3 Retail Pharmacy and Drugstore Stocks to Watch Amid Industry Headwinds

The past three years of the public health crisis have significantly altered the structure and trend of the Retail - Pharmacies and Drug Stores industry. On a positive note, amid acute supply-chain disruption and staffing shortages within healthcare, the retail pharmacy business has been in high demand, thanks to the exponentially growing demand for distant medical services and remote patient care. Particularly, mail-order pharmacies are registering growth on account of telehealth and remote monitoring services. Added to this, with digitization, retail industry players are significantly strengthening their omnichannel presence from sole brick-and-mortar dependency. All these are creating unique opportunities for stalwarts within the industry like CVS Health CVS, Herbalife HLF and Rite Aid RAD, which are investing strategically in easy patient access to prescription and maintenance medications.

However, the majority of the retail drug store heavyweights have been southbound due to the ongoing pressure of inflation and labor shortages. Further, unfavorable drug pricing and reimbursement are a burden on this sector. Added to this, with COVID-19 almost fading away, the demand for related retail health support has decreased, resulting in a significant drop in pandemic-led revenue generation for the industry players. Last but not the least, perceiving the huge growth prospects of this space, there have been a number of new entries in this industry, increasing the competitiveness of the space. Especially, a stalwart like Amazon’s AMZN entry into the retail drugstore space has created a survival issue among the existing entities.

Industry Description

The Zacks Retail - Pharmacies and Drug Stores industry includes retailing of a range of prescription and over-the-counter medications. The broad retail network of companies within the retail pharmacy industry delivers advanced health solutions to patients, customers and caregivers. Over the past few years, the scope of the retail pharmacy and drugstore market has expanded exponentially. In North America, some of these entities evolved to add wellness products and groceries to their traditional portfolio of prescription and over-the-counter medications. Looking at the attractive growth potential of this industry, non-healthcare leaders like Amazon, in 2018, acquired pharmacy delivery startup PillPack to enter the U.S. healthcare space.

3 Trends Shaping the Future of the Retail - Pharmacies and Drug Stores Industry

Online Pharmacy and Mail Order Boom: Thanks to the pandemic, there has been a significant shift in demand toward mail order and online pharmacies. Even during the post-pandemic phase, pharmacy retailers experience growing consumer preference for these alternative channels compared to brick-and-mortar pharmacies. A recent Mckinsey report says that, in 2021, mail-order and online pharmacies accounted for less than 10% of total U.S. prescriptions, but they are gaining traction. Going by a Patch report, “Two years ago, 11% of U.S. adult pharmacy customers got their prescription from an online pharmacy, based on a survey conducted by market research firm CivicScience, [.] That figure has been steadily rising over the years, according to Statista.com, an online statistics portal.” With Amazon’s big move into the healthcare space, the retail pharmacy industry entered a new phase of fierce competition. To counter this rivalry, the companies are strategically attempting to gain in size and scale.

Industry Trend Remains Dismal Amid Reimbursement Pressure: Brand-name drugs, which hold wide profit margins, are protected with a reliable supply chain. However, low-margin generic drugs, which have a fragile supply chain network, have been bearing the brunt of the ongoing economic slump. Drug retailers are also witnessing a constant rise in medicine prices, stemming from the rising cost of raw materials of drugs. The industry players are currently grappling with continued pressure from non-reimbursable pharmacy expenses, which are significantly pulling down the mass demand for prescription as well as over-the-counter drugs and vaccinations. It has been widely observed that patients are replacing prescription medicines with low-cost generic drugs. Meanwhile, to improve operating margins, pharmacy retailers have announced plans to reduce their footprint. According to a Mckinsey report, in 2019, Walgreens said it would close 200 U.S. stores. CVS Health, too, announced that it would close 900 stores by 2024.

Amazon's Entry Steals Market Share: A Business Insider report in 2021 came up with the speculation that there have been discussions about Amazon setting up standalone stores in a few locations, including Boston and Phoenix. Further, per the report, which cites insider sources, Amazon is exploring plans to place the pharmacies inside Amazon-owned Whole Foods locations. Earlier, following its entry, the e-commerce giant grabbed a significant chunk of the online pharmacy market from the legacy retail drug store space. Amazon Pharmacy’s omnichannel performance has been significantly robust since its inception. Going by a Viseven report dated Jan 5, 2023, Amazon’s omnichannel experiences are the keystone to customer retention, helping it to cover previous sales reductions. This has already significantly increased competition in the retail pharmacy market. Needless to say, the speculation of Amazon planning to enter the brick-and-mortar space has come as a major blow to the industry, putting retail pharmacy and drugstore stocks in a tighter spot.

