3 Shipping Stocks Up 20% Year to Date With More Room to Grow

The Zacks Transportation - Shipping industry is grappling with headwinds like supply-chain disruptions, weak freight rates and high inflation-induced elevated interest rates. Although economic activities increased from the pandemic gloom, supply-chain disruptions continue to dent stocks in the industry. Costs will likely continue to be steep going forward due to supply chain and labor troubles. Below-par freight rates are also hurting the industry’s prospects.

Despite the reopening of the Chinese economy, the fact remains that the country’s export volumes to the United States are dropping. With the shipping industry responsible for transporting the bulk of the goods involved in global trade, China’s export drop is a worry for the industry. In fact, demand for Chinese goods is waning globally, with consumer spending being hit by inflation, in addition to shifting of preferences from goods toward services.

Despite the aforementioned headwinds, the industry stands to benefit from the decline in fuel prices. This is because fuel expenses represent a significant input cost for any transportation player and this bodes well for the bottom-line growth of shipping stocks. Notably, oil prices declined 6.6% in the April-June period.

3 Shipping Stocks to Enhance Your Portfolio

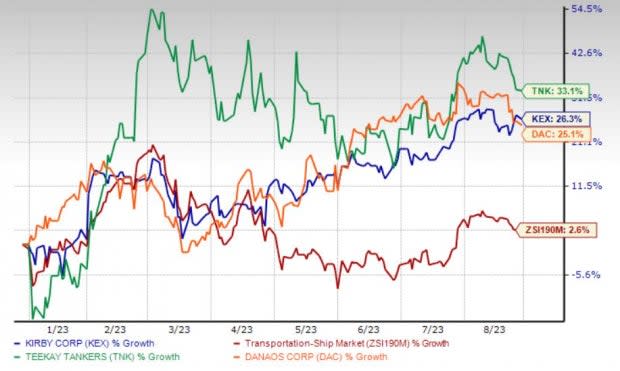

Given this encouraging backdrop, we present three shipping stocks, Teekay Tankers Ltd. TNK, Danaos Corporation DAC and Kirby Corporation KEX, which investors can bet on.

The aforementioned stocks have a Zacks Rank #1 (Strong Buy) or 2 (Buy), a VGM Score of A or B and a solid expected earnings growth rate for the current year. These stocks have also witnessed upward estimate revisions in the past 90 days. Additionally, these stocks have a strong trailing four-quarter average earnings surprise history.

Our research shows that stocks with a VGM Score of A or B, combined with a Zacks Rank #1 or 2, offer the best investment opportunities for investors. The selected companies appear to be compelling investment propositions at the moment.

Also, each stock has gained more than 20% year to date and has outperformed the industry.

Image Source: Zacks Investment Research

Each stock has a market capitalization of more than $1 billion.

Teekay Tankers: Headquartered in Hamilton, Bermuda, Teekay Tankers offers marine transportation services to oil industries in Bermuda and internationally. TNK is gaining from the resumption of economic activities and the uptick in world trade. This is because the shipping industry is responsible for transporting several goods involved in world trade.

Teekay presently carries a Zacks Rank #2 and has a VGM Score of A. The Zacks Consensus Estimate for TNK’s 2023 earnings per share (EPS) has moved up 3.6% in the past 90 days. Its expected earnings growth rate for 2023 is more than 100%. TNK has a trailing four-quarter earnings surprise of 14.86%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

TNK has a market capitalization of $1.40 billion.

Teekay Tankers Ltd. Price and EPS Surprise

Teekay Tankers Ltd. price-eps-surprise | Teekay Tankers Ltd. Quote

Danaos: Based in Piraeus, Greece, Danaos owns and operates containerships in Australia, Asia, Europe, and the United States. The company provides seaborne transportation services, such as chartering its vessels to liner companies.

Danaos currently carries a Zacks Rank #2 and has a VGM Score of A. The Zacks Consensus Estimate for DAC’s 2023 EPS has moved up 3.1% in the past 90 days. DAC has a trailing four-quarter earnings surprise of 11.69%, on average.

DAC has a market capitalization of $1.35 billion.

Danaos Corporation Price and EPS Surprise

Danaos Corporation price-eps-surprise | Danaos Corporation Quote

Kirby: Headquartered in Houston, TX, Kirby operates domestic tank barges in the United States. Kirby is benefiting from strength across its distribution and services segment. Favorable market conditions at its marine transportation unit are encouraging as well. Meanwhile, KEX’s strong cash flow generating ability looks encouraging. During the first half of 2023, Kirby generated $227.9 million of cash from operating activities, higher than $95.6 million in the year-ago period. For 2023, KEX has raised its guidance for net cash generated from operating activities between $500 million and $580 million, higher than the prior view of $480-$580 million.

Kirby presently carries a Zacks Rank #2 and has a VGM Score of B. The Zacks Consensus Estimate for KEX’s 2023 EPS has moved up 4.2% in the past 90 days. Its expected earnings growth rate for 2023 is 76.19%. KEX has a trailing four-quarter earnings surprise of 8.03%, on average.

KEX has a market capitalization of $4.87 billion.

Kirby Corporation Price and EPS Surprise

Kirby Corporation price-eps-surprise | Kirby Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kirby Corporation (KEX) : Free Stock Analysis Report

Danaos Corporation (DAC) : Free Stock Analysis Report

Teekay Tankers Ltd. (TNK) : Free Stock Analysis Report