3 Stocks Set to Sail as CPI Comes in Better Than Expected

The CPI data released yesterday has investors breathing easier. With all-items inflation now down to 4%, the smallest increase since Mar 2021, it’s clear that the Fed’s actions have born fruit. The immediate impact of that could be seen as a pause in rate hikes when the Fed meets later today.

A deeper look reveals however that the decline is largely driven by energy, which has borne the brunt of continued supply from Russia, as well as traders working down inventories in a high-rate environment. While the OECD cutting supply could have raise prices, demand will be a more important determinant.

The Chinese government’s dovish stance and the likelihood of a stronger stimulus package targeting demand would be supportive. Overall, emerging markets will be increasingly important as developed economies shift away from fossil fuels and struggle with growth in the near term. Overall, the demand outlook is not great, which means that energy prices could remain soft at least through the rest of this year.

Food, the other highly volatile item that the BLS typically excludes from its core basket, offset part of the decline in energy as both food at home and away from home increased. Proteins and dairy prices were supportive with fruit and vegetables, bakery goods and other items going the other way. Food prices depend on a combination of various factors including supply chain issues, labor, transportation costs and weather conditions such as droughts. Most of these items have an element of uncertainty, which means that we can’t depend on food as a contributor to lower CPI.

Prices in the core basket should come down in most with shelter being the major exception, because market dynamics are not supportive.

Overall, it seems extremely likely that prices will continue to moderate, which is why the Fed may end up pausing the rate hikes. Add to that the fact that the labor market remains resilient despite Fed actions and GDP growth projections remain positive, although declining. Therefore, the balancing act between labor on one side and GDP growth on the other appears to be going well. Therefore, while we may expect volatility is share prices, this remains a buyers’ market for stocks, both growth and value.

So here are three stocks that can help you play this market. All have a Zacks #1 (Strong Buy) rank and an A for both Value and Growth. They also belong to the top 50% of industries classified by Zacks, which means that they have an above average chance of beating stocks in the bottom 50% of industries.

Sinclair, Inc. (SBGI)

Sinclair, a Maryland-based media company founded in 1986, provides content through local TV stations and digital platforms. It distributes programming from third-party networks, syndicators, local news, original programming and college sports. The company also manages digital media products related to its TV station assets and oversees technical and software services companies. Additionally, Sinclair owns intellectual property for broadcast technology advancement and engages in diverse businesses like real estate, venture capital, private equity and direct investments.

The company is expected to grow its earnings 158% this year and 87% in the next. 2023 earnings estimates are up from a loss of 16 cents on average to a profit of $2.71 in the last 60 days. For 2024, they’re up $1.52, or 42.7%. in the last quarter, the company beat the Zacks Consensus Estimate by 559% with the last four quarters’ surprise averaging 290%.

The shares are trading at an 80% discount to the Media Conglomerates industry to which it belongs and a 79% discount to the S&P 500. They’re also trading at a 59% discount to their own median value over the past year. Considering the growth prospects and analyst sentiments, share prices aren’t reflecting the intrinsic value.

Tingo Group, Inc. (TIO)

Tingo, a New Jersey-based company operating in fintech and agri-fintech sectors, works towards improving financial inclusion in rural farming communities across Africa, Southeast Asia and the Middle East. The company provides a variety of services, including online trading, auto insurance after-market service, payment services, food processing and commodities trading through different platforms. These offerings encompass smartphone leasing, an agricultural marketplace, utility payments, bill-pay and e-wallet, insurance products, and access to finance and lending services.

Tingo’s earnings are expected to increase 971% this year and 119% in the next. The 2023 estimate increased 7 cents while the 2024 estimate increased 23 cents in the last 60 days. Surprise history is only available for the last quarter, in which the company surprised by around 18%.

TIO shares have started trading only recently and the discount to the industry (Technology Services)/S&P 500 is too great to mention.

Vipshop Holdings Limited (VIPS)

Guangzhou, China-based Vipshop operates online platforms offering a range of products including apparel, shoes, accessories, lifestyle goods and supermarket products. It operates through Vip.com, Shan Shan Outlets, and other segments, also providing Internet finance services such as consumer and supplier financing. Additional business activities include warehousing services, retail business, product procurement, and IT support. Products are sold through its vip.com and vipshop.com platforms and retail stores.

Vipshop is expected to grow 25% this year and 6% in the next. Its 2023 estimates are up 29 cents (18%) in the last 60 days while the 2024 estimate is up 32 cents (18%) in the last 60 days. In the last quarter it beat by 31% and in the last four quarters, it beat by an average 28%.

At 9.85X P/E, VIPS shares trade at a 31% discount to the industry (Internet - Delivery Services) and 49% discount to the S&P 500. This is a roughly 2% discount to its median level over the past year. Therefore, the shares are cheap any way you look at it.

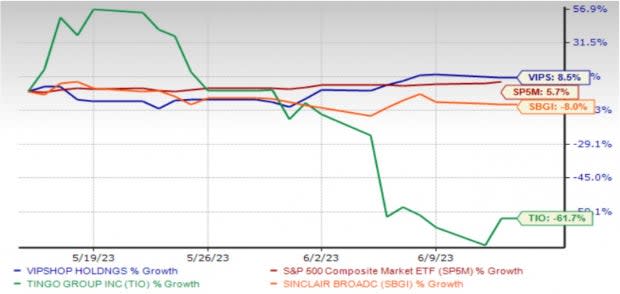

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sinclair, Inc. (SBGI) : Free Stock Analysis Report

Vipshop Holdings Limited (VIPS) : Free Stock Analysis Report

Tingo Group, Inc. (TIO) : Free Stock Analysis Report