3 Strong Stocks Down at Least 30% to Buy Now

The Nasdaq and the S&P 500 have climbed roughly 9% in 2024, driven by projected Fed rate cuts, the AI boom, a stable U.S. economy, earnings growth, and more. The strong performance and outstanding showings from Nvidia, Constellation Energy, Meta, and others might have some investors worried about chasing possibly overheated stocks.

Long-term investors shouldn’t worry too much about ‘missing the boat’ since time in the market is proven to work far better than market timing. That said, there is value in finding beaten-down underperforming stocks that offer long-term upside.

Today we explore three S&P 500 stocks worth considering as buy-and-hold investments that are down at least 30% from their highs even as the market trades at records.

Public Storage (PSA)

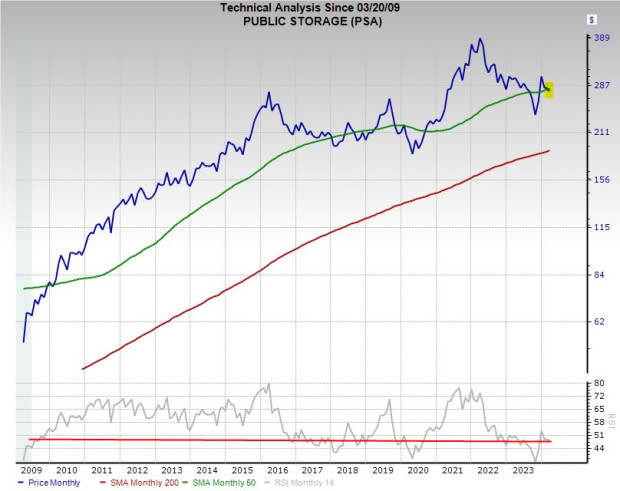

Public Storage shares have fallen 8% YTD and are down 33% from their peaks. Wall Street sold the stock as its growth slowed against a boom during the Covid housing and spending spree. PSA remains one of the largest self-storage firms in the U.S., with over 3,000 facilities, and its fundamentals are attractive. Despite its downturn, PSA stock has crushed the market over the past 20 years.

Image Source: Zacks Investment Research

Public Storage is a REIT that’s expanded steadily over the last 25 years based on a simple fact that’s not changing. Americans from all walks of life continue buying tons of stuff they don’t have room for.

PSA grew its revenue from $2.18 billion 10 years ago to $4.52 billion in FY23. Public Storage posted 17% growth in FY21 and 22% expansion in FY22, followed by 8% growth in FY23.

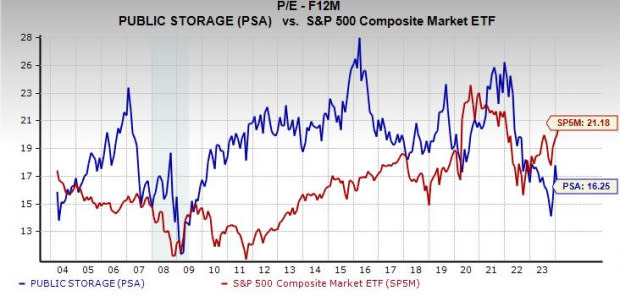

Public Storage is projected to post over 4% sales growth in FY24 and FY25, topping its growth during the four-year stretch before its Covid boom. Public Storage’s adjusted FFO (EPS for REITs) are projected to come in flat this year and then pop 4.5% next year. PSA’s bottom-line outlook has slipped, but it has stabilized recently to help it earn a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Public Storage’s dividend yields 4.3% to match the 10-year U.S. Treasury. PSA has climbed 480% over the last 20 years to crush the benchmark’s 375% and its sector’s 40%. PSA’s total return during that stretch hit 1,000% vs. the S&P 500’s 642%.

PSA trades 8% below its average Zacks price target and 33% under its highs. PSA hovers near its 50-month moving average and at historically oversold RSI levels. PSA trades at a 42% discount to its 20-year highs and 18% below its median at 16.3X forward earnings.

