3 Sub-$10 Stocks Poised to Triple Before 2025 Ends

Low-price stocks under $10 can be quick money-making machines if the entry is timed well. These stocks carry a high risk, and trading should be limited to a small part of the portfolio.

However, if stocks double or triple in quick time, even a small allocation significantly impacts the overall portfolio health. This column focuses on three stocks under $10, likely to triple before the end of next year.

First, low-price stock does not necessarily imply speculative ideas. These stocks represent companies with good fundamentals and growth visibility. The investment horizon can be expanded beyond 2025, depending on how the story develops. I also see these ideas as EBITDA margin expansion stories in the next few years.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Let’s discuss the fundamental reasons these stocks are under $10 worth considering for multibagger returns.

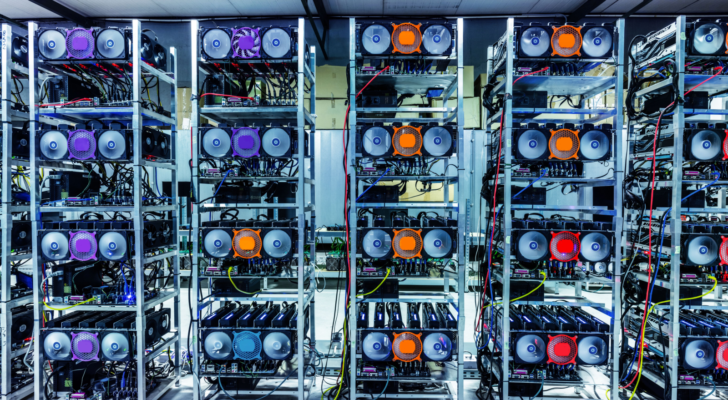

Bitfarms (BITF)

Source: PHOTOCREO Michal Bednarek / Shutterstock.com

Bitfarms (NASDAQ:BITF) was subdued in the recent past even as Bitcoin (BTC-USD) touched new all-time highs. The reason is a $375 million at-the-market offering that resulted in equity dilution. However, Bitfarms has ambitious expansion plans and I expect a big rally in the coming quarters.

It’s worth noting that the Bitcoin miner has strong fundamentals. As of Dec. 2023, the company has $118 million in liquidity buffer. The recent fundraising adds to the liquidity. Further, with a zero-debt balance sheet, there is ample flexibility to make big investments.

As of February, Bitfarms reported a hash rate capacity of 6.5EH/s. The company is targeting to increase capacity to 21EH/s in the second half of 2024. As a low-cost Bitcoin miner, Bitfarms is positioned for stellar revenue growth and massive EBITDA margin expansion. After some consolidation on account of equity dilution, BITF stock will surge.

Ring Energy (REI)

Source: PopTika / Shutterstock

Ring Energy (NYSE:REI) stock looks massively undervalued at a forward price-earnings ratio of 4.4. After being sideways for the last year, REI stock is poised to surge higher.

The first reason to be bullish on Ring Energy is the potential upside in oil prices. Multiple rate cuts are likely coming in the next 12 to 18 months. This will support GDP growth and oil will trend higher. Factors of production cut by the OPEC and geopolitical tensions will likely support the rally.

The second reason for being bullish on Ring Energy is the asset potential. As of 2023, Ring Energy reported 129.8mmboe in proved reserves. These reserves have a PV10 of $1.65 billion. In comparison, Ring Energy has a market valuation of $380 million.

With the visibility of steady growth in production coupled with higher oil prices, Ring Energy is positioned to deliver healthy cash flows. The balance sheet also looks sound, with a leverage ratio of 1.62x.

Joby Aviation (JOBY)

Source: T. Schneider / Shutterstock.com

Flying car stocks look attractive considering the point that commercialization of eVTOL aircraft is due in the next 12 to 18 months. Joby Aviation (NYSE:JOBY) stock is among the attractive names to consider. After surging to highs of $12 in July 2023, JOBY stock has corrected to current levels of $5.3. A big rally seems impending, considering the positive business developments.

It’s worth noting that Joby has already completed three of five stages of the type certification process. The company is, therefore, on track for commercialization next year. Outside the United States, Joby has signed an agreement with the government of Dubai granting exclusive rights to operate air taxis in the Emirate for six years.

For the current year, Joby is focusing on expanding its presence in other key markets. At the same time, the company is looking to increase its engagement with the Department of Defense. The order backlog will swell significantly in the coming quarters. This will set the stage for strong growth in 2025 and beyond.

On the date of publication, Faisal Humayun did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Faisal Humayun is a senior research analyst with 12 years of industry experience in the field of credit research, equity research and financial modeling. Faisal has authored over 1,500 stock specific articles with focus on the technology, energy and commodities sector.

More From InvestorPlace

The #1 AI Investment Might Be This Company You’ve Never Heard Of

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

It doesn’t matter if you have $500 or $5 million. Do this now.

The post 3 Sub-$10 Stocks Poised to Triple Before 2025 Ends appeared first on InvestorPlace.