3 Top Blockchain Stocks With Unprecedented 1,000% Gain Potential

Venturing into the dynamic realm of blockchain investments requires uncovering hidden treasures poised for extraordinary growth. This exploration leads to three blockchain stocks with unparalleled 1,000% gain potential.

The first one’s robust cash flow, edgy business models, and flourishing apps set the stage for substantial returns. Meanwhile, the second one was strategically aligned with Bitcoin-halving events and boasted a global expansion plan toward scalability. The third, utilizing Bitcoin to fund operations and focusing on responsible mining practices, suggests an edgy and forward-looking strategy.

The article delves into these blockchain giants’ financial intricacies and strategic moves. Read more to uncover the key drivers propelling them toward unprecedented growth. From the first’s impressive cash flow dynamics to the second’s global expansion and the third’s innovative energy-focused approach, these stocks are poised to reshape the blockchain ecosystem and redefine investment returns.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Top Blockchain Stocks: Block (SQ)

Source: Piotr Swat / Shutterstock.com

For Block (NYSE:SQ), cash flow generation is vital to its financial standing and deriving its market value. Block delivered solid cash flow in Q3 2023, with adjusted free cash flow hitting $427 million. This suggests a considerable increase from $88 million in Q2 2023. Over the last 12 months, Block’s adjusted free cash flow was a solid $945 million, a remarkable turnaround from a negative $99 million in Q3 2022. This positive trend in cash flow indicates Block’s ability to generate sustainable cash from its operations.

Another critical fundamental for value growth is the performance of Square and Cash Apps. The Square app generated $899 million in gross profit, a rapid 15% year-over-year increase. This growth demonstrates Square’s business model’s effectiveness and ability to drive revenue. Square’s Gross Payment Volume (GPV) grew by 11% year-over-year, or 12%, on a constant currency basis, highlighting Square’s lead in serving sellers locally and through its banking products.

Also, specific products within Square, such as vertical points of sale, experienced remarkable growth, with gross profit up by 29% year-over-year. This indicates Square’s product strategy’s effectiveness and ability to capture market demand for specific solutions.

Cash App, Block’s mobile payment platform, delivered a progressive performance with a gross profit of $984 million, a substantial increase of 27% year-over-year. This indicates Cash App’s popularity and its ability to generate profits on revenue through various financial services. Also, the growth can be observed in the components of Cash App’s inflows framework, including the number of monthly transacting actives (55 million, up 11% year-over-year) and inflows per transacting active ($1,132 in Q3, up 8% year-over-year). Therefore, these metrics reflect Square and Cash App’s ability to attract and engage a growing user base.

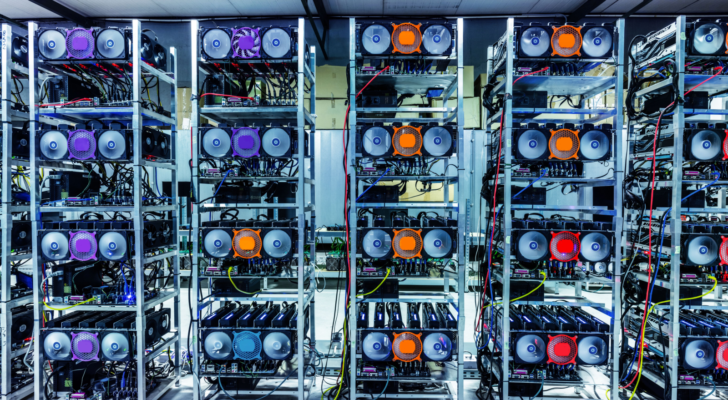

Bitfarms (BITF)

Source: PHOTOCREO Michal Bednarek / Shutterstock.com

Bitfarm’s (NASDAQ:BITF) four-year cycle in Bitcoin mining is closely tied to the Bitcoin halving event, which occurs approximately every four years. This event reduces the rewards for mining (halved). Bitfarms concentrates on the significance of this cycle and aligns its capital investment strategy accordingly. There is a disciplined plan and stress on an attractive return on investment (ROI) hurdle for upgrades and new projects. This positions Bitfarms strategically for the halving events, especially the upcoming one in April 2024.

Fundamentally, the company’s diversified portfolio comprises eleven operating farms in four countries and two more in development, reflecting the focus on global expansion. The attainment of hitting 240 megawatts in operating capacity in October 2023, a 32% increase from a year ago, suggests tangible progress in scaling operations.

Additionally, acquiring hydropower purchase agreements in Paraguay (Paso Pe and Iguazu) is a strategic move to tap into abundant, cost-effective energy sources. The progress in construction, preparation of sites, and the purchase of high-performance miners align with Bitfarm’s goal of expanding capacity with lower costs. Also, only 42% of the contracted capacity has been put into operation, suggesting that Bitfarms has a significant embedded development runway. This untapped capacity gives the company flexibility for future expansion, reflecting a forward-looking approach to growth.

Finally, the correlation between Bitcoin’s price and the hash price is fundamental to the industry. The recent increase in Bitcoin prices from $26K to more than $40K positively impacts hash prices. Hence, the upward trajectory in Bitcoin prices may continue to benefit Bitfarms due to the industry’s sensitivity to cryptocurrency valuations. This is easily one of the top blockchain stocks on the market.

CleanSpark (CLSK)

CleanSpark’s (NASDAQ:CLSK) operational strategy includes a balanced approach to maximizing holdings while using Bitcoin to fund operations. This reduces reliance on equity for operating expenses. Notably, the upcoming Bitcoin halving event prompts the company to lean into a strategy that ensures flexibility in capital decisions.

Additionally, the acquisition of Sandersville, Georgia’s largest Bitcoin mining data center, is a key focus for CleanSpark. There is an ongoing expansion of Sandersville and plans to address additional capacity needs, including the 15-megawatt expansion at Dalton. This demonstrates an edgy approach to supporting growth exceeding 20 exahashes per second.

Furthermore, CleanSpark’s focus on maintaining flat corporate overhead while substantially growing operations is a vital strength. This suggests significant financial effects, equivalent to lowering all-in costs by almost a full $0.01 per kilowatt-hour. Hence, this cost management positions CleanSpark to drive more value growth.

Moreover, CleanSpark’s choice of Georgia as a home, given its access to abundant and net-exported energy, highlights the strategic importance of energy availability. The expansion of the Sandersville facility, once completed, is expected to be the largest Bitcoin mining data center in Georgia, producing more than six exahashes per second.

Overall, the company’s consumption of a significant amount of energy as a Bitcoin miner is viewed as essential to securing and maintaining a robust decentralized mining system. Despite substantial growth, CleanSpark focuses on maintaining most of its energy mix from clean energy sources. Therefore, this suggests responsible mining practices and additional support for its market valuations. If you are lookginf for top blockchain stocks, start here.

On the date of publication, Yiannis Zourmpanos did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Yiannis Zourmpanos is the founder of Yiazou Capital Research, a stock-market research platform designed to elevate the due diligence process through in-depth business analysis.

More From InvestorPlace

The #1 AI Investment Might Be This Company You’ve Never Heard Of

Musk’s “Project Omega” May Be Set to Mint New Millionaires. Here’s How to Get In.

The post 3 Top Blockchain Stocks With Unprecedented 1,000% Gain Potential appeared first on InvestorPlace.