3 Top-Ranked Stocks to Buy for High-Yield

Everybody loves dividends, as they provide a passive income stream and more than one way to reap a return from an investment.

In addition, many have begun seeking high-yield stocks following the recent climb in treasury yields.

And for those seeking high-yields, three stocks – Kinder Morgan KMI, Black Stone Minerals BSM, and USA Compression Partners USAC – could all be considerations. Let’s take a closer look at each.

Kinder Morgan

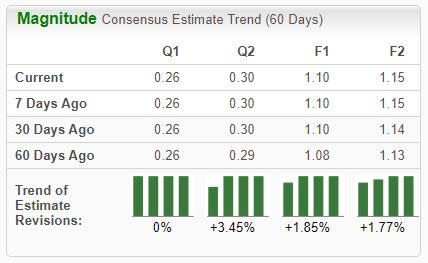

Kinder Morgan is a leading midstream energy infrastructure provider in North America. Earlier in the year. The stock is a current Zacks Rank #2 (Buy), with earnings expectations increasing across several timeframes.

Image Source: Zacks Investment Research

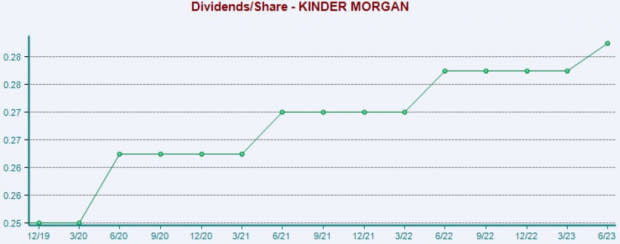

KMI shares currently yield a sizable 6.9% annually, nicely above the yield of the S&P 500. And the company has consistently boosted its payout as of late, with the payout growing by 5.5% annually over the last five years.

Image Source: Zacks Investment Research

Keep an eye out for the company’s upcoming release expected on October 18th, as the Zacks Consensus EPS Estimate of $0.26 suggests a modest 4% improvement from the year-ago period. Down 6% on a year-to-date basis, KMI shares have primarily traded sideways in 2023.

Black Stone Minerals

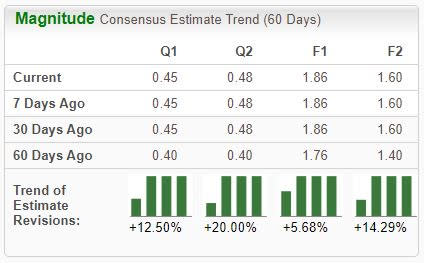

Black Stone Minerals owns oil and natural gas minerals primarily in the United States. The company’s earnings outlook has improved across the board, pushing it into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

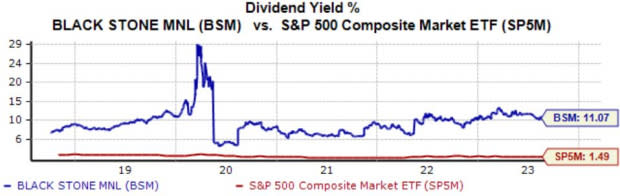

BSM shares currently yield a sizable 11.1%, well above the S&P 500 average of 1.5%. Like KMI, Black Stone has shown a commitment to increasingly rewarding shareholders, with the payout growing nearly 10% annually over the last five years.

Image Source: Zacks Investment Research

It’s worth noting that the company is expected to witness a growth cooldown in its current year, as the $1.86 Zacks Consensus EPS Estimate suggests a 16% pullback year-over-year.

USA Compression Partners

USA Compression Partners, a current Zacks Rank #1 (Strong Buy), is one of the largest independent natural gas compression services providers across the U.S. in terms of fleet horsepower. USAC shares currently yield 8.9% annually, nicely above the S&P 500 average.

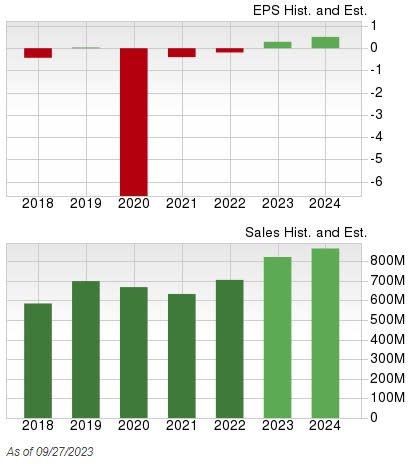

It’s nearly impossible to ignore the company’s growth trajectory, with earnings forecasted to climb 260% on 18% higher revenues in its current year (FY23). And peeking ahead to FY24, estimates allude to a further 93% bump in earnings paired with a 7% sales climb.

The company’s favorable growth shift is illustrated below.

Image Source: Zacks Investment Research

USAC’s next earnings release expected in early November could bring some fireworks, as the Zacks Consensus EPS Estimate of $0.11 suggests a sizable 470% improvement from the year-ago period. Impressively, quarterly revenue of $206.9 million throughout its latest quarter reflected a quarterly record, with USAC also reaffirming its 2023 outlook.

Bottom Line

High-yield stocks can allow investors to build cash piles quickly. And with treasury yields rising, many are no longer interested in stocks with yields on the lower end of the spectrum.

For those seeking stocks paying investors handsomely, all three above – Kinder Morgan KMI, Black Stone Minerals BSM, and USA Compression Partners USAC – could be considerations.

On top of sizable payouts, all three sport a favorable Zacks Rank, reflecting analyst optimism.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report

Black Stone Minerals, L.P. (BSM) : Free Stock Analysis Report