3 Stocks Ready for Dividend Hikes in 2024

One of the great things about dividend stocks is, not only do they pay you to own them, often they increase how much they're paying out. Many companies pay and increase their dividends for 10 years, 25 years, and (in the case of Dividend Kings) even 50 years or more.

Predicting which companies will increase their dividends is easier than you might think. But sometimes, the timing can be less predictable. Indeed, stocks that I would have featured for this article -- including Domino's Pizza, Waste Management, and Universal Display -- already announced a dividend hike in recent weeks, just before I could highlight them.

Here's why it's relatively easy to find dividend-growth companies: Management teams generally like to continue dividend streaks once they get going. And dividends are paid from a company's earnings. Therefore, when companies already pay a dividend and have consistent earnings far above what's needed to cover the dividend, these are good candidates for dividend increases.

Coffee giant Starbucks (NASDAQ: SBUX), discount-retail chain Dollar General (NYSE: DG), and swimming pool supply company Pool Corp. (NASDAQ: POOL) are three companies that fit this description right now and could consequently hike their dividends in 2024.

1. Starbucks

With over 38,000 locations around the world and bagged coffee available in grocery stores nationwide, Starbucks is a global brand that needs no introduction.

However, many might be surprised to learn how quickly this company is still growing. It opened more than 500 new locations in its fiscal first quarter of 2024 alone -- that's a new Starbucks location every four hours on average.

Starbucks doesn't intend to slow down at all. It hopes to have 45,000 locations by the end of fiscal 2025, which means that the pace of new store openings could actually increase from Q1.

These new Starbucks locations are a growing source of profits. And this is why I believe the company will have plenty of room to hike its dividend in 2024 and in subsequent years as well.

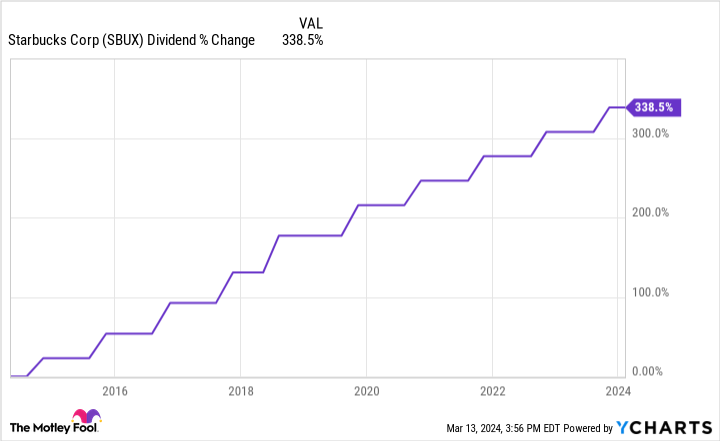

Starbucks has paid and increased its dividend for 13 straight years now -- a streak management is eager to keep going. It last raised its dividend by 7% in September. And it's grown like clockwork over the past decade, as the chart below shows.

2. Dollar General

As recently as October, Dollar General shareholders were experiencing the worst pullback since it went public, down more than 60% from its all-time high. Back then, the market was concerned about slowing store traffic and slumping profits. But the stock is coming back as the company charts a course to overcome its challenges.

In its fiscal 2023 (which ended Feb. 2), Dollar General had net sales of nearly $39 billion, which was a slight increase from its fiscal 2022. However, all of its profit metrics took a step back because its had too much inventory, leading to theft and other issues.

Dollar General doesn't necessarily expect marked improvement in fiscal 2024. Management is only guiding for 6% net sales growth, most of which will come from opening 800 new stores. And it expects full-year earnings per share (EPS) of $6.80 to $7.55 -- a far cry from its EPS of $10.68 in its fiscal 2022.

But Dollar General management is making progress to fix its struggles -- inventory per store was down 1% at the end of fiscal 2023. In the meantime, the company is profitable enough to support the dividend even at these suppressed levels. Its annual dividend is only $2.36 per share as of this writing.

Even if Dollar General hits the low end of its EPS guidance in fiscal 2024, it will still have room to hike its dividend. It's raised its dividend for eight straight years now. And with plenty of breathing room, I doubt the company will miss the chance to extend the streak to nine years in the near future.

3. Pool Corp.

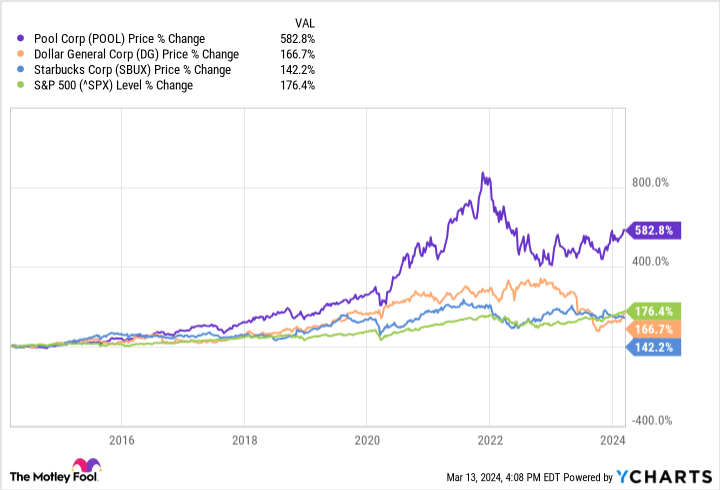

Of these three companies, Pool Corp. is likely the most obscure and that's a shame. Over the last 10 years, shares of Pool are up nearly 600%, trouncing the returns for Starbucks, Dollar General, and the S&P 500.

Pool is in an interesting situation right now. It experienced unusually high growth during the pandemic as people upgraded their living spaces with swimming pools. Net sales of nearly $6.2 billion in 2022 were its highest ever. But in 2023, net sales dropped by 10%.

It's unusual for Pool's sales to drop. But for perspective, net sales of $5.5 billion in 2023 were still its second highest ever. And for 2024, Pool expects its profits to be stable.

That's all Pool needs to hike its dividend for an 11th consecutive year in 2024. In the past year, it's only paid out roughly one-third of its profits as dividends, so it has plenty of breathing room for an increase. And long-term, investors don't need to fret either. The company benefits when pools are installed but continues to profit for years to come with ongoing sales of supplies.

I believe Starbucks, Dollar General, and Pool could all be great dividend growth stocks for long-term investors. They provide an opportunity to lock in a safe and growing stream of dividend income that will only get better with time.

Should you invest $1,000 in Starbucks right now?

Before you buy stock in Starbucks, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Starbucks wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

Jon Quast has positions in Dollar General and Starbucks. The Motley Fool has positions in and recommends Domino's Pizza and Starbucks. The Motley Fool recommends Universal Display and Waste Management. The Motley Fool has a disclosure policy.

3 Stocks Ready for Dividend Hikes in 2024 was originally published by The Motley Fool