3 School Stocks to Buy Despite Industry Headwinds

The popularity of e-books, online learning in the country, the launch of new technologies and prudent acquisitions for wider global reach have been resulting in the growth of the multifaceted U.S. education industry. However, the companies in the Zacks Schools industry have been facing COVID-related challenges like higher advertising and marketing expenses along with costs pertaining to online education. That said, companies’ prudent cost management, persistent focus on driving profitability and strategic initiatives are expected to lend support to some prominent players in this industry like PowerSchool Holdings, Inc. PWSC, Grand Canyon Education, Inc. LOPE and Perdoceo Education Corporation PRDO. Also, for-profit education companies are forging corporate and community college partnerships to educate their workforce.

Industry Description

The Zacks Schools industry comprises for-profit education companies that offer undergraduate, graduate and specialized programs in finance, accounting, analytics, marketing, healthcare, business and technology. They are engaged in offering career-oriented programs in the field of business and management, nursing, computer science, engineering, information systems and technology, project management, cybersecurity as well as criminal justice. The industry players also offer child-care services and career-oriented, post-secondary courses. Some companies within the industry also provide yoga classes and yoga-related retail merchandise-integrated fitness classes, as well as conduct workshops and teacher training programs.

3 Trends Shaping the Future of the Schools Industry

Rising Demand for Online Education: For-profit education stocks have been reaping benefits from the rise in the virtual delivery of education. As the world struggles to contain the virus spread, many for-profit education companies have undertaken initiatives to reach students who aspire to complete their courses as planned, with the help of various online education platforms. Also, classroom-type-education-providing companies are cashing in on the unprecedented surge in demand for online education.

Cost-Saving Efforts, Increasing Use of Technology & Introduction of More Programs: In order to boost profitability, school companies are resorting to aggressive cost cutting through significant layoffs, campus closings and consolidations. Developments like switching to online education programs, increasing use of technology in education, more investments in education, the regular introduction of programs and specializations should boost student outcomes. Tie-ups with different organizations to reduce exposure to Title IV funding, improve academic quality and retain students also bode well. Many for-profit education companies are investing in non-degree programs and designing programs specifically aimed at meeting the educational needs of working adults in targeted professions.

Higher Rates & COVID-19 Impact: The Federal Reserve’s hawkish stance, comprising a series of rate increases to combat inflation, is making a slew of debt offerings, including new mortgages, credit cards and some student loans, more expensive. Although federal student loans are doled out at a fixed rate, private loans come with variable rates that have been edging up since the latest Fed rate hikes.

The COVID-19 pandemic has caused a disruption in educational services. There are headwinds as inflationary pressures, a tight labor market and ongoing supply-chain issues continue to impact business. The general economic slowdown has reduced the number of jobs available to graduates and resulted in lower salaries being offered in connection with the available employment, affecting the companies’ placements and persistence. The slowdown may compel students to repay their loans, which could increase institutions’ student loan cohort default rates, ultimately bumping up bad debt expenses. Higher default rates may also adversely impact the industry players’ eligibility to participate in some Title IV programs, affecting the companies’ operations and financial condition. Extended restrictions and COVID-related border closures, increased competition, advertising inflation, higher expenses for various programs, and a shortage of skilled labor are concerning. Higher unemployment levels may prove detrimental to for-profit education companies.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Schools industry is a 16-stock group within the broader Zacks Consumer Discretionary sector. The industry currently carries a Zacks Industry Rank #92, which places it at the top 37% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates impressive near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s bottom-line growth potential. Since October 2022, the industry’s earnings estimates for 2022 and 2023 have been respectively revised 6.7% and 2.8% upward.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Outperforms Sector & S&P 500

The Zacks Schools industry has outperformed the broader Zacks Consumer Discretionary sector and the Zacks S&P 500 composite over the past year.

The stocks in this industry have collectively lost 13.2% compared with the broader sector’s decline of 39.5%. Meanwhile, the S&P 500 has slipped 16.7% in the said period.

One-Year Price Performance

Industry's Current Valuation

The Zacks Schools industry has outperformed the broader Zacks Consumer Discretionary sector and the Zacks S&P 500 composite over the past year.

The stocks in this industry have collectively lost 13.2% compared with the broader sector’s decline of 39.5%. Meanwhile, the S&P 500 has slipped 16.7% in the said period.

