3 Top Electronics Stocks to Overcome Industry Headwinds

The challenging global macroeconomic environment and end-market volatility worldwide have affected the Zacks Electronics - Miscellaneous Components industry. Moreover, geo-political tensions, unfavorable forex and rising inflationary pressure weigh heavily on the industry’s prospects.

Nevertheless, nVent Electric NVT, Fabrinet FN and OSI Systems OSIS are well-poised to benefit from the solid adoption of AI and the democratization of IoT techniques, which are transforming robotics, transportation systems, retail and healthcare. The ongoing automation drive and increased spending by semiconductors, automobiles, machinery and mobile phone manufacturers are other positives for industry players. Also, easing supply chain constraints are benefiting industry participants.

Industry Description

The Zacks Electronics - Miscellaneous Components industry primarily comprises companies providing various accessories and parts used in electronic products. The industry participants’ offerings include power control and sensor technologies to mitigate equipment damage, testing products for safety and advanced medical solutions. They cater to varied end markets, such as telecommunications, automotive electronics, medical devices, industrial, transportation, energy harvesting, defense and aerospace electronic systems and consumer electronics. Its customers are mainly original equipment manufacturers, independent electronic component distributors and electronic manufacturing service providers.

4 Trends Shaping the Future of Electronics - Miscellaneous Components Industry

Macroeconomic Headwinds Pose Concerns: Rising inflationary pressure and fears of global recession have negatively impacted the rate of deal wins. Due to the challenging macroeconomic scenario, enterprises are reluctant to sign multi-year deals worldwide. These trends do not bode well for industry participants.

Geo-political Tensions Are Worrisome: The ongoing Russia-Ukraine war and, most importantly, the souring relationship between the United States and China remain headwinds. Increasing dependency on AI-backed electronic devices on semiconductors and current restrictions ordered by the U.S. on trading with China, which remains the main hub for chip production, is a significant negative for the underlined industry.

Automation Boom a Tailwind: The requirement for faster, more powerful and energy-efficient electronics leads to increased automation. Control systems, such as computers and robots and information technologies for handling different processes and machinery, are driving the industry. The growing installation of collaborative robots, which add efficiency to production processes by working with production workers, will benefit industry participants. IoT-supported factory automation solutions are other contributing factors. The evolution of smart cars and autonomous vehicles is expected to drive growth for the industry.

Miniaturization Remains a Key Lever: The industry participants benefit from the ongoing transition in semiconductor manufacturing technology. Demand for advanced packaging, enabling the miniaturization of electronic products, remains strong. The consistent shift to smaller dimensions, the rapid adoption of new device architectures, like FinFET transistors and 3D-NAND and the increasing utilization of new manufacturing materials to increase transistor and bit density are driving the demand for solutions provided by industry players.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Electronics – Miscellaneous Components industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #187, placing it in the bottom 25% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, basically the average of the Zacks Rank of all the member stocks, indicates bearish near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries results from the negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, analysts are pessimistic about this group’s earnings growth potential. Since May 31, 2023, the industry’s earnings estimates for the current year have moved 8.6% down.

Despite the gloomy industry outlook, a few stocks have the potential to outperform the market based on a strong earnings outlook. But before we present the top industry picks, it is worth looking at the industry’s shareholder returns and current valuation first.

Industry Underperforms S&P 500 & Sector

The Zacks Electronics - Semiconductors industry has underperformed the Zacks S&P 500 composite and the broader Zacks Computer and Technology sector in the past year.

The industry has returned 12.2% over this period compared with the S&P 500’s gain of 19.7% and the broader sector’s rally of 39.7%.

One-Year Price Performance

Industry's Current Valuation

Based on the forward 12-month price to earnings, a commonly-used multiple for valuing electronics - miscellaneous components stocks, the industry is currently trading at 21.17X compared with the S&P 500’s 18.7X and the sector’s 23.59X.

In the past five years, the industry has traded as high as 25.99X, as low as 14.58X and recorded a median of 20.35X, depicted in the charts below.

Forward 12-Month Price-to-Earnings (P/E) Ratio

3 Electronics - Miscellaneous Components Stocks to Watch

OSI Systems: This Hawthorne, CA-headquartered company is a vertically integrated designer and manufacturer of specialized electronic systems and components. Its products are primarily utilized for critical homeland security, healthcare, defense and aerospace applications. The company is riding on its strong portfolio of security screening solutions. It recently received a $10-million contract for mobile cargo and vehicle inspection. Also, the $14 million contract win for its advanced security inspection technology and services remains a major positive.

