3 Reasons to Retain Nevro (NVRO) Stock in Your Portfolio

Nevro Corp. NVRO is well-poised for growth in the coming quarters, courtesy of its research and development (R&D) edge. The optimism led by a solid first-quarter 2023 performance and continued strength in its flagship Senza platform are expected to contribute further. However, stiff competition and dependence on third-party payors persist.

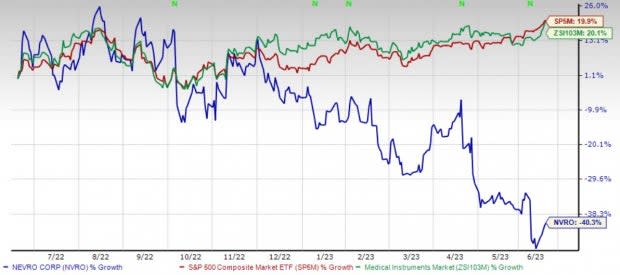

Over the past year, this Zacks Rank #3 (Hold) stock has lost 40.3% against the 20.2% rise of the industry and 19.9% growth of the S&P 500.

The renowned global medical device company has a market capitalization of $901.9 million. The company projects 31.5% growth for 2024 and expects to maintain its strong performance. Nevro’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average earnings surprise being 5.6%.

Image Source: Zacks Investment Research

Let’s delve deeper.

R&D Edge: Nevro aims to continue to improve patient outcomes and expand patient access to HF10 therapy through enhancements to Senza and the development of newer indications, raising our optimism. Since the launch of the initial Senza system, the company introduced a number of product enhancements, like active anchors with improved performance, among others. The company continues to make enhancements to Senza to boost its performance.

On the first-quarter earnings call in April, Nevro’s management stated that the company submitted the two-year data from its non-surgical back pain trial for publication.

Strength in Senza: We are optimistic about Nevro’s continued strength in its flagship Senza platform. Based on analysis from the company’s SENZA- Randomized Controlled Trial (RCT) and European studies, as well as the SENZA-PDN (Painful Diabetic Neuropathy) and SENZA-NSRBP (non-surgical refractory back pain) RCTs, Nevro believes the 10 kHz therapy can be an attractive treatment option for patients.

In March, Nevro initiated the full-market release of the Senza HFX iQ System in the United States, which has received favorable feedback from physicians and patients.

Strong Q1 Results: Nevro’s better-than-expected first-quarter 2023 results buoy optimism. The company recorded an improvement in overall top-line results and robust domestic revenues. An uptick in total U.S. permanent implant procedures and U.S. trial procedures was also witnessed. The improvement in U.S. PDN trial procedures is also encouraging.

Downsides

Dependence on Third-Party Payors: Nevro’s success in marketing its products largely depends on whether U.S. and international government health administrative authorities, private health insurers and other organizations adequately cover and reimburse customers for the cost of its products. Access to adequate coverage and reimbursement for spinal cord stimulation procedures using Senza by third-party payors is essential for the acceptance of Nevro’s products by its customers.

Stiff Competition: Nevro operates in a highly competitive medical device industry, which is subject to technological change. The company’s success depends partly upon its ability to establish a competitive position in the neuromodulation market by securing broad market acceptance of its HF10 therapy and Senza products for the treatment of approved chronic pain conditions.

Estimate Trend

Nevro has been witnessing a negative estimate revision trend for 2023. Over the past 90 days, the Zacks Consensus Estimate for its loss has widened from $2.43 per share to $2.51.

The Zacks Consensus Estimate for the company’s second-quarter 2023 revenues is pegged at $109.8 million, suggesting a 5.4% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Merit Medical Systems, Inc. MMSI and Boston Scientific Corporation BSX.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 5.1% for fiscal 2024. HOLX’s earnings surpassed estimates in all the trailing four quarters, the average being 27.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 19.6% compared with the industry’s 20.2% rise in the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 20.2%.

Merit Medical has gained 60.2% compared with the industry’s 22.9% rise over the past year.

Boston Scientific, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.5%. BSX’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, the average surprise being 1.9%.

Boston Scientific has gained 50.9% against the industry’s 19.4% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Nevro Corp. (NVRO) : Free Stock Analysis Report