3 Top-Ranked Stocks Pushing 52-Week Highs

Stocks making new highs tend to make even higher highs, especially when analysts' positive earnings estimate revisions begin rolling in.

And by targeting stocks breaking out or near new highs, investors find themselves in favorable trends where buyers are in control.

With the market’s rebound in 2023, many stocks are now near or breaking 52-week highs, including American Eagle Outfitters AEO, Applied Industrial Technologies AIT, and Copart CPRT.

In addition to seeing favorable price action, all three have enjoyed positive earnings estimate revisions, indicating optimism among analysts. Let’s take a closer look at each.

American Eagle Outfitters

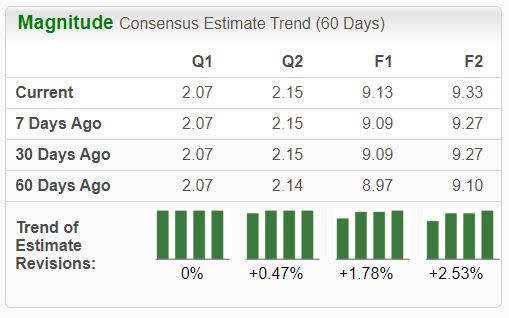

American Eagle Outfitters is a specialty retailer of casual apparel, accessories, and footwear for men and women. The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations increasing across the board.

Image Source: Zacks Investment Research

The company’s shares aren’t valuation stretched given its forecasted growth, with expectations suggesting 33% earnings growth on 2% higher sales in its current year. Shares presently trade at a 13.0X forward 12-month earnings multiple, well below highs of 18.1X in 2022.

Income-focused investors could also be attracted to AEO shares, currently yielding a solid 2.4% annually. The current yield is nicely above the respective Zacks Retail & Wholesale sector average of 1%.

Applied Industrial Technologies

Applied Industrial Technologies, a current Zacks Rank #2 (Buy), distributes value-added industrial products, including engineered fluid power components, bearings, specialty flow control solutions, power transmission products, and miscellaneous industrial supplies.

Analysts have taken their expectations modestly higher across nearly all timeframes.

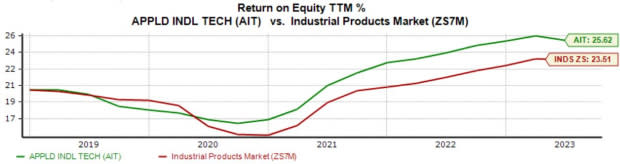

Image Source: Zacks Investment Research

The company’s 25.6% trailing twelve-month return on equity (ROE) is worth highlighting, reflecting a higher efficiency level in generating profits from existing assets relative to peers.

Image Source: Zacks Investment Research

Keep an eye out for the company’s upcoming release expected on October 26th, as the Zacks Consensus EPS Estimate of $2.07 suggests a 5% improvement from the year-ago period. Our consensus revenue estimate stands at $1.1 billion, roughly 3% higher than the year-ago figure.

Copart

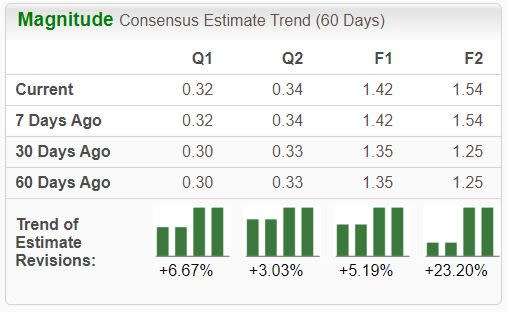

Copart, a Zacks Rank #1 (Strong Buy), provides online auctions and a wide range of remarketing services to process and sell salvage and clean title vehicles. Analysts have raised their earnings expectations across all timeframes.

Image Source: Zacks Investment Research

It’s worth noting that investors will have to pay a premium for CPRT shares, currently trading at a 31.9X forward 12-month earnings multiple, above the five-year median by a fair margin. Still, it’s worth noting that valuation isn’t always a great timing tool.

Image Source: Zacks Investment Research

Bottom Line

Stocks nearing or breaking 52-week highs reflect considerable momentum, with positive earnings estimates from analysts commonly providing the fuel needed to continue climbing.

And for those interested in stocks seeing notable buying pressure, all three above – American Eagle Outfitters AEO, Applied Industrial Technologies AIT, and Copart CPRT – precisely fit the criteria.

In addition to favorable price action, all three have seen their near-term earnings outlooks shift positively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Copart, Inc. (CPRT) : Free Stock Analysis Report