3 Top-Ranked Stocks Delivering Long-Term Outperformance

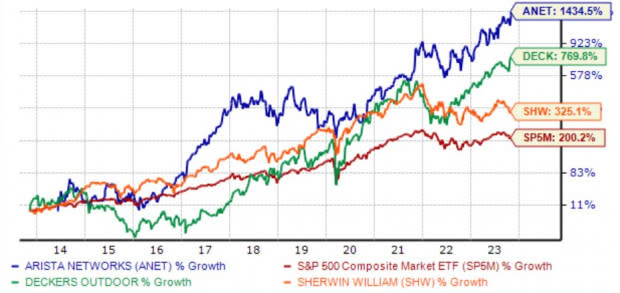

Investors are always searching for stocks that deliver market-beating gains. Interestingly, many non-tech stocks have done precisely that over the last decade, exceeding the S&P 500’s impressive 220% gain and 12% annualized return.

Three stocks – Deckers Outdoor DECK, Sherwin-Williams SHW, and Arista Networks ANET – have all outperformed the S&P 500 over the last decade. This is illustrated below.

Image Source: Zacks Investment Research

On top of market-beating performances, all three currently sport a favorable Zacks Rank, with analysts positively raising their expectations. Let’s take a closer look at each.

Sherwin-Williams

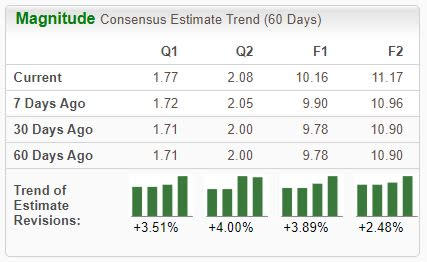

Sherwin-Williams, a Zacks Rank #1 (Strong Buy), manufactures paints, coatings, and other related products. Analysts raised their expectations across the board following the company’s latest quarterly release.

Image Source: Zacks Investment Research

The company’s quarterly results have been strong in 2023, exceeding the Zacks Consensus EPS Estimate by an average of 12.6% across its last four prints. In its latest release, SHW posted a 15% EPS beat and reported revenue 2% ahead of expectations.

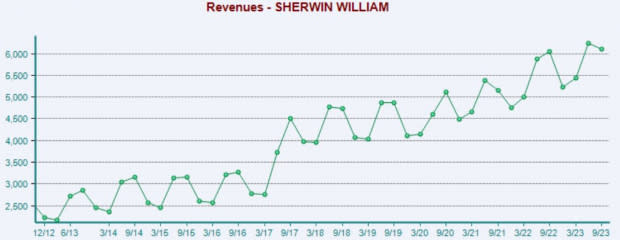

Image Source: Zacks Investment Research

Interestingly enough, the CEO of Sherwin-Williams recently swooped in and purchased 2125 shares, with the transaction totaling just above $500 thousand. Insider purchases are closely monitored, with buys commonly injecting positive sentiment within shareholders.

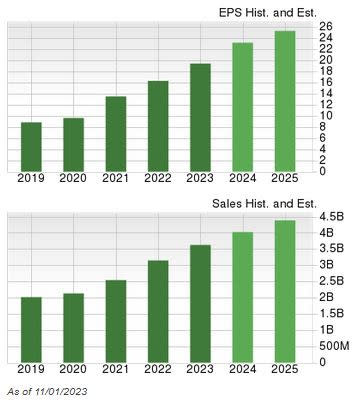

Deckers Outdoor

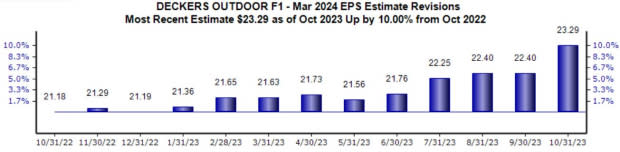

Deckers Outdoor is a leading designer, producer, and brand manager of innovative, niche footwear and accessories developed for outdoor sports and other lifestyle-related activities. The stock is currently a Zacks Rank #1 (Strong Buy), with the revisions trend particularly bullish for its current fiscal year.

Image Source: Zacks Investment Research

The company’s growth profile is hard to ignore, further reflected by its Style Score of “A” for Growth. The company’s earnings are forecasted to climb 20% in its current year on 11% higher revenues, with FY25 estimates suggesting an additional 12% growth in earnings paired with a 10% sales bump.

Image Source: Zacks Investment Research

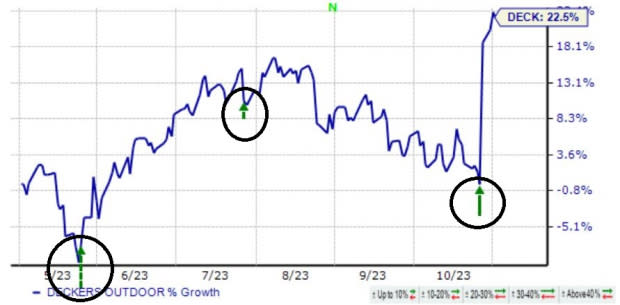

Deckers has a strong track record of exceeding quarterly expectations, beating the Zacks Consensus EPS Estimate by an average of 26% across its last four releases. In its latest print, the company posted a 54% beat and reported revenue 14% above expectations.

Shares have regularly seen bullish activity post-earnings in 2023, as we can see below.

Image Source: Zacks Investment Research

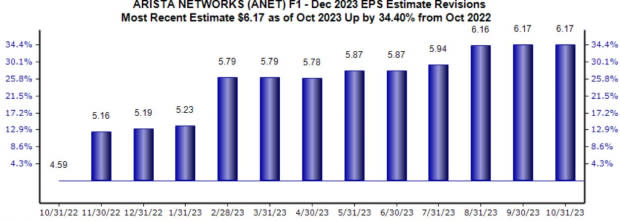

Arista Networks

Arista Networks shares have benefited nicely from the AI frenzy in 2023, up more than 60% year-to-date and widely outperforming relative to the S&P 500. The stock is a Zacks Rank #1 (Strong Buy), with the consensus EPS estimate for its current fiscal year up 34% since October of last year.

Image Source: Zacks Investment Research

The company recently posted quarterly results that impressed the market, a continuation of a trend in 2023. In its latest print, ANET posted a 15% EPS surprise and reported revenue 2% ahead of expectations, with both items improving notably from the same period last year.

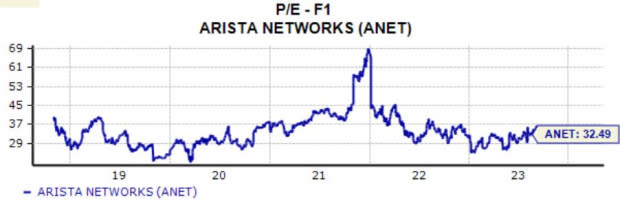

As shown below, ANET’s revenue growth has been remarkable over the recent years, picking up considerable steam post-pandemic lows.

Image Source: Zacks Investment Research

Investors will have to fork up a premium for ANET shares, with the current 32.5X forward earnings multiple undoubtedly residing on the higher end. Still, investors have had little issue forking up the premium given ANET’s forecasted growth, with earnings forecasted to climb 35% in its current year paired with a 33% revenue boost.

Image Source: Zacks Investment Research

Bottom Line

Market-beating returns appeal to any investor. And for those seeking long-term outperformers, all three stocks above – Deckers Outdoor DECK, Sherwin-Williams SHW, and Arista Networks ANET – precisely fit the criteria.

In addition to outperformance, all three sport a favorable Zacks Rank, reflecting optimism among analysts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Sherwin-Williams Company (SHW) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report