3 Stocks to Watch From the Growing Waste Removal Industry

Increased government regulations, adoption of newer technologies and increased awareness about the environment bode well for the waste management industry. The industry is benefiting from heightened industrialization and urbanization, growing apprehensions about the environment, and the implementation of improved waste management methods. Per Statista, the global waste management sector was valued at $1.6 trillion in 2020 and is projected to reach $2.5 trillion by 2030. Factors driving this growth include enhanced waste collection and rising volumes in emerging markets.

Republic Services, Inc. RSG, Clean Harbors, Inc. CLH and Core & Main, Inc. CNM are some stocks likely to gain from the abovementioned factors.

Industry Description

Zacks Waste Removal Services industry players have a crucial role in gathering, treating, and responsibly handling various types of waste to mitigate their impact on the environment and public health. In terms of the type of waste, the market is divided into Industrial, Commercial, Domestic and Agricultural waste segments. Industrialization has driven the prominence of the industrial waste category as it generates substantial demand for effective waste management solutions. In terms of service type, the market comprises Collection and Disposable services. Disposal services, driven by the increasing need for waste recycling to reduce environmental effects, is the leading revenue-generating segment.

Factors Influencing the Future of the Waste Removal Services Industry

Reviving Demand: The industry is mature, with demand for services remaining stable over time. Revenues, income and cash flows are anticipated to gradually reach the pre-pandemic healthy levels, aiding most industry players in paying out stable dividends.

Sustained Business Opportunities: An increase in population, industrialization and urbanization should remain the key drivers of the industry as these result in a significant rise in garbage and recycling. Also, the use of advanced collection and recycling solutions is expected to pick up pace. Further, increasing global consciousness about environmental preservation has prompted governments and industries to adopt stringent waste management regulations. These promote responsible waste handling, disposal and recycling practices, thus enhancing business opportunities for waste management companies.

Rising Costs a Headwind: Fluctuating commodity prices and changes in the global recycling landscape present a risk to the waste management sector. When recycling costs surpass market returns, waste management firms could encounter financial difficulties. Moreover, market disruptions like import restrictions by other nations on specific materials could affect recycling operations' profitability and sustainability.

Zacks Industry Rank Indicates Encouraging Prospects

The Zacks Waste Removal Services industry, which is housed within the Zacks Business Services sector, currently carries a Zacks Industry Rank #101. This rank places it in the top 40% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that investors can buy or retain given their sturdy potential, let’s take a look at the industry’s recent stock market performance and current valuation.

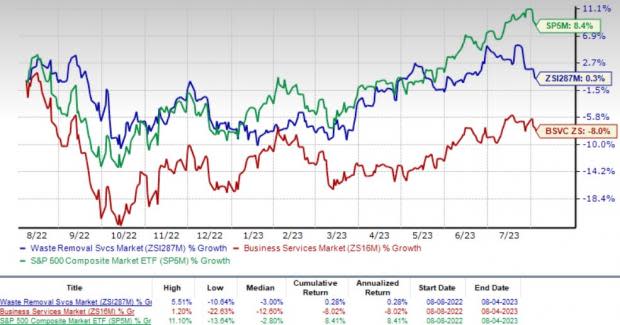

Industry Outperforms Sector, Lags S&P 500

The Zacks Waste Removal Services industry has outperformed the broader Zacks Business Services sector but lagged the Zacks S&P 500 composite over the past year.

The industry has gained 0.3% over this period against the 8% decline of the broader sector. The Zacks S&P 500 composite has meanwhile witnessed an 8.4% upside.

One-Year Price Performance

Industry's Current Valuation

On the basis of EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation and amortization), which is commonly used for valuing Waste Removal services stocks, the industry is currently trading at 13.86X compared with the S&P 500’s 13.64X and the sector’s 25.94X.

Over the past 5 years, the industry has traded as high as 15.06X, as low as 13.15X and at the median of 13.77X as the charts below show.

EV-to-EBITDA

Stocks to Watch

Core & Main, sporting a Zacks Rank #1 (Strong Buy), is a U.S.-based distributor of water, wastewater, storm drainage, and fire protection products and services, catering to municipalities, private water companies and professional contractors. Its comprehensive product range includes pipes, valves, hydrants, fittings, storm drainage solutions, fire protection systems, sprinkler devices, and meter products, including smart meters and associated services.

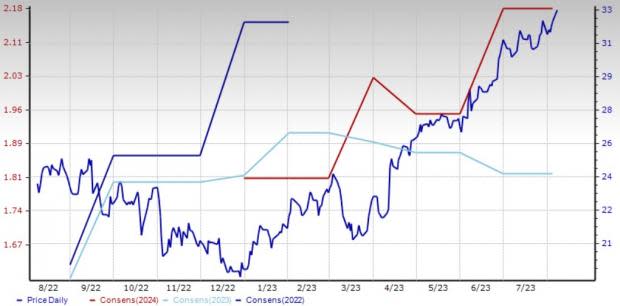

The growing emphasis on infrastructure development and modernization in the United States bodes well for the company. This trend drives demand for water, wastewater, storm drainage, and fire protection products and services, aligning with the company's offerings and positioning it for potential growth. The company’s 2023 revenues are expected to grow 1.8% year over year. Estimates for CNM’s 2023 earnings have been revised northward by 4% in the past 90 days.

The company has gained 67.1% year to date. You can see the complete list of today’s Zacks #1 Rank stocks here.

Price & Consensus: CNM

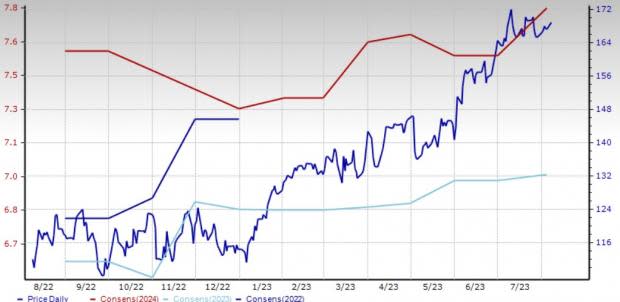

Clean Harbors, carrying a Zacks Rank #2 (Buy), is headquartered in Massachusetts. It offers environmental and industrial solutions globally. The company prioritizes efficiency enhancement and cost reduction by leveraging advanced technology, streamlined processes and rigorous cost control. Its ongoing capital investments improve service quality and ensure compliance with governmental and local mandates. Strategic acquisitions broaden the company's service offerings, while steady share buybacks reinforce investor trust and contribute positively to earnings per share. The company’s 2023 revenues are expected to grow 5.2% year over year. Estimates for CLH’s earnings have been revised northward by 1.3% in the past 90 days.

The company has gained 46.5% year to date.

Price & Consensus: CLH

Republic Services, having a Zacks Rank 3 (Hold), is headquartered in Arizona. It provides environmental services across the United States. The company's revenues benefit from favorable acquisitions and internal expansion. Republic Services is actively enhancing operational efficiency through initiatives like transitioning to compressed natural gas collection vehicles and upgrading rear-loading trucks to automated-side loaders, resulting in cost reduction and improved profitability. Furthermore, its steady dividend distribution and share repurchases enhance both investor trust and earnings per share.

The company’s 2023 revenues are expected to grow 9.7% from the year-ago reported figure. Estimates for RSG’s 2023 earnings have improved 2.1% in the past 90 days.

The company has gained 15.1% year to date.

Price & Consensus: RSG

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

Core & Main, Inc. (CNM) : Free Stock Analysis Report