One-Year Price Performance

3 School Stocks to Buy

Below, we have discussed three stocks from the industry that have solid growth potential. The chosen companies currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Grand Canyon Education: This Phoenix, AZ-based company is an education services provider to colleges and universities in the United States and has developed key technological solutions, infrastructure and operational processes to deliver superior services in these areas on a large scale. The company has been benefiting from an increase in the Grand Canyon University (GCU) traditional campus enrollments and higher revenue per student. Also, the company has been working with GCU on two main strategies (B2B and the rollout of new and relevant programs) to offset the downturn in online enrollment. On the back of these measures, new student enrollment injected positivity in third-quarter 2022 and management expects it to return to total online enrollment growth in the first half of 2023.

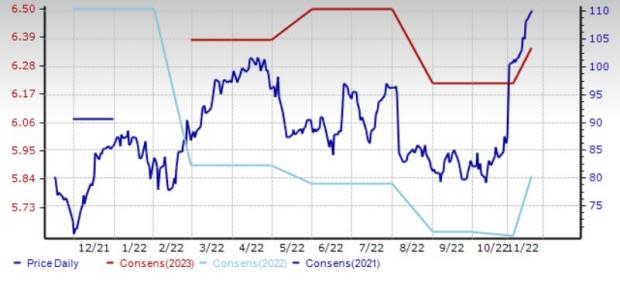

Grand Canyon Education currently carries a Zacks Rank #2. The stock has gained 36.7% over the past year. This company’s earnings estimate for 2023 has increased to $6.35 per share from $6.21. The estimated figure is expected to register 8.6% growth from a year ago.

Price and Consensus: LOPE

PowerSchool Holdings: Based in Folsom, CA, PowerSchool provides cloud-based software to the K-12 education market. PowerSchool is one of the leaders in providing mission-critical solutions to the growing online K-12 schooling market. Growing pipeline and demand for the company’s differentiated unified platform of best-in-class solutions will benefit PowerSchool to generate revenues. PowerSchool’s sales pipeline was up 20% year over year in third-quarter 2022, which includes some notably large deals and provides solid visibility for the near term. Also, cross-/upselling activity continues at a robust pace, with more than 500 transactions in the quarter. Management is witnessing a variety of sales progressions across product types.

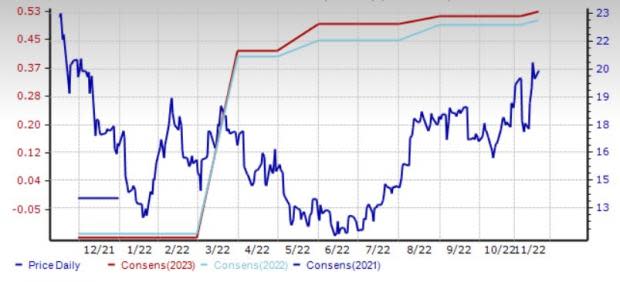

PowerSchool currently carries a Zacks Rank #2. The stock has lost 12% over the past year, faring better than the industry. The company’s earnings for 2023 are expected to grow 10.7%. The earnings estimate for 2023 has increased to 87 cents per share from 86 cents.

Price and Consensus: PWSC

Perdoceo Education: Headquartered in Schaumburg, IL, this company offers bachelor's, associate and non-degree programs in information technologies, visual communication and design technologies, business studies as well as culinary arts. The company’s focus on increased investments in technology and student-serving processes as well as the acquisition of California Southern University bodes well. Also, a meaningful improvement in student retention and engagement is expected to drive growth.

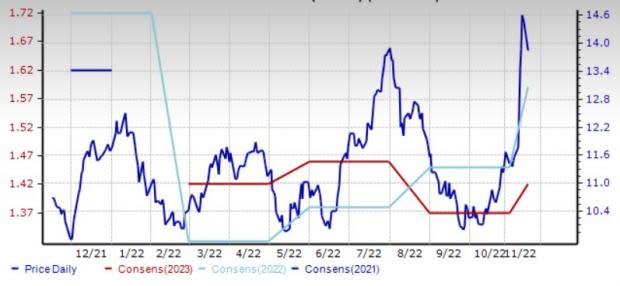

Perdoceo Education currently carries a Zacks Rank #2. The stock has gained 29% over the past year, outperforming the industry. This company’s earnings estimate for 2023 has increased to $1.42 per share from $1.37.

Price and Consensus: PRDO

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PowerSchool Holdings, Inc. (PWSC) : Free Stock Analysis Report

Grand Canyon Education, Inc. (LOPE) : Free Stock Analysis Report

Perdoceo Education Corporation (PRDO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research