Insulet Corporation (PODD)

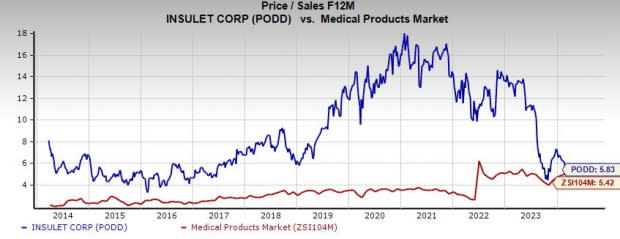

Insulet Corporation is a medical device maker focused on diabetes, with growth potential in other areas. PODD has outclimbed the benchmark over the last 10 years and crushed its medical products industry, yet it is down over 20% YTD and trades 50% below its highs.

Insulet stock got washed away in a wave of selling on fears the growing use of weight loss drugs will lead to fewer health issues, particularly diabetes. But PODD’s downturn, which was also spurred by higher rates, offers long-term investors an opportunity to buy a strong growth stock at a discount.

Image Source: Zacks Investment Research

Insulet’s wearable insulin pumps provide up to three days of non-stop insulin delivery and integrate with continuous glucose monitors. Insulet’s addressable market is expanding even though 1 in 10 Americans already have diabetes because far more have prediabetes, according to the CDC.

Diabetes is also on the rise outside of the U.S. Insulet is trying to expand by tailoring its Omnipod technology for the delivery of non-insulin subcutaneous drugs across other therapeutic areas. Most importantly, its outlook remains robust despite the rise of weight loss drugs.

Image Source: Zacks Investment Research

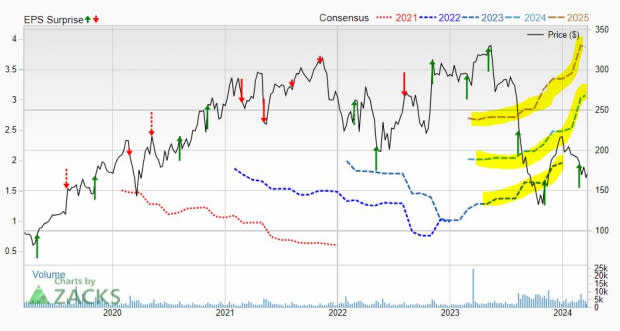

Insulet’s 2023 revenue surged 30%, capped off by a 38% expansion in Q4. PODD also posted blowout bottom line growth and crushed our EPS estimates by an average of 100% in the trailing four quarters. PODD’s upward earnings revisions help it land a Zacks Rank #2 (Buy). PODD’s sales are projected to climb 16% this year and 19% next year to $2.34 billion. POD’s adjusted EPS are projected to jump 12% in FY24 and 26% next year.

PODD has skyrocketed nearly 4,000% in the last 15 years and climbed 235% in the past 10. Yet it trades 50% below its peaks and 40% under its average Zacks price target. PODD trades at 5.8X forward sales, slightly above its industry and 70% below its highs. Insulet’s PEG and P/E ratios look more reasonable as well.

ON Semiconductor (ON)

ON Semiconductor shares are down around 30% from their August highs and trade 24% below their average Zacks price target. ON is suffering setbacks within the cyclical chip space and from near-term headwinds within the EV industry and the industrial sector. Despite its downturn, ON Semi is roughly neck-and-neck with the Zacks Semiconductor market over the last 20 years, soaring 910%.

Image Source: Zacks Investment Research

ON Semi is an analog chip industry standout, with solutions for the industrial and automotive sectors. The firm has grown alongside EVs, energy storage, solar, and beyond. ON also spent the last few years boosting its margins and continuing to exit low-margin non-core products. Plus, a key 2021 acquisition transformed ON into a silicon carbide supplier, which is used in EVs, chargers, energy infrastructure, and beyond.

ON is a $32 billion market cap firm that expanded its sales from around $2.78 billion in FY13 to $8.25 billion in 2023, despite several YoY declines. ON’s revenue dipped by 0.9% in FY23 after it climbed 24% in FY22 and 28% in FY21. ON Semi’s sales and earnings are projected to slip in FY24 and then bounce back in FY25 to the tune of 10% revenue growth and 19% adjusted EPS expansion.

Image Source: Zacks Investment Research

ON Semi has climbed 21% off its October 2023 lows. The stock is currently chopping around its 21-day and 50-day moving averages, while sitting solidly below its 200-day. Buyers have stepped in recently around its 21-week moving average.

ON trades at a 37% discount its 10-year highs and the Tech sector at 16.4X forward 12-month earnings. ON also boasts a great balance sheet, and investors might start to nibble as more people look for deals with the market at fresh highs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Insulet Corporation (PODD) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report