The Zacks Rank #1 (Strong Buy) player also benefits from its strengthening optoelectronics business. Its growing customer base across multiple industries is bringing higher-margin opportunities for the business.

You can see the complete list of today’s Zacks #1 Rank stocks here.

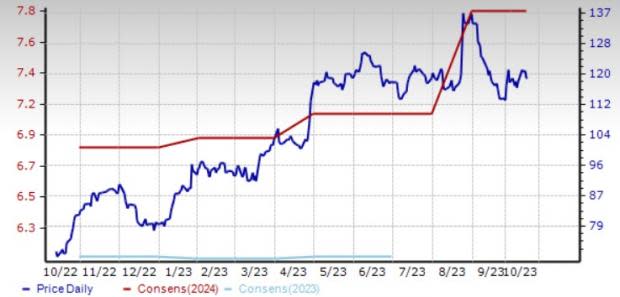

OSI Systems has gained 65% in the past year. The Zacks Consensus Estimate for OSIS’ fiscal 2024 earnings has been revised 10% upward to $7.79 per share in the past 60 days.

Price and Consensus: OSIS

nVent Electric: This London, U.K.-based entity, which is a provider of electrical connection and protection solutions, is optimistic about solid demand for its products and solutions. It is gaining from strength in modular and digital platforms. Further, strengthening relationships with strategic channel partners will continue benefiting it.

The Zacks Rank #2 (Buy) player is expected to continue delivering strong financial performance on the back of its growth, profits and cash strategies remain noteworthy. Moreover, a solid execution of its strategy across high-growth verticals, product introductions, global expansion and strategic acquisitions are tailwinds.

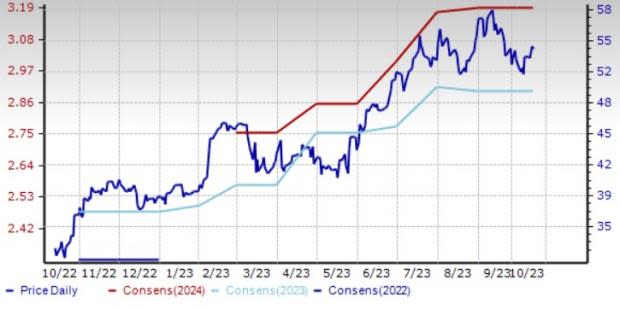

nVent Electric has gained 66.8% in the past year. The Zacks Consensus Estimate for NVT’s 2023 earnings has been revised 0.7% upward to $2.90 per share in the past 60 days.

Price and Consensus: NVT

Fabrinet: The Bangkok, Thailand-based company offers advanced optical packaging, precision optical and electro-mechanical and electronic manufacturing services to original equipment manufacturers of complex products. It is benefiting from a favorable demand environment. Further, solid momentum across optical communications products is aiding Fabrinet’s financial performance.

The Zacks Rank #2 player will likely remain on the growth trajectory, owing to the rising momentum across optical communications OEM customers. Increasing demand for optical communications components and modules, driven by growing outsourcing production activities to third parties by OEMs, remains a tailwind. This apart, the company’s strengthening AI product offerings are a plus.

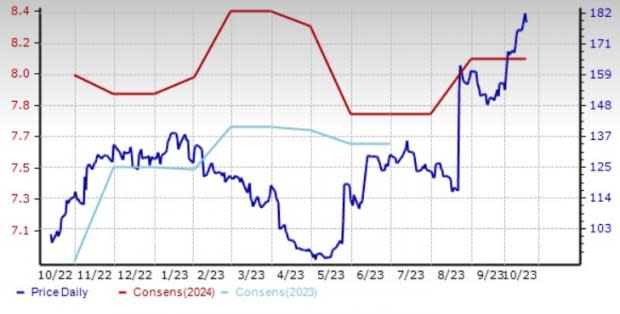

Fabrinet has gained 77.6% in the past year. The Zacks Consensus Estimate for fiscal 2024 earnings has been revised 4% upward to $8.09 per share in the past 60 days.

Price and Consensus: FN

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

nVent Electric PLC (NVT) : Free Stock Analysis Report

OSI Systems, Inc. (OSIS) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report