3 Things We Learned From Fiverr's Surprise Q4 Results

Fiverr International (NYSE: FVRR) shares slipped 14% in value after the company reported fourth-quarter earnings last week. As one might expect, most of the news failed to meet the market's expectations.

Hidden in this bad news, however, are a few positive nuggets worth paying attention to. Growth investors looking for a bargain should understand what happened this quarter since this could be a great buying opportunity.

1. What the market hated -- Fiverr's revenue growth rate continues to decline

Let's get the bad news out of the way first because these numbers are the reason Fiverr stock immediately nose-dived following the earnings release.

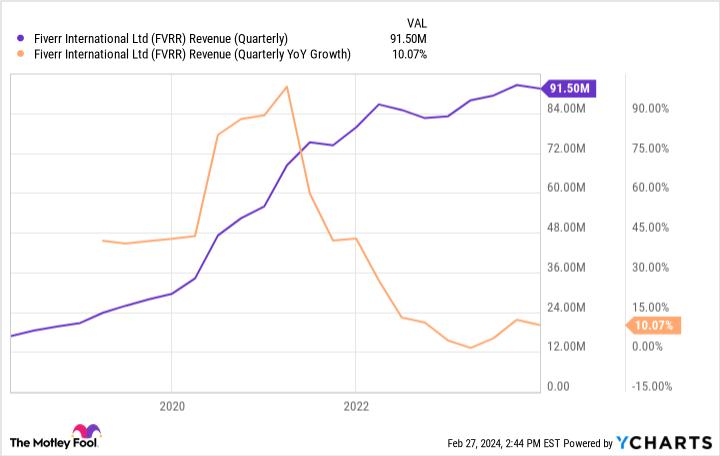

Revenue grew 10.1% year over year, reaching $90.3 million for the quarter. That result looks good on the surface, but Fiverr's issue hasn't been growing its business -- the issue has been growth rates that are slowing.

During the pandemic, the company was increasing revenue by up to 90% year over year. In comparison, a 10.1% rate looks paltry.

Revenue tied to what the company calls "simple services" actually fell by 17%. These services are typically one-off projects, like translations or voice-overs.

There is a silver lining to this decline, but an absolute drop in revenue in a category representing roughly one-third of its platform sales is certainly a negative. CEO Micha Kaufman blamed a "challenging macroeconomic environment, weak [small and medium-size business] sentiment, and waves of layoffs and hiring freezes across industries."

Lastly, the market responded negatively to weak guidance for the quarter ahead, in which revenue is expected to increase by only 4% to 6% year over year. That's still growth, but the trend line continues to fall.

2. What the market missed -- a new growth engine has emerged

There is no sugarcoating Fiverr's top-line results. These figures show a growth business in decline -- one that is in desperate need of a revival.

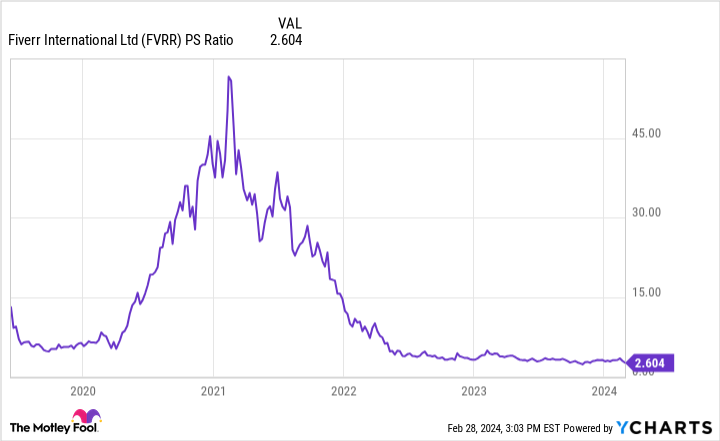

After the latest drop, however, it appears that the market is already expecting the worst. On a price-to-sales (P/S) basis, Fiverr stock has never been this cheap. And if you dig deeper into the numbers, there's reason to believe a turnaround could be just around the corner.

Revenue related to simple services is on the decline, but this drop is partly due to a shift in Fiverr's business model. When the company's freelancer platform was launched, it focused on this simple-services category, vying to meet demand for quick, one-off jobs.

Over time, however, the platform grew stronger with a more capable user base. Today, Fiverr not only provides voice-overs and translation services but also complex tasks like full-production commercials or custom web design.

These complex services often cost more, a reality reflected in the company's average buyer spending for the quarter, which increased by 6% to $278. The "complex services" category as a whole grew 29% year over year in 2023, compared to just 12% in 2022.

Fiverr is experiencing a decline in what used to be its core business, but it is replacing this lost revenue with a higher-quality, higher-spend revenue stream. The fact that these shifts are occurring simultaneously masks the promise of the transition.

2. Why the company is hopeful -- artificial intelligence could be a game changer

Another signal of Fiverr's promising turnaround is its adoption of artificial intelligence (AI). Last year, the company unveiled Fiverr Neo, which uses AI to more quickly and effectively match buyers and sellers. Management believes its AI-related innovations helped lift revenue generated from its platform by 4% for the quarter.

Fiverr isn't just incorporating artificial intelligence into its platform. It has also positioned itself to meet the rising demand for AI services. For example, Fiverr's freelancer workforce can create custom ChatGPT agents and train new data models. You can even hire an expert on Fiverr to train you on how to develop your own AI services.

Fiverr doesn't break out its AI revenue yet, but it is another sign that the company is shifting focus toward more complex, higher value services. It's clear that meeting demand for this type of work exposes the company to a rising tide. According to Indeed, job posts related to AI increased nearly 250% over a two-year period.

It's early, but artificial intelligence could prove to be a game changer for Fiverr in multiple ways.

Is now the time to buy?

Fiverr is a former growth darling stuck in a period of transition. The rapid gains of previous years likely won't be attained for several more years. Today's bargain valuation, however, already seems to be pricing in this reality.

Given Fiverr's focus on providing pricier, more complex services delivered through an AI-enabled matching algorithm that will only strengthen over time, growth should pick up once the decline in simple services bottoms out. There could be another few quarters of rocky results, but Fiverr stock looks like a bargain for growth investors willing to bet on a turnaround.

Should you invest $1,000 in Fiverr International right now?

Before you buy stock in Fiverr International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fiverr International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Ryan Vanzo has positions in Fiverr International. The Motley Fool has positions in and recommends Fiverr International. The Motley Fool has a disclosure policy.

3 Things We Learned From Fiverr's Surprise Q4 Results was originally published by The Motley Fool