3 Solar Stocks to Watch Amid Increased Installation Activities

Increased solar installation activities across the nation, along with impressive projections in 2023, bode well for U.S. solar stocks. Also, the Inflation Reduction Act has been bolstering the prospects of these stocks. However, consistent supply-chain challenges might continue to hurt their near-term prospects to some extent. Nevertheless, considering the rapidly growing demand for renewable energy as the preferred source among electricity developers, an investor might keep some solar stocks on the watchlist. The forerunners in the U.S. solar industry are Enphase Energy ENPH, Canadian Solar CSIQ and JinkoSolar Holdings JKS.

About the Industry

The Zacks Solar industry can be fundamentally segregated into two groups of companies. While one group is involved in designing and producing high-efficiency solar modules, panels, and cells, the other set is engaged in installing grids and, in some cases, entire solar power systems. The industry also includes a handful of companies that manufacture inverters for solar power systems, which convert solar power from modules into electricity required by electric grids. Per a report by Solar Energy Industries Association (SEIA) published in March 2023, buoyed by robust installation trends, solar accounted for 50% of all new electricity-generating capacity added in the United States in 2022, reflecting an improvement from 46% in 2021. This represents solar’s largest-ever share of generating capacity. It ranked first among all technologies for the second year in a row.

3 Trends Shaping the Future of the Solar Industry

Record Solar Installations Boost Prospects: With growing demand over the past couple of quarters, the U.S. solar industry has been witnessing a solid upside, overcoming the initial adverse impacts of the COVID-19 pandemic. This is evident from the latest installation trend prevalent in the nation. For instance, as reported by SEIA, the U.S. solar industry installed 6.1 gigawatts-direct current (GWdc) of capacity in the first quarter of 2023, indicating a 47% increase from that reported in the first quarter of 2022. We expect to witness similar robust solar growth in the United States going forward. To this end, Wood Mackenzie forecasts U.S. solar industry to deliver a 39% year-over-year recovery in 2023. Such impressive projections are indicative of a bright outlook for U.S. solar stocks.

Inflation Reduction Act to be Growth Catalyst: The historic Inflation Reduction Act (IRA) passed by the U.S. Senate last August has been proven to be a solid growth catalyst for U.S. solar stocks. Evidently, the IRA supported additions of more than 3 GW to U.S. solar development pipelines, reflecting a 25% year-over-year increase, as stated in a report by Wood Mackenzie in July 2023. Going ahead, this ruling by the Biden administration is expected to be a major growth driver for the solar industry. As part of this Act, for the first time, the U.S. solar industry has access to production tax credits and an investment tax credit for domestic manufacturing across the solar value chain. SEIA and Wood Mackenzie project IRA to aid the U.S. solar market to grow 40% through 2027. This, in turn, should boost U.S. solar stocks’ growth trajectory.

Supply-Chain Challenges Might Hurt: Supply-chain constraints have been hurting the solar industry, a trend expected to continue in the near term. To this end, Wood Mackenzie earlier announced its expectation that the solar industry will remain supply constrained through at least the second half of 2023. Due to near-term supply-chain constraints, SEIA expected 77% of the effect of the IRA to materialize in the utility-scale segment beginning in 2024. Consequently, the supply-chain issue is expected to remain an overhang on utility-scale solar installations, at least in the near term.

Zacks Industry Rank Reflects Bright Outlook

The Zacks Solar industry is housed within the broader Zacks Oils-Energy sector. It currently carries a Zacks Industry Rank #78, which places it in the top 31% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few alternative energy stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags Sector & S&P 500

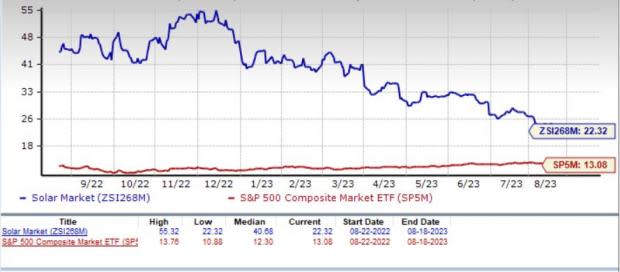

The Solar Industry has underperformed both its sector and the Zacks S&P 500 Composite over the past year. The stocks in this industry have collectively lost 33.9%, while the Oils-Energy Sector went up 2.7% in the same time frame. Moreover, the Zacks S&P 500 Composite has surged 6.1%.

One-Year Price Performance

Industry's Current Valuation

On the basis of a trailing 12-month EV/EBITDA, which is commonly used for valuing solar stocks, the industry is currently trading at 22.32X compared with the S&P 500’s 13.08X and the sector’s 3.40X.

Over the last five years, the industry has traded as high as 55.32X, as low as 22.32X and at the median of 40.68X, as the charts show below.

