3 Safe Stocks to Buy for Stability and Income

The Fed’s mixed messaging has confused and disappointed markets. While everybody welcomed the pause in rate hikes, markets were miffed by the expectation of another 50 bps of increase by the end of the year, taking the upper limit to 5.6%. This only means that the Fed will most likely go through with the increase unless the economy’s reaction to prior actions brings inflation down to the targeted 2%.

There was also some positive commentary about wage inflation ticking down, and how that is impacting the Fed’s decision. The pause was to give the Fed more time to watch events unfold. Therefore, the situation may not be as bad as the markets are making it out to be. However, Jay Powell’s comments mean that market volatility may be expected to continue for a while yet. Therefore, it may be a good strategy to continue playing safe.

To that end, we may want to adjust the way we consider stocks. At times we are so focused on bottom line results that we tend to overlook or underestimate the importance of the top line. However, the best way to tell if a company is doing well is by the way customers are accepting its products. That’s one part of it. The other part is about how well the company is maneuvering its circumstances to keep its products flowing to customers. Both these factors are expressed in the quarterly (or annual) sales numbers. Therefore, if you’re looking for a safe stock, one of the things you should be checking is the companies’ sales numbers. If there is steady or even moderate growth in sales over the historical period, in all probability the company is doing a good job. This is particularly true in the current circumstance, when the last five years includes the pandemic and all the related supply chain and inventory imbalance issues that came with it.

Another important factor is whether the company pays a dividend. And why does this lend stability? Since dividends are a return on what you pay for the stock and any capital loss on the investment is reduced by the amount of dividend the company is paying, investors are generally willing to pay a premium for it. Therefore, it kind of sets a floor for share prices.

You may also want to protect against too much downside in the near term. The best way of ensuring that is to choose only those stocks that have seen substantial increase in earnings estimates. While it’s impossible to time investors’ reaction to rising estimates, i.e., how long after the revisions investors continue to demand the shares, it has been seen historically that shares tend to be buoyant when the trend in upward revisions is strong. Therefore, this is an important factor when you’re looking for “safe” stocks.

Estimate revisions are captured in the Zacks stock ranking system. So, you may want to refer to that Zacks Rank on stocks. A #1 rank denotes Strong Buy, #2 Buy, #3 Hold, #4 Sell and #5 Strong Sell.

When paired with a good Zacks Industry Rank, the stock rank is a clear indicator of near-term upside. The Industry Rank is awarded based on Zacks’ classification of industries. It has been seen historically that stocks belonging to the top 50% of Zacks-classified industries outperform those in the bottom 50%. The ostensible reason for this is that there are industrywide factors that impact all companies operating within a particular industry.

Last but not the least, it’s a really good idea to not overpay for stocks. Instead go for those that are trading below their intrinsic value.

Here are a few stocks that satisfy these criteria:

Medallion Financial Corp. (MFIN)

Medallion is a finance company based in New York City. The company operates in four segments: Recreation Lending, Home Improvement Lending, Commercial Lending and Medallion Lending. It offers loans for consumer purchases of recreational vehicles, boats, trailers and home improvements. Medallion Financial also provides commercial loans for businesses and taxi medallions, as well as equipment financing for new or existing businesses. Additionally, the company offers debt, mezzanine and equity investment capital to various industries and conducts other banking activities.

Medallion’s sales have increased 16.9% in the last five years.

The Zacks Rank #1 stock belongs to the Financial - SBIC & Commercial Industry (top 14%).

The company blew past estimates in the last quarter, recording a surprise of 168%. Estimate revisions in the last 60 days have taken the 2023 estimate up 35.4% and the 2024 estimate up 88.1%.

Its dividend yields 4.17%.

The shares trade at a discount of 12.2% to their median value over the past year, as well as a discount of 36.8% to the industry and a discount of 75.9% to the S&P 500.

Reinsurance Group of America, Incorporated (RGA)

Chesterfield, Missouri-based Reinsurance Group provides a range of life and health insurance products, including individual and group policies. The company offers reinsurance solutions for mortality, morbidity, lapse and investment-related risks associated with these products. It also provides asset-intensive and financial reinsurance products, as well as technology solutions, consulting and outsourcing services for the insurance and reinsurance industries.

In the last five years, Reinsurance Group’s sales have grown 6.6%.

The Zacks Rank #1 stock belongs to the Insurance - Life Insurance (top 33%).

In the March quarter, its earnings beat estimates by a whopping 53.1%. Estimates for the years ending Dec 2023 have increased 13.6% while for the following year, they’ve increased 5.1%.

Its dividend yields 2.27%.

RGA shares are undervalued based on their own performance over the past year. They’re also trading at a discount of 53.8% to the S&P 500.

Greif, Inc. (GEF)

Headquartered in Delaware, Ohio, Greif specializes in the production and sale of industrial packaging products and services. Its three operating segments are Global Industrial Packaging, Paper Packaging & Services, and Land Management. Its industrial packaging products include drums, containers, closure systems and transit protection products. Paper packaging includes containerboards, corrugated sheets and containers for various markets. Land management is to do with timber harvesting and the sale of timberland properties. Because of the range of its offerings, it has customers across a large number of industries including chemicals, paints and pigments, food and beverage, petroleum, industrial coatings, agriculture, pharmaceuticals, mineral product, building product, automotive, consumer goods, furniture and other industries. The broad application also lends stability to its business.

Greif has seen historical sales growth of 11.5% in the last five years.

The Zacks Rank #1 stock belongs to the Containers - Paper and Packaging industry (top 16%).

Its last-reported earnings represented a solid 35.1% surprise. For the years ending October 2023 and 2024, its earnings estimates have increased 10.4% and 4.3%, respectively over a 60-day period.

Its dividend yields 2.85%.

The shares are trading more or less in line with the industry but at a discount of 34.2% to the S&P 500.

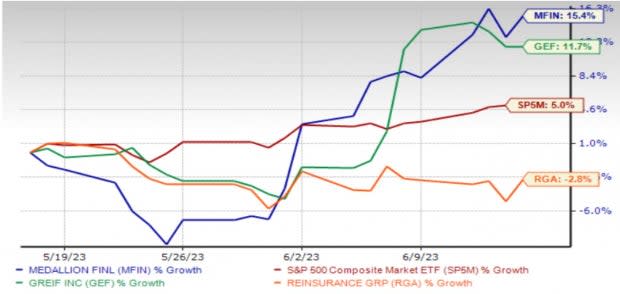

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

Medallion Financial Corp. (MFIN) : Free Stock Analysis Report