3 Stocks to Watch on Dividend Hikes Amid High Volatility

Investors in the United States remain skeptical as the Federal Reserve's hawkish tone continues. The Fed paused its aggressive interest rate hike policy in its June FOMC meet but Chairman Jerome Powell suggested that the central bank will act according to month-on-month data and most likely raise interest rates this year.

The S&P 500, the Nasdaq and the Dow have posted positive returns of 13.70%, 29.0% and 2.43%, respectively, so far this year.

The central bank has hinted at another half a percentage point increase in overnight interest rate within this year. Possibilities of such a move is validated by the inflation reading of 4.9% for April, which is still two times higher than the Fed's long-term inflation expectation. Currently, the interest rate is at a 16-year high.

The U.S. labor market remains strong as payroll employment added more than 300,000 jobs in May. Yet,other key economic indicators like retail sales, manufacturing PMI, services PMI and industrial production have shown signs of shrinking in 2023. Many economists have given warnings of an impending recession if the Fed fails to strike the right balance.

Economic challenges continue worldwide as well. China's economy is showing signs of slowing down, which will indirectly impact global manufacturing and supply chain. Also, the decision to cut down on oil supply by OPEC+ members is expected to push oil prices higher.

Thus, from an investor's point of view, dividend stocks can be the preferred choice for investors looking for regular income and capital preservation in such adverse economic conditions. These companies have mature businesses, pay out regular dividends and remain profitable due to their proven business models. Companies that tend to reward investors with a high dividend payout outperform non-dividend-paying stocks during market volatility. Investors can expect a regular flow of income in volatile market conditions.

On that note, let us look at companies like National Fuel Gas Company NFG, Host Hotels & Resorts HST and Casey's General Stores CASY that have lately hiked their dividend payouts.

National Fuel Gas Company is an integrated energy company. This Zacks Rank #3 (Hold) company has natural gas assets located in the prolific Appalachian basin and oil-producing assets in California. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

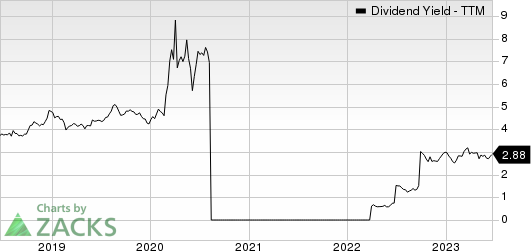

On Jun 15, NFG declared that its shareholders would receive a dividend of 50 cents a share on Jul 14, 2023. NFG has a dividend yield of 3.73%.

Over the past five years, NFG has increased its dividend six times, and its payout ratio presently sits at 31% of earnings. Check National Fuel Gas Companies’ dividend history here.

National Fuel Gas Company Dividend Yield (TTM)

National Fuel Gas Company dividend-yield-ttm | National Fuel Gas Company Quote

Host Hotels & Resorts is a leading lodging real estate investment trust. This Zacks Rank #1 (Strong Buy) company is engaged in the ownership, acquisition and redevelopment of luxury and upper-upscale hotels in the United States and abroad.

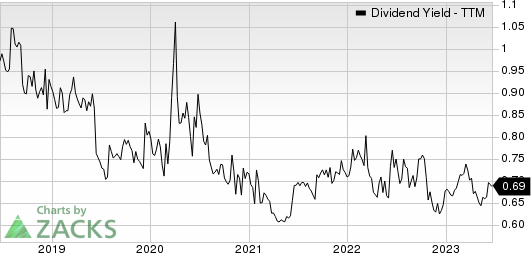

On Jun 14, HST announced that its shareholders would receive a dividend of 15 cents a share on Jul 17, 2023. HST has a dividend yield of 2.89%.

Over the past five years, HST has increased its dividend six times. Its payout ratio now sits at 25% of earnings. Check Host Hotels & Resorts' dividend history here.

Host Hotels & Resorts, Inc. Dividend Yield (TTM)

Host Hotels & Resorts, Inc. dividend-yield-ttm | Host Hotels & Resorts, Inc. Quote

Casey's General Stores is headquartered in Ankeny, IA. This Zacks Rank #2 (Buy) company operates as a convenience store.

On Jun 6, CASY declared that its shareholders would receive a dividend of 43 cents a share on Aug 15, 2023. CASY has a dividend yield of 0.70%.

In the past five years, CASY has increased its dividend six times. Its payout ratio at present sits at 13% of earnings. Check Casey's General Stores' dividend history here.

Casey's General Stores, Inc. Dividend Yield (TTM)

Casey's General Stores, Inc. dividend-yield-ttm | Casey's General Stores, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Host Hotels & Resorts, Inc. (HST) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report