EV-EBITDA Ratio (TTM)

3 Solar Stocks Worth Watching

JinkoSolar Holdings: Based in Shanghai, China, the company is a manufacturer of solar products like silicon wafers, solar cells and solar modules, with a global network spanning Europe, North America and Asia. On Aug 14, 2023, JinkoSolar announced its second-quarter 2023 results. Its total solar module, cell and wafer shipments were 18,613 megawatts (MW) (17,763 MW for solar modules, and 850 MW for cells and wafers) in the second quarter, up 28.5% from that recorded in the last reported quarter.

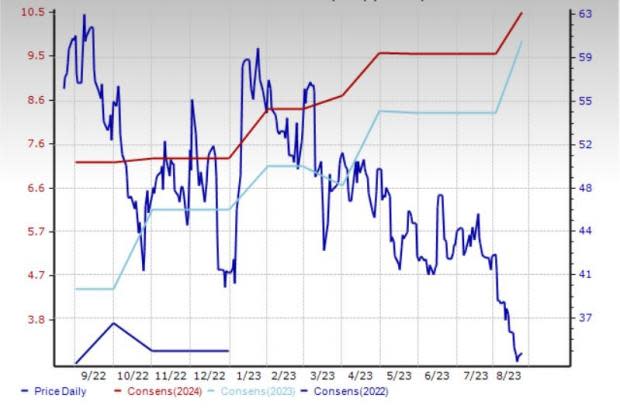

The Zacks Consensus Estimate for JinkoSolar’s 2023 sales indicates an improvement of 30.3% from the prior-year reported figure. Earnings estimates for 2023 indicate an improvement of 59.3% from the 2022 reported figure. The company currently sports a Zacks Rank #1 (Strong Buy).

Price & Consensus: JKS

Canadian Solar: Based in Ontario, Canada, the company is a vertically integrated manufacturer of silicon ingots, wafers, cells, solar modules (panels) and custom-designed solar power applications. It designs, manufactures and delivers solar products and solar system solutions for both on-grid and off-grid use to customers worldwide. On Aug 17, 2023, CSIQ announced that it will deliver 1,200 MWh (1,519 MWh DC nominal) of energy storage solutions to its subsidiary, Recurrent Energy's Papago Storage project in Arizona. Recurrent Energy, is expected to begin construction on Papago Storage in the third quarter of 2024.

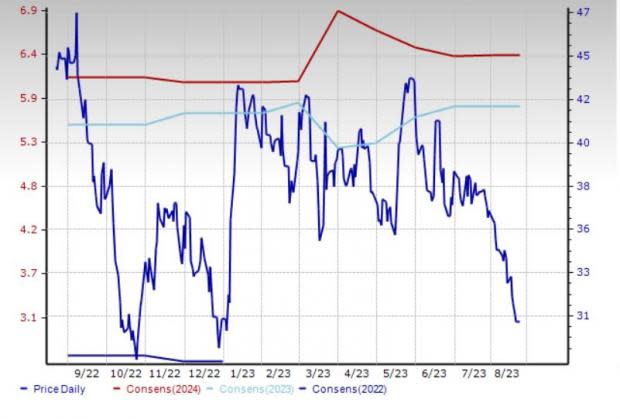

The Zacks Consensus Estimate for Canadian Solar’s 2023 sales indicates an improvement of 24.4% from the prior-year reported figure. Earnings estimates for 2023 imply growth of 67.4% from the 2022 reported figure. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Price & Consensus: CSIQ

Enphase Energy: Based in Fremont, CA, the company is a global energy technology company that delivers energy management technology for the solar industry. It designs, develops, manufactures and sells home energy solutions, which connect energy generation, energy storage and control and communications management on one intelligent platform. On Aug 15, 2023, Enphase announced a comprehensive solution that can improve homeowner return-on-investment (ROI) under California’s new net billing tariff. The solution includes the Enphase Energy System, powered by IQ8 Microinverters and IQ Batteries, as well as an energy management system that can maximize ROI for homeowners.

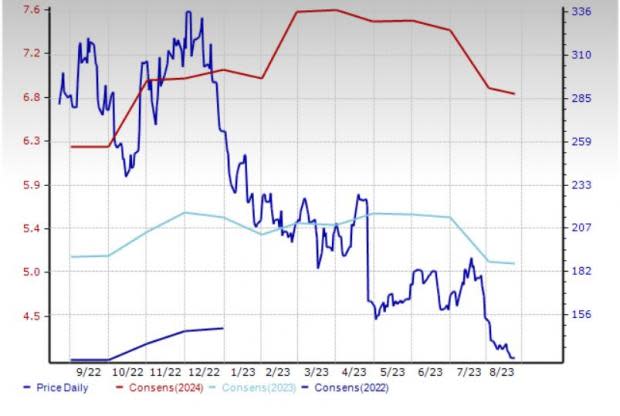

The Zacks Consensus Estimate for Enphase’s 2023 sales indicates an improvement of 17.1% from the prior-year reported figure. The consensus estimate for 2023 earnings indicates an improvement of 9.7% from the previous year’s reported figure. The company currently carries a Zacks Rank #3 (Hold).

Price & Consensus: ENPH

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

JinkoSolar Holding Company Limited (JKS) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report