3 Supercharged ETFs to Buy Hand Over Fist Ahead of 2024

Exchange-traded funds, or ETFs, are the fastest-growing investment products in the world. The reason for their rising popularity is simple: ETFs provide an easy and cost-effective way to gain exposure to certain themes or segments of the market. Although these investing vehicles rarely deliver explosive gains like some stocks, they are inherently less risky because of their diversification factor. Investors, in turn, can rest easy owning a handful of ETFs.

How can you make the most of ETF investing? The answer to this question will ultimately depend on your personal financial goals and investing style. But one proven and straightforward strategy is to own a basket of ETFs that provide exposure to the main areas of value creation in the market. More specifically, you can buy three funds that cover large-cap, mid-cap, and small-cap stocks. Combining these three funds with a handful of low-risk bond funds should deliver returns either on par or superior to the broader market over the long term.

Which funds are optimal for this strategy? Below is a nuts-and-bolts overview of three ETFs that screen as some of the best performers in their respective categories.

Large-cap growth

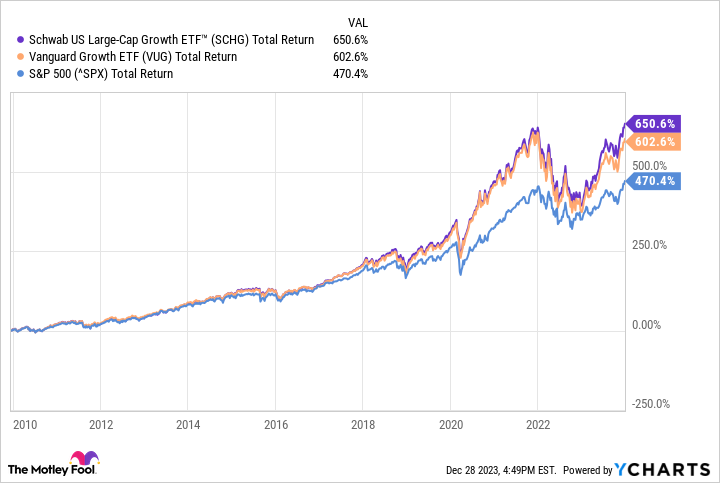

The Schwab U.S. Large-Cap Growth ETF (NYSEMKT: SCHG) is an ETF that invests in large-cap U.S. companies with strong growth potential. It tracks the Dow Jones U.S. Large-Cap Growth Total Stock Market Index, which selects companies based on characteristics such as sales and earnings growth. The SCHG sports an extremely low expense ratio of 0.04%, which is 95.8% lower than the category average. This Charles Schwab large-cap growth ETF also offers a modest yield of 0.43%.

Since its inception in 2009, the SCHG has delivered total returns (before taxes and assuming the distribution was reinvested) of 650%. For reference, the Vanguard counterpart to the SCHG, known as the Vanguard Growth Index Fund, delivered total returns of 602% over the same period. Both of these U.S. large-cap funds outperformed the S&P 500 by a wide margin over the past 13 years.

Mid-cap growth

The iShares Morningstar Mid-Cap Growth ETF (NYSEMKT: IMCG) is an ETF that invests in mid-cap U.S. companies that are expected to grow their earnings faster than the broader market. It tracks the Morningstar Mid Growth Index, which holds shares of companies with above-average growth potential. The IMCG has an ultra-low expense ratio of 0.06%, which is 87% lower than the category average. It also offers a modest yield of 0.9%.

This mid-cap fund has been one of the best performers in its category since its inception in 2004. Speaking to this point, the IMCG has delivered excess returns relative to both the Vanguard Mid-Cap Index Fund and the S&P 500 over the prior 19 years.

Small-cap value

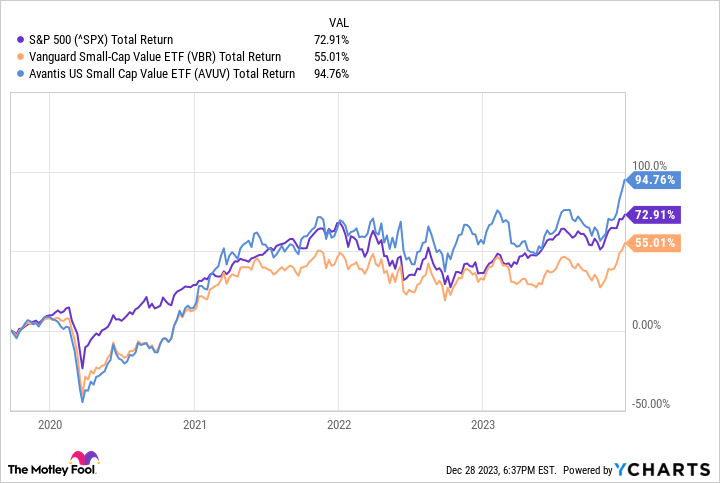

The Avantis U.S. Small Cap Value ETF (NYSEMKT: AVUV) is an ETF that invests in small-cap U.S. companies that screen as undervalued by the fund's managers. Unlike the other two funds discussed above, the AVUV is an actively managed fund. Its performance benchmark is the Russell 2000 Value Index.

However, this fund does not track a specific underlying index. The AVUV has an expense ratio of 0.25%, which is extremely low for an actively managed fund. Since its inception in 2019, it has markedly outperformed both the Vanguard Small-Cap Value Index and the S&P 500.

And despite being a small-cap fund, the AVUV still sports a fairly generous yield of 1.83%. The AVUV thus offers a compelling mix of income, low fees, and above-average performance.

Should you invest $1,000 in Schwab Strategic Trust-Schwab U.s. Large-Cap Growth ETF right now?

Before you buy stock in Schwab Strategic Trust-Schwab U.s. Large-Cap Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Schwab Strategic Trust-Schwab U.s. Large-Cap Growth ETF wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Charles Schwab is an advertising partner of The Ascent, a Motley Fool company. George Budwell has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Growth ETF and Vanguard Index Funds-Vanguard Mid-Cap ETF. The Motley Fool recommends Charles Schwab and recommends the following options: short December 2023 $52.50 puts on Charles Schwab. The Motley Fool has a disclosure policy.

3 Supercharged ETFs to Buy Hand Over Fist Ahead of 2024 was originally published by The Motley Fool