3 “Strong Buy” Pharma Stocks With Fast-Approaching Catalysts

Given the widespread market volatility, some investors are seeking refuge in more defensible stocks. However, this certainly doesn’t apply to every Wall Street observer. A select group remains ready to take on some risk, enticed by the possibility of massive returns. Where are they looking for these opportunities? The pharmaceutical industry.

The nature of the sector sets names up for impressive upside potential as only a few key events like data readouts and regulatory decisions indicate whether a pharma company will be able to generate essential revenues. As a result, any development can serve as a catalyst that gets the ball rolling, and sends shares either skyrocketing or tumbling downwards. This is what makes investing in pharma stocks such a high stakes game.

Understanding the risk involved, we set out to find only the stand-outs in the pharma space, as determined by the analyst community. Looking at three in particular, TipRanks’ database revealed the stocks are getting plenty of love from the Street, enough to score a “Strong Buy” consensus rating, ahead of possible catalysts. Not to mention each ticker offers pretty serious upside potential.

Albireo Pharma (ALBO)

Through the power of bile acid modulation, Albireo Pharma is developing potential treatment options to improve the lives of people with liver disease. With the company gearing up for an important data readout, several members of the Street think that now could be the time to get in on the action.

ALBO is slated to release top-line data from the Phase 3 PEDFIC-1 trial in Q3, which is evaluating its lead candidate, odevixibat. The therapy is an ileal bile acid transporter (IBAT) inhibitor designed as a treatment of progressive intrahepatic cholestasis (PFIC).

Ahead of the readout, five-star analyst Ritu Baral likes what she’s seeing. “Top-line data would be a major catalyst to ALBO shares and support both NDA and MAA filings. We see the trial's probability of success at ~60% with ~80% upside to ALBO shares,” the analyst commented. What’s driving her optimistic approach? The data from the Phase 2 study and odevixibat’s targeted mechanism of action.

Looking more closely at the available data, in the MAD Phase 2 study, a four-week treatment with odevixibat was able to produce a 61% reduction in serum bile acid (sBA) levels. Additionally, the company has provided “strong data supporting the correlation between reduction in sBA levels and improvement in itch scores.” Baral added, “Odevixibat specifically targets and inhibits IBAT, which should cause a greater increase in bile acid excretion relative to production. We think this mechanism should lead to meaningful improvements in sBA and itch scores in the pivotal Phase 3.”

As for institutional investors, they also appear to be optimistic. After surveying 13 institutional investors regarding the upcoming Phase 3 trial, Baral found that “investors are overall bullish on the Phase 3 PEDFIC-1 trial with a majority believing the trial will hit on its itch endpoint (the primary endpoint for FDA review).” That being said, some participants weren’t convinced that odevixibat will show a diarrhea signal. This is problematic as it could hamper commercial uptake within the PFIC population. However, Baral still has high hopes going forward given the promising Phase 2 results.

Everything that ALBO has going for it prompted Baral to maintain an Outperform rating and $39 price target. Should the target be met, a twelve-month gain of 54% could be in store. (To watch Baral’s track record, click here)

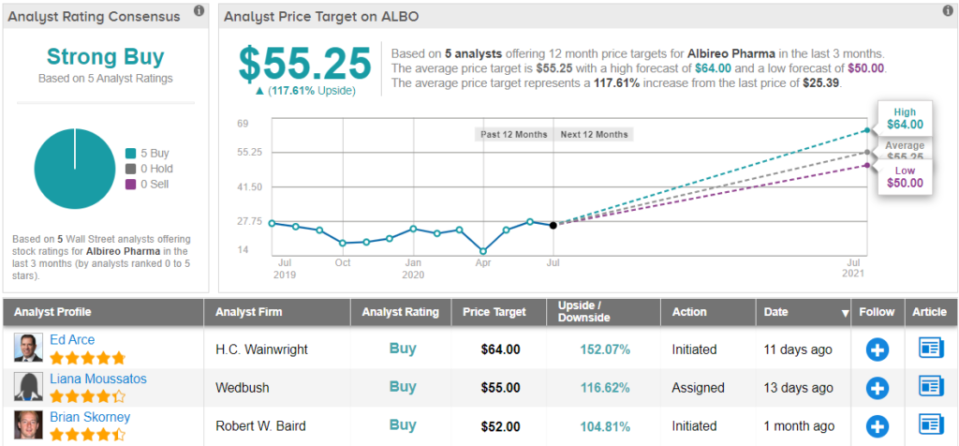

Do other analysts agree with Baral? They do. Only Buy ratings, 5, in fact, have been issued in the last three months, so the consensus rating is a Strong Buy. At $55.25, the average price target implies shares could climb 118% higher in the next year. (See ALBO stock analysis on TipRanks)

Homology Medicines (FIXX)

Hoping to advance its unique gene editing and gene therapy platform, Homology Medicines believes its assets could potentially cure rare genetic diseases. As the fast-approaching release of clinical data could fuel significant upside, this pharma name is scoring significant attention from the Street.

Writing for RBC Capital, analyst Luca Issi acknowledges that there is limited data available, making it difficult to gauge if the Phase 1/2 update, which should come by September at the latest, will be positive. The Phase 1/2 program is assessing its lead asset, a liver-targeting AAVHSC15 vector, in adult phenylketonuria (PKU), a metabolic disease caused by reduced phenylalanine activity that affects 50,000 people globally.

