3 Stocks I'm Adding to My Retirement Account in March

Are you a little leery of jumping into any new stocks right now? If so, you're not alone. The market was looking overbought and overpriced a couple of months ago. Now it's showing signs of weakness, perhaps weighed down by steep valuations and profit-taking pressure. Even a few of the so-called "Magnificent Seven" stocks aren't looking so magnificent anymore.

This isn't a reason to simply step away from the entire stock market though. Rather, it's an opportunity to ferret out new picks that may not have been great performers of late, but still offer great long-term upside potential.

With that as the backdrop, here's a closer look at three stocks I'm thinking about adding to my retirement account this month. And yes, these are names that I see as being better-suited picks for an IRA than a conventional brokerage account. I'll tell you why.

1. Fastly

Fastly (NYSE: FSLY) isn't a household name. There's a good chance, however, you or someone in your household regularly relies on its service.

In simplest terms, Fastly helps companies that manage cloud computing platforms and cloud-based apps do their jobs better. It supports businesses that deal with streaming, financial services, e-commerce, video gaming, and more, providing cybersecurity solutions, data load optimization, and a wide range of edge computing solutions just to name a few. (Edge computing just means any computing that can be handled by an end user's device rather than by a remote server.) Forrester Research even named Fastly Compute a top edge development platform for 2023. Its client list includes Reddit, SpaceX, Stripe, and plenty of other familiar names.

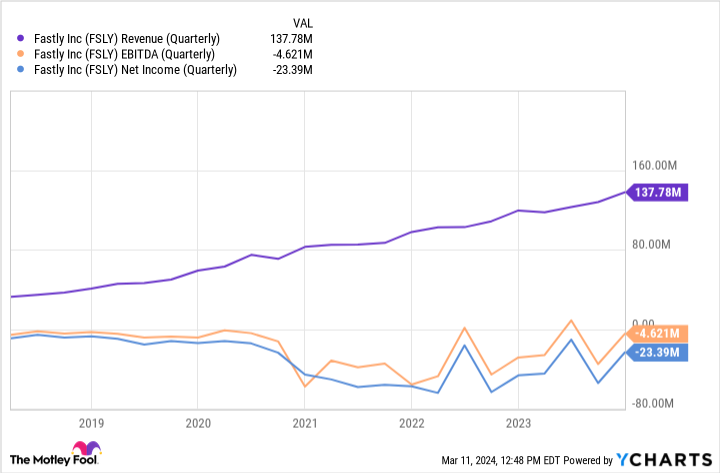

The proof, of course, is in the numbers. How is Fastly doing?

The stock's not been doing all that well of late, actually. It soared in 2020, when pandemic lockdowns forced the world to live most of their lives online. The advance was much too far and too fast though. Shares are down 90% from their late-2020 high, as investors struggled to support its frothy valuation. Indeed, Fastly isn't profitable, and it still isn't expected to become so this year.

Now take a step back and look at the bigger picture. Revenue hasn't failed to grow in any quarter since 2020, pushing the company ever closer to profitability. It's still doing so well, in fact, that this year's and then next year's projected top-line growth of nearly 16% should translate into its first-ever actual profit in 2025. Don't be surprised to see shares start reflecting that possibility before it actually happens, though. After all, stocks have a funny way of moving in anticipation of the future, particularly when there's a new CEO at the helm.

This technology pick is probably a little more aggressive and higher-risk than most investors might normally pick for their retirement portfolios. But, its service/product has a decidedly bright long-term future. Polaris Market Research and Global Market Insights both suggest the worldwide edge computing market is going to grow by an average of more than 30% per year through 2030.

2. StoneCo

There's a good chance you've never heard of StoneCo (NASDAQ: STNE), albeit for a different reason than the one that's kept Fastly off of your radar. That is, this company doesn't serve the North American market. The entirety of its business is done within Brazil.

Simply put, StoneCo helps small and medium-sized businesses better manage the money-related aspects of their operations. Online and offline sales platforms, payment-acceptance tools, and even basic banking services including lines of credit are all part of its offerings. Compare it to more familiar platforms like Block -- formerly Square -- or PayPal, except built from the ground up to meet the unique needs of Brazil's small businesses.

It can be a bit unnerving to invest in a foreign company. Not only are these organizations less visible to you, but it's also difficult to keep tabs on overseas economies. Yet, most investors do know that several South American and Latin American countries are currently experiencing some significant social and economic turmoil. This pick isn't for the completely casual, passive investor.

But, maybe this is a case where you just hold your nose and dive in.

