3 Stocks to Buy From Transport Equipment & Leasing Industry

The Zacks Transportation - Equipment and Leasing industry is facing challenges, ranging from raging inflation, higher interest rates, supply-chain disruptions and high operating costs. The headwinds are likely to hurt the demand for containers.

Nonetheless, we believe that betting on three industry players, namely Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation (WAB), Triton International TRTN and GATX Corporation (GATX), is a prudent move as they are better positioned to brave multiple industry challenges.

Industry Overview

The Zacks Transportation - Equipment and Leasing industry includes companies offering equipment financing as well as leasing and supply-chain management services. The industry includes aircraft, railcar and intermodal container lessors. Some of these companies even provide logistics and transportation solutions, such as vehicles, drivers, management and administrative services. Most industry participants offer fleet management solutions and serve customers, varying from small businesses to large international enterprises. Customers range from a wide variety of industries, the most significant being automotive, electronics, transportation, grocery, lumber and wood products, food service and home furnishing. A few of these companies provide locomotives and technology-based equipment, systems and services to freight rail and passenger transit industries.

3 Key Trends Influencing the Transportation - Equipment and Leasing Industry

Strong Financial Returns for Shareholders: With economic activities gaining pace from the pandemic lows, more and more companies are allocating their increasing cash pile by way of dividends and buybacks to pacify the long-suffering shareholders, thereby underlining their financial strength and confidence in business. Among the Transportation - Equipment and Leasing industry players, Ryder announced a 14.5% hike in its quarterly dividend, taking the total to 71 cents per share (annualized $2.84) in July 2023.

Economic Uncertainty Remains: It is agreed that signs of easing inflation have brought some relief for U.S. stock markets, but the fact remains that we are far from being out of the woods. The Fed reinitiated its interest rate hike process in the July FOMC meeting after taking a breather in June. On Jul 26, the Fed raised the benchmark lending rate by 25 basis points to 5.25%-5.5%. This marked the highest range of the Fed fund rate since March 2001. With inflation remaining a formidable foe, risks associated with an economic slowdown and geopolitical tensions dampen the prospects of stocks belonging to this industrial cohort. Sluggish economic growth and inflationary woes are likely to hurt consumer spending in the remainder of 2023. Challenges in Europe are also hurting shipping volumes. These do not bode well for the industry participants.

Supply-Chain Disruptions & High Costs: Although economic activities picked up from the pandemic gloom, supply-chain disruptions continue to dent stocks in the industry. Increased operating costs are also limiting bottom-line growth. Costs will likely continue to be steep due to supply-chain troubles.

Zacks Industry Rank Indicates Encouraging Prospects

The Zacks Transportation - Equipment and Leasing industry, housed within the broader Transportation sector, currently carries a Zacks Industry Rank #19. This rank places it in the top 8% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that investors can buy, given their growth prospects, let’s take a look at the industry’s recent stock market performance and current valuation.

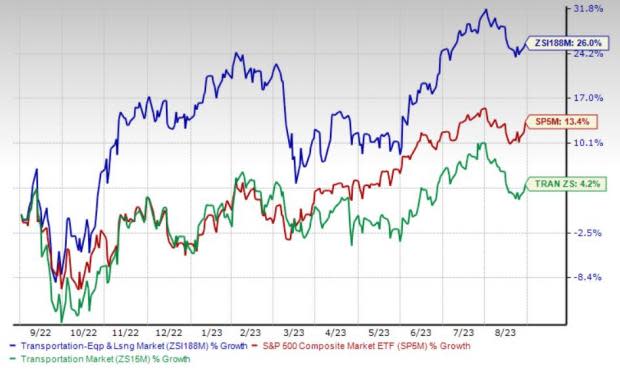

Industry Outperforms S&P 500 As Well As the Sector

The Zacks Transportation - Equipment and Leasing industry has outperformed the Zacks S&P 500 composite index and the broader sector over the past year.

Over this period, the industry has gained 26% compared with the S&P 500 Index’s northward movement of 13.4%. The broader sector has gained 4.2% in the same timeframe.

