3 Stocks Growing Earnings Faster than Sales

- By Alberto Abaterusso

Investors may want to consider the following stocks, as they are growing earnings faster than sales, which may indicate efficient operating activities as profit margins increase with growth.

The below companies have five-year revenue growth rates of no less than 5% per year and five-year net income growth rates of no less than 10% per year.

Manulife Financial Corp

The first stock value investors may want to consider is Manulife Financial Corp (NYSE:MFC), a Canadian insurance and asset management company serving individuals and institutional clients in North America and internationally.

The company saw its trailing 12-month revenue rise by 16.7% and its trailing 12-month net income rise by 22.9% (on average) per annum over the last five years.

The stock traded at around $21 per share at close on Thursday for a market cap of $40.84 billion and a 52-week range of $10.86 to $22.25. Currently, Manulife Financial Corp pays quarterly dividends with the last distribution, 28 Canadian cents per common share, issued on March 19. This payment, in line with the prior one, leads to a trailing 12-month dividend yield of 4.1% as of April 22.

GuruFocus assigned a financial strength rating of 5 out of 10 and a profitability rating of 6 out of 10 to the company.

Wall Street sell-side analysts recommend a median recommendation rating of overweight for this stock and have established an average target price of $22.52 per share.

LHC Group Inc

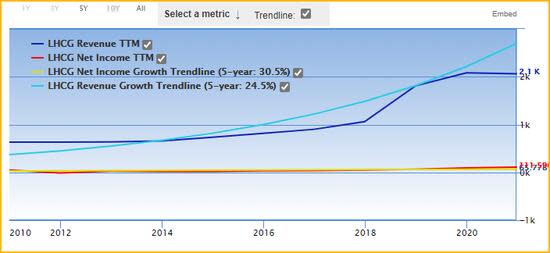

The second stock to consider is LHC Group Inc (NASDAQ:LHCG), a Lafayette, Louisiana-based healthcare company operating more than 650 home health and community-based services as well as more than 130 hospice community-based service locations and long-term acute care hospitals. The company also provides liable care organizations with strategic health management services.

The company saw its trailing 12-month revenue rise by 24.5% and its trailing 12-month net income rise by 30.5% (on average) per annum over the last five years.

The stock was trading at around $209.67 per share at close on Thursday for a market cap of $6.62 billion and a 52-week range of $116.26 to $236.81. Currently, LHC Group Inc does not pay dividends.

GuruFocus assigned a score of 8 out of 10 to the company's financial strength rating and of 7 out of 10 to its profitability rating.

Wall Street sell-side analysts recommend a median rating of buy for this stock and have established an average target price of $251.80 per share.

Ameresco Inc

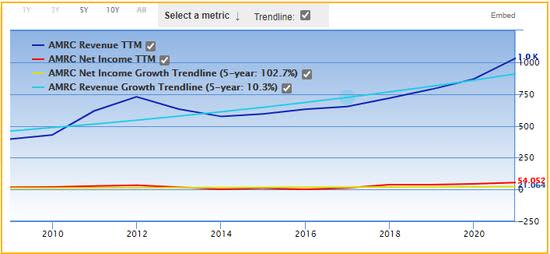

The third stock to consider is Ameresco Inc (NYSE:AMRC), a Framingham, Massachusetts-based owner and operator of about 130 small-scale renewable energy facilities and solar PV installations providing comprehensive energy services in North American and Europe.

The company saw its trailing 12-month revenue rise by 10.3% and its trailing 12-month net income rise by 102.7% (on average) every year over the last five years.

The stock traded at around $48.49 per share at close on Thursday for a market capitalization of $2.46 billion and a 52-week range of $16.01 to $70.26. Ameresco Inc is not currently paying dividends.

GuruFocus assigned the company a score of 3 out of 10 for its financial strength rating and 7 out of 10 for the profitability rating.

Wall Street sell-side analysts recommend a median rating of buy for this stock and have established an average target price of $67.33 per share.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.