See, Brazil may be something of an underestimated bright spot in the region. The International Monetary Fund believes the country's gross domestic product (GDP) growth will roll in at a respectable 1.7% this year, slightly accelerating its growth pace as of late last year. In the meantime the United States' International Trade Administration expects Brazil's e-commerce market to grow by 14.3% between now and 2026, while GSMA Intelligence predicts that 83% of Brazil's adult residents will own smartphones by 2025. By 2030, the number of Brazilians with 5G mobile connections could be quintupled compared to today's penetration, making mobile commerce fast and easy. This tailwind plays right into the hand StoneCo is holding.

Or, if nothing else, look at it like this: StoneCo is a smart way of adding some much-needed international exposure to your mix of stocks.

3. Pfizer

Last but not least, I'm looking at Pfizer (NYSE: PFE) as a potential pick for my retirement account.

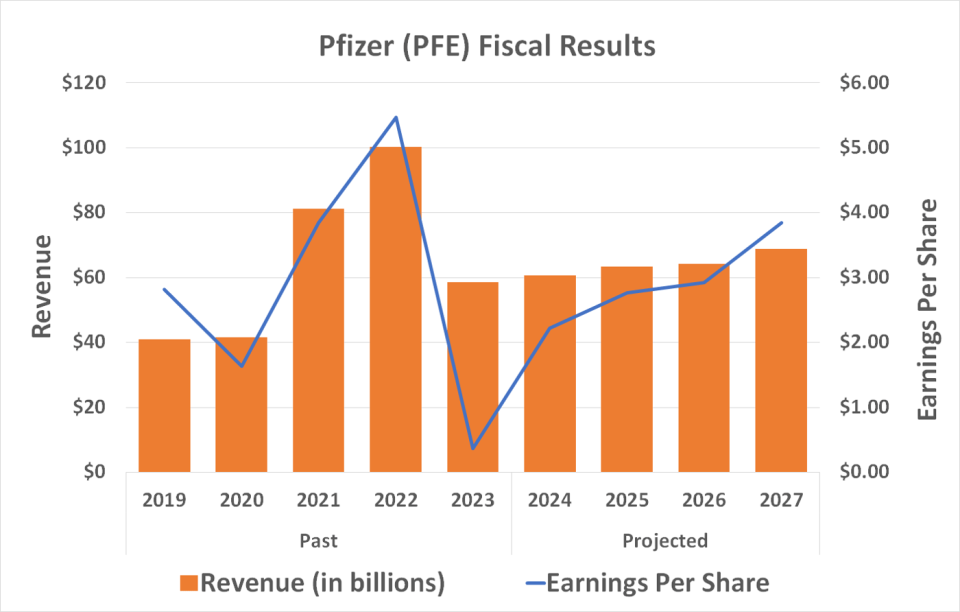

The pharmaceutical giant's stock has been a particularly poor performer of late. It's been more than halved from its late-2021 high, in fact, and is still dancing with multiyear lows.

Mostly blame the effective wind-down of the coronavirus pandemic vaccine market. Pfizer co-developed one of the preferred COVID-19 vaccines with biopharma drug company BioNTech in addition to offering a couple of its own treatments. As the contagion abates though, so does demand. Last year's top line slumped 41% year over year, for perspective.

Dig deeper into the details, however. Not counting COVID-19-related revenue, Pfizer's sales were actually up 7% in 2023. More forward progress is in the cards, too. The company's 2024 guidance suggests Pfizer will see slight sales growth, while earnings growth should be a marked rebound from 2023's lull.

That's still just the beginning. All told, in addition to a portfolio that already includes blockbuster drugs like pneumonia vaccine Prevnar, blood thinner Eliquis, and oncology drugs Ibrance and Xtandi, Pfizer's got 106 clinical drug trials underway, plus six New Drug Applications waiting for regulatory review. Of the 106 trials, 31 of them are in their third and final phase of testing. Meanwhile, the recently completed acquisition of Seagen sets the stage for an expansion of Pfizer's cancer drug portfolio later this year.

Admittedly, the company's long-term growth potential is subpar. That's largely a function of its sheer size; it's tough to grow much when you're already generating billions of dollars' worth of annual revenue with dozens of different drugs.

What Pfizer doesn't offer in growth, though, it offers in income. The stock's sizable, overbaked pullback has beefed up its reliable dividend's yield up to a little more than 6%. I don't need the investment income at this time, but I'll gladly add those cash payments to my retirement account right now to fund the purchase of other stocks in my IRA later.

Should you invest $1,000 in Fastly right now?

Before you buy stock in Fastly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fastly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Block, Fastly, PayPal, Pfizer, and StoneCo. The Motley Fool recommends BioNTech Se and recommends the following options: short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

3 Stocks I'm Adding to My Retirement Account in March was originally published by The Motley Fool