3 Technology Services Stocks to Buy for a Stronger Portfolio

The technology services market has been gaining since the pandemic, which introduced the world to remote work. The trend gained popularity very quickly, accelerating the digital transition. Work from home compelled service providers to ensure that customers have the tools and technologies to enable speed, security, quality, and overall efficacy of services, thereby increasing the demand for technology services.

The rapid uptake of technology services came with its share of downsides. The FBI reported a 300% increase in cybersecurity cases. The industry, nevertheless, has been reaping the benefits of increased demand for data security and privacy protection solutions. Per Statista, the IT Services market is expected to reach $1,204 billion in 2023. The market volume is expected to reach $1,570 billion, indicating an annual growth rate (CAGR 2023-2027) of 6.86%.

Notably, the Zacks Technology Services industry has gained 19.6% in the year-to-date period outperforming the S&P 500 composite’s rise of 14.9%. It currently carries a Zacks Industry Rank #102, which places it in the top 41% of 251 Zacks industries.

HIVE Blockchain Technologies Ltd. HIVE, OneConnect Financial Technology Co., Ltd. OCFT and Trane Technologies plc TT are some stocks that are likely to gain from the promising developments in the industry.

Current Key Drivers of Technology Services

With the current trend of global digitization, new opportunities are opening up for the market in the form of 5G, blockchain, and artificial intelligence (AI) among others. The United States, considered one of the major IT markets, is expected to witness growth supported by the widespread adoption of smart technologies and increasing security investments.

Companies are looking to gain a competitive advantage with the adoption of AI, machine learning, blockchain and data science.

The world has seen a breakthrough in cloud computing in the past few years, with cloud solution offering a variety of advantages. For the adoption of cloud computing, companies are considering the implementation of IT services that can analyze all executions, applications, and network connections. According to a report published by Cloudward in 2022, with 94.44%, Google Drive emerged as the most used cloud storage service globally. In the next place was Dropbox, used for cloud storage for collaboration, with a still impressive 66.2%, followed by OneDrive (39.35%), iCloud (38.89%), MEGA (5.09 %), Box (4.17%), and pCloud (1.39%).

Cybersecurity has been one of the fastest-moving industries thanks to increasing remote work. The rising complications increase the need for the implementation of IT services.

Our Picks

Given the promising developments in technology services, investors may consider buying sound stocks from the space. It is crucial to pick winning stocks in order to reap maximum gains.

Our research shows that stocks with a Zacks Rank #1 (Strong Buy) or #2 (Buy) offer attractive investment opportunities. You can see the complete list of today’s Zacks #1 Rank stocks here.

HIVE Blockchain: This cryptocurrency mining company currently has a Zacks Rank #2 and a VGM Score of A.

The Zacks Consensus Estimate for its first-quarter fiscal 2023 earnings has been revised upward by 64.3% in the past 60 days and indicates an increase of more than 100% from the year-ago reported figure.

HIVE Blockchain Technologies Ltd. Price, Consensus and EPS Surprise

HIVE Blockchain Technologies Ltd. price-consensus-eps-surprise-chart | HIVE Blockchain Technologies Ltd. Quote

OneConnect Financial Technology: This provider of cloud-platform-based Fintech solutions and online information and operating support services also has a Zacks Rank #2.

The Zacks Consensus Estimate for fiscal 2023 earnings has been revised upward by 26.3% in the past 60 days and indicates an increase of 38.2% from the year-ago reported figure.

OneConnect Financial Technology Co., Ltd. Sponsored ADR Price and Consensus

OneConnect Financial Technology Co., Ltd. Sponsored ADR price-consensus-chart | OneConnect Financial Technology Co., Ltd. Sponsored ADR Quote

Trane Technologies: The company designs, manufactures, sells, and services heating, ventilation, air conditioning and transport refrigeration. Trane generated around 72% of its revenues from the United States and rest from more than 100 other countries.

The Zacks Consensus Estimate for 2023 earnings has been revised upward by 2.4% in the past 60 days and indicates an increase of 14.5% from the year-ago reported figure. TT currently carries a Zacks Rank #2.

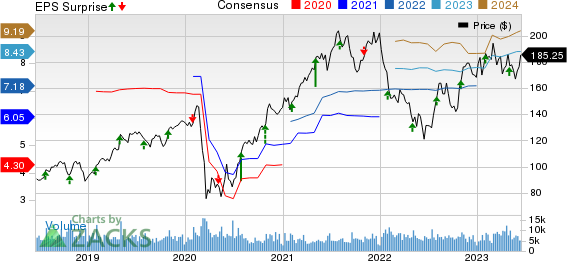

Trane Technologies plc Price, Consensus and EPS Surprise

Trane Technologies plc price-consensus-eps-surprise-chart | Trane Technologies plc Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HIVE Blockchain Technologies Ltd. (HIVE) : Free Stock Analysis Report

Trane Technologies plc (TT) : Free Stock Analysis Report

OneConnect Financial Technology Co., Ltd. Sponsored ADR (OCFT) : Free Stock Analysis Report