Issi tells investors it’s “difficult to pound the table,” given that FIXX only released data for three patients so far. However, based on the $14.77 share price and the fact that the early data “showed a positive trend,” the analyst is on board. “Recall, Dec-19 first look at pheNIX showed no response at low dose (n=2) and one responder at mid-dose. Despite some controversy around baseline vs pre-treatment values, we are encouraged by the early look given concomitant Phe reduction/Tyr boosting, suggesting restoration of metabolic pathway,” he explained.

In terms of how many patients will be included in this update, Issi believes there will be an additional one or two patients at the mid-dose and up to three at the high dose. It’s also possible that FIXX will report data from an even higher dose. At the mid-dose, Issi is anticipating a longer patient 3 follow up, a first look at patient 4 (prior data immature) and potentially even data from one additional patient. “At the high dose, which is most important, we are expecting ≤3 patients. Cohort 4 data is also possible (recall FIXX can dose in between mid- and high- dose or go even higher by amending the protocol),” he said.

Although the “devil will be in the details,” competing therapy Palynziq’s recent approval suggests that a 50% reduction in Phe is the threshold for success. Not to mention given Palynziq’s shortcomings, “FIXX may revolutionize PKU given potential for one-time functional cure.”

Issi added, “Competition is fierce, but FIXX is leading the way (only gene-therapy with clinical data) and capitalizing on first-mover advantage will be key given curative nature of gene therapy depletes the prevalence pool.”

With Issi estimating peak sales of $1.1 billion, the deal is sealed. In addition to reiterating an Outperform recommendation, he left the price target at $30. This target implies massive upside potential of nearly 100%.

Overall, the bulls have it on this one. Out of 6 total reviews published in the last three months, all 6 analysts rated the stock a Buy. So, FIXX gets a unanimous Strong Buy consensus rating. Given the $33.50 average price target, shares could soar 123% in the next twelve months. (See FIXX stock analysis on TipRanks)

Assembly Biosciences (ASMB)

Primarily focused on the development of two clinical platforms, a hepatitis B virus (HBV) program and a microbiome program, Assembly Biosciences wants to address the unmet needs of millions of patients around the world. Even before its presentation of updated Phase 2 biomarker data at medical meetings in August and November, this pharma company has already impressed the analyst community.

Representing SVB Leerink, analyst Geoffrey Porges calls ASMB a “compelling investment” ahead of the Phase 2 ABI-H0731 biomarker update. ABI-H0731 is its core inhibitor (CI) that was designed as a possible cure for HBV. Citing previously released data, Porges points out the therapy has produced positive results and demonstrated a clean safety profile.

While interim data was released back in November 2019, in May 2020, management revealed that since then, approximately two-thirds of the virally suppressed cohort had reached ultra-low/undetectable biomarker levels to meet therapy stopping criteria. Additionally, 80% of the treatment-naïve cohort is set to continue treatment because biomarkers continued to decline.

“This tells us that updates at the European Association for the Study of Liver (EASL, August) and the American Association for the Study of Liver Disease (AASLD, November) are likely to be directionally positive, which should draw incremental investor interest ahead of the binary cure event in 1H 2021,” Porges commented.

This update could drive upside, but Porges is focused on the cure event in 1H 2021.” He explained, “The pharmaceutical industry’s investment in HBV cures has stalled as progress could not surpass the spontaneous <1%/year cure rate achievable with approved nucleoside reverse transcriptase inhibitors (NRTIs). If initial cures are unlocked with the CI/NRTI combination, then CIs would also become the backbone for future therapies.”

To this end, Porges believes “large biopharma companies are very likely to be interested in the potential value generated from treating the 292 million global HBV patient population, which could generate $75 billion in cumulative sales using HCV cure therapies as a proxy.” The analyst also told clients, “As an HBV leader and pureplay during this potential therapeutic breakthrough, we believe ASMB should earn a premium price because it owns the first-to-market and potentially best-in-class CI portfolio.”

Based on all of the above, Porges put his stamp of approval on ASMB. Along with his bullish call, he bumped up the price target from $36 to $38. Shares could appreciate by 60%, should the analyst’s thesis play out in the coming months. (To watch Porges' track record, click here)

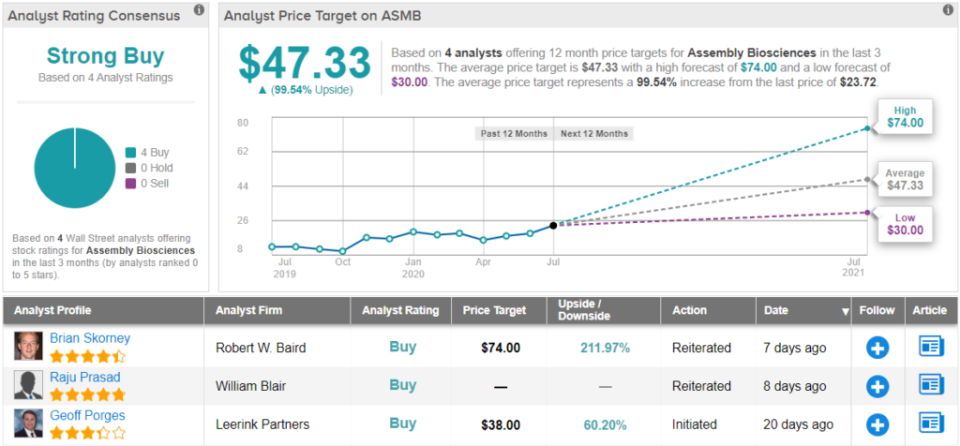

Judging by the consensus breakdown, other analysts also like what they’re seeing. 4 Buys and no Holds or Sells add up to a Strong Buy consensus rating. The $47.33 average price target puts the upside potential at nearly 100%. (See Assembly stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.