024 and expects to witness continued improvements in its business. Inogen’s P/S ratio of 0.6 compares favorably with the industry’s 4.4.

Image Source: Zacks Investment Research

Let us delve deeper.

High Prospects in the POC Space: We are optimistic about the POCs’ superiority over conventional oxygen therapy (known as the delivery model). Inogen primarily develops, manufactures and markets innovative POCs to deliver supplemental long-term oxygen therapy (LTOT) to patients suffering from chronic respiratory conditions. INGN’s proprietary Inogen One and Inogen Rove systems concentrate the air around the patient to offer a source of supplemental oxygen anytime, anywhere, with a battery that can be plugged into an outlet.

Product Portfolio: We are optimistic about Inogen’s expanding product portfolio. The company completed the acquisition of Physio-Assist SAS in September 2023. Following the close of the transaction, it owns Physio-Assist and will now market the Simeox device outside the United States.

On the fourth-quarter 2023 earnings call in February 2024, Inogen’s management informed about their pursuit of regulatory clearance for Physio-Assist introduction to the U.S. market. The company also confirmed that their recent sales were in part driven by the full launch of Rove 6 in Europe.

Strong Q4 Results: Inogen’s robust year-over-year uptick in rental revenues and international business-to-business sales in fourth-quarter 2023 buoy optimism. The expansion of the adjusted gross margin also looks promising.

Downsides

Stiff Competition: The LTOT market is one with intense industrial competition. Inogen faces competition from several POC producers and distributors as well as suppliers of other LTOT services, like home delivery of oxygen cylinders or tanks. Inogen anticipates that the oxygen therapy device manufacturing business will grow more competitive in the future due to the relatively simple regulatory road in place.

Forex Volatility: The foreign market accounts for a sizeable amount of INGN's income. Because of the distributor's size and timing, the management anticipates that overseas revenues will continue to be erratic. In the near future, we also expect that unfavorable foreign exchange rates will hinder revenue growth because the US dollar is increasing relative to the euro and other foreign currencies.

Estimate Trend

Inogen has been witnessing a stable estimate revision trend for 2024. In the past 90 days, the Zacks Consensus Estimate for its loss per share has remained unchanged at $2.47.

The Zacks Consensus Estimate for first-quarter 2024 revenues is pegged at $73.3 million, suggesting a 1.5% improvement from the year-ago reported number.

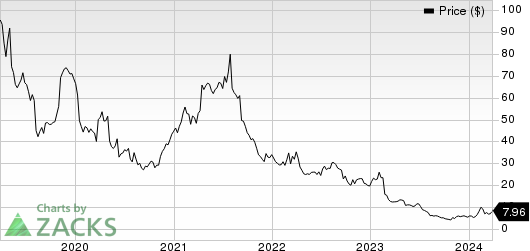

Inogen, Inc Price

Inogen, Inc price | Inogen, Inc Quote

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

DaVita, sporting a Zacks Rank #1 (Strong Buy), has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 58.3% compared with the industry’s 18.9% rise in the past year.

Cardinal Health, flaunting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 51.9% compared with the industry’s 3.2% rise in the past year.

Cencora, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 9.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 6.7%.

Cencora’s shares have rallied 51.5% compared with the industry’s 3.6% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Inogen, Inc (INGN) : Free Stock Analysis Report