These 3 Stocks Could Positively Surprise Investors

It’s shaping up to be a busy week in the market, with inflation data and earnings season taking center stage. On Wednesday, we’ll receive PPI data, whereas we’ll see CPI data on Thursday. And then we have ‘Big Bank Friday’ to cap off the week’s events.

The Q3 cycle will be largely important, potentially sparking a rally that could last into year-end. And after the last few months of volatility, it’d be welcomed among investors.

As usual, there are surprises lurking beneath the hood, a few of which could come from Matador Resources MTDR, Asure Software ASUR, and Build-A-Bear Workshop BBW. All three sport a positive Zacks Earnings ESP Score, reflecting recent optimism among analysts.

Zacks Earnings ESP (Expected Surprise Prediction) finds companies that have recently seen positive earnings estimate revision activity.

The idea is that more recent information is generally more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season.

Let’s take a closer look at each.

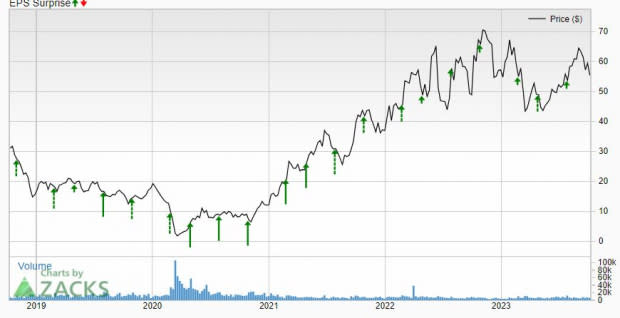

Matador Resources

Matador is an independent energy company engaged in the exploration, development, production, and acquisition of oil and natural gas resources in the United States. Analysts have raised their expectations for the release, with the $1.54 Zacks Consensus EPS Estimate up 10% over the last few months.

As we can see below, the current estimate is up from the $1.52 per share expected just seven days ago. The value reflects a 42% pullback from the year-ago period. The company’s release is scheduled for October 24th.

Image Source: Zacks Investment Research

The company’s latest results were aided by record quarterly production, averaging more than 130,000 barrels of oil and natural gas equivalent per day. Impressively, production results were 3% above MTDR’s expectations and 23% higher compared to the year-ago period.

For the quarter to be reported, the Zacks Consensus Estimate for daily production volumes stands at roughly 131,700, 25% higher than the year-ago figure of 105,200.

As we can see below, the company has a long history of exceeding the Zacks Consensus EPS Estimate, reflecting its consistent nature. Regarding top line expectations, our quarterly revenue estimate sits at $679 million, 20% lower than the year-ago period.

Image Source: Zacks Investment Research

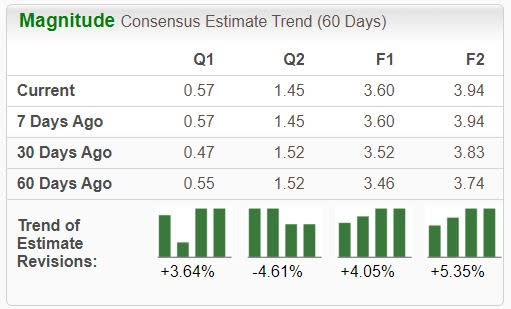

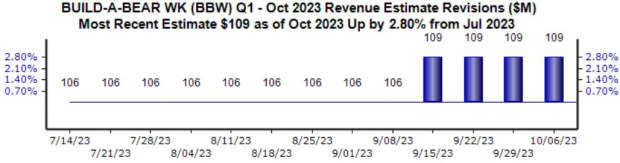

Build-A-Bear Workshop

Build-A-Bear Workshop is an American retailer that sells teddy bears and other stuffed animals and characters. The company’s quarterly results will provide a deeper view surrounding consumer sentiment, with its products a popular discretionary item.

Analysts originally took their quarterly expectations lower but have since been revised higher, with the $0.57 Zacks Consensus EPS Estimate up 3.6% overall over the last several months. The company’s quarterly release is scheduled for November 29th.

Image Source: Zacks Investment Research

Build-A-Bear’s latest quarterly results pleased investors, with shares seeing bullish activity post-earnings. Regarding the release, the company posted its eighth consecutive quarter of record quarterly revenue thanks to strong store traffic growth and reaffirmed its FY23 guidance.

Analysts have also taken their sales expectations higher over the last month, with the $109 million expected up roughly 3% since mid-September.

Image Source: Zacks Investment Research

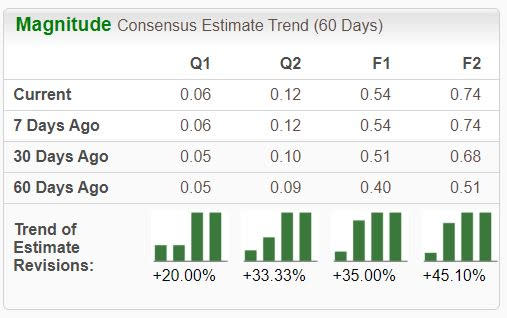

Asure Software

Asure Software provides Web-based workforce management solutions that enable organizations to manage their office environment and human resource and payroll processes.

The Zacks Consensus EPS Estimate of $0.06 has been taken a penny higher over the last month. Asure will report on November 6th.

Image Source: Zacks Investment Research

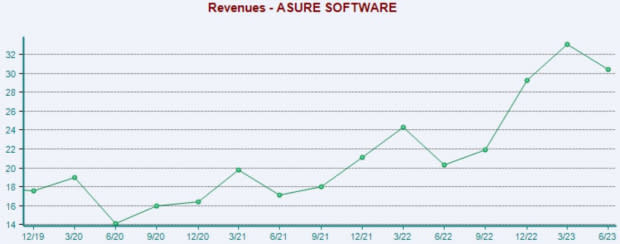

In addition, we expect the company to post $26.6 million in sales, 21% higher than the year-ago figure. As we can see illustrated below, Asure’s revenue growth has been strong over the last year. Impressively, the company’s 50% Y/Y revenue growth rate in Q2 was all organic.

Image Source: Zacks Investment Research

Bottom Line

Zacks Earnings ESP (Expected Surprise Prediction) finds companies that have recently seen positive earnings estimate revision activity.

The idea is that more recent information is, generally speaking, more accurate, and can be a better predictor of the future, which can give investors an advantage in earnings season.

And for those seeking stocks with a positive Zacks Earnings ESP, all three above – Matador Resources MTDR, Asure Software ASUR, and Build-A-Bear Workshop BBW – fit the criteria.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Build-A-Bear Workshop, Inc. (BBW) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report