One-Year Price Performance

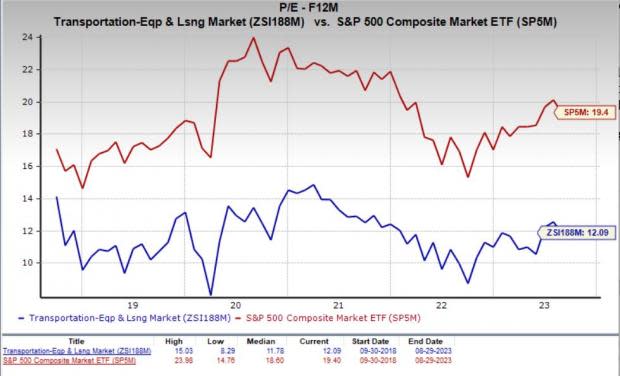

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings (P/E- F12M), a commonly used multiple for valuing equipment and leasing stocks, the industry is currently trading at 12.09X, compared with the S&P 500’s 19.40X. It is also below the sector’s P/E (F12) ratio of 13.75X.

Over the past five years, the industry has traded as high as 15.03X, as low as 8.29X and at the median of 11.78X, as the chart below shows.

P/E Ratio (Forward 12-Month)

3 Transport Equipment Leasing Stocks to Buy Now

We are presenting three Zacks Rank #2 (Buy) stocks that are well-positioned to grow in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wabtec: Wabtec’s top-line performance continues to benefit from solid growth across its Freight segment revenues. Segmental growth was backed by strength across all product lines, with solid growth in Equipment, Digital Electronics and Services. Wabtec has raised its 2023 sales view in the range of $9.25-$9.50 billion (prior view: $8.7-$9 billion). For 2023, Wabtec anticipates strong cash flow generation with operating cash flow conversion exceeding 90%.

Wabtec has an encouraging track record with respect to earnings surprise, having surpassed the Zacks Consensus Estimate in three of the past four quarters. The average beat is 3.42%. The Zacks Consensus Estimate for 2023 earnings has been revised 4.31% upward over the past 90 days.

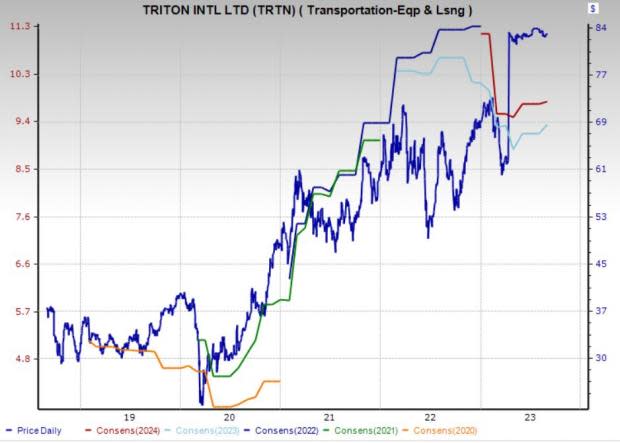

Price and Consensus: WAB

Triton: Headquartered in Hamilton, Bermuda, Triton engages in acquiring, leasing, re-leasing, and selling various types of intermodal containers and chassis to shipping lines and freight forwarding companies. We are impressed by Triton International’s impressive liquidity position and efforts to reward shareholders. TRTN has outpaced the Zacks Consensus Estimate for earnings in each of the last four quarters. The average beat is 4.52%. The Zacks Consensus Estimate for 2023 earnings has been revised 1.9% upward over the past 90 days.

Price and Consensus: TRTN

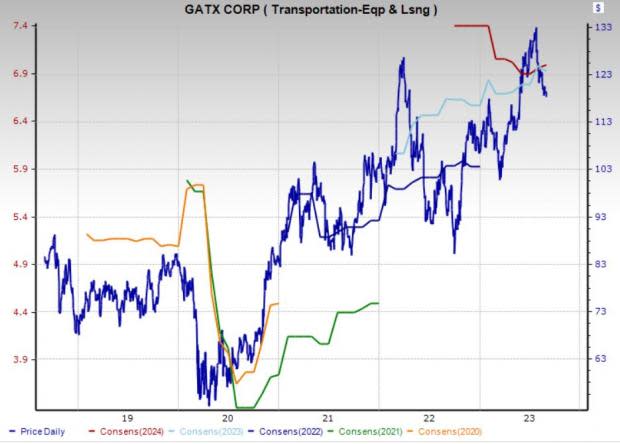

GATX: Based in Chicago, IL, GATX is a global railcar lessor with owned fleets in North America, Europe and Asia. Continued recovery in the North American railcar leasing market is expected to support GATX’s growth. Efforts to reward its shareholders also bode well.

GATX has an encouraging track record with respect to earnings surprise, having surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the remaining one). The average beat is 17.30%. The Zacks Consensus Estimate for 2023 earnings has been revised 2.1% upward over the past 90 days.

Price and Consensus: GATX

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Triton International Limited (TRTN) : Free Stock Analysis Report