Zacks Industry Rank Indicates Dull Near-Term Prospects

The industry’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. The Zacks Retail - Pharmacies and Drug Stores industry, housed within the broader Zacks Retail and Wholesale sector, currently carries a Zacks Industry Rank #196, placing it in the bottom 22% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

We will present a few stocks that have the potential to outperform the market based on a strong earnings outlook. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

Industry Underperforms S&P 500 & Sector

The Zacks Retail - Pharmacies and Drug Stores industry has underperformed the Zacks S&P 500 composite as well as its sector over the past year. The stocks in this industry have collectively lost 25% over this period compared with the Retail-Wholesale Sector’s rise of 9.7%. The S&P 500 composite has improved 16.8% over the said time frame.

One-Year Price Performance

Industry's Current Valuation

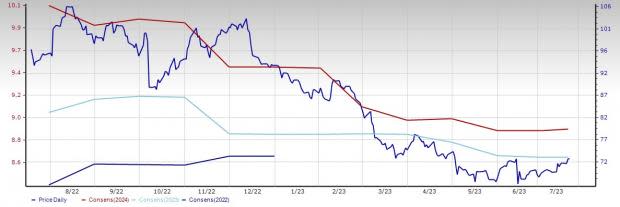

On the basis of forward 12-month price-to-earnings (P/E), which is commonly used for valuing medical stocks, the industry is currently trading at 7.87X compared with the S&P 500’s 19.97X and the sector’s 23.49X.

Over the last five years, the sector has traded as high as 12.03X, as low as 7.44X, and at the median of 9.71X, as the charts below show.

Price-to-Earnings Forward Twelve Months (F12M)

Price-to-Earnings Forward Twelve Months (F12M)

3 Retail - Pharmacies and Drug Stores Stocks in Focus

CVS Health is currently seeing greater engagement in an expanded set of digital health services such as antibody and PCR testing, vaccinations and omni-channel pharmacy. According to the company, CVS.com is one of the top health websites, with more than 2 billion visits last year, up nearly 55% over the prior year. CVS Health’s digital capabilities for health interactions, such as COVID testing and vaccines, prescription services and sales of health and wellness products, have dramatically increased consumer engagement across all CVS Health businesses. During the first quarter, CVS Health stated that it continues to place a high priority on digital engagement and that it has surpassed 50 million unique digital customers.

The Zacks Consensus Estimate for 2023 revenues indicates an 8% rise from 2022. CVS Health, a Zacks Rank #3 (Hold) stock, also has an impressive five-year expected earnings growth rate of 6.4%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: CVS

Herbalife, as a premier health and wellness company and community, offers science-backed products to consumers in more than 90 markets through entrepreneurial distributors. The company provides health and wellness products in North America, Mexico, South and Central America, Europe, the Middle East, Africa, China, and rest of Asia Pacific. Herbalife provides products in the areas of weight management, targeted nutrition, energy, sports, and fitness, outer nutrition, and literature and promotion items.

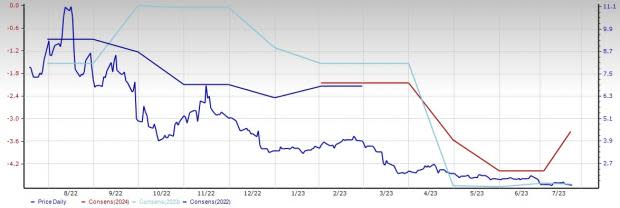

The Zacks Consensus Estimate for 2024 revenues indicates a rise of 4% from 2023 estimated figure. The long-term historical earnings growth rate is pegged at 5.7%. Herbalife carries a Zacks Rank #3 at present.

Price and Consensus: HLF

Rite Aid is benefiting from the expansion of delivery services to its customers. It has been providing home delivery service to customers with an eligible prescription, with the benefit of zero delivery fees. It also provides pick-up and drive-through services for prescriptions and over-the-counter products at its stores. The company remains focused on accelerating the growth of riteaid.com’s e-commerce sales and expanding its buy online, pick up at store offerings. Continued strength in on-demand delivery, third-party marketplaces, and buy online, pick up at store options is a positive.

The Zacks Consensus Estimate for fiscal 2025 earnings indicates a rise of 29.5% from fiscal 2024 estimated figure. Rite Aid currently carries a Zacks Rank of #3.

Price and Consensus: RAD

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Rite Aid Corporation (RAD) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Herbalife Ltd (HLF) : Free Stock Analysis Report