3 Top-Ranked Stocks Shrugging Off Market Woes

Relative strength focuses on stocks that have performed well compared to the market as a whole or another relevant benchmark. And by targeting those displaying this favorable price action, investors can find themselves in positive market trends where buyers are in control.

And for those interested in recent momentum, three stocks – HSBC HSBC, Live Nation Entertainment LYV, and Super Micro Computer SMCI – could all be considered. Let’s take a closer look at each.

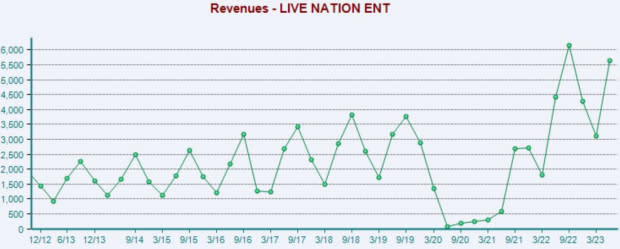

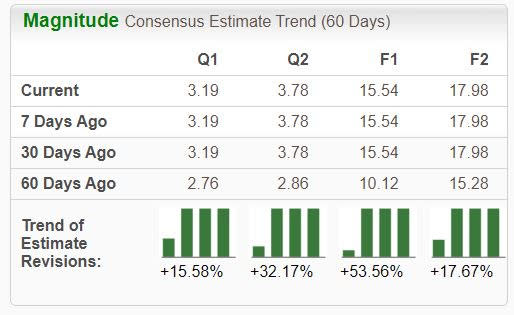

Live Nation Entertainment

Live Nation Entertainment, a current Zacks Rank #1 (Strong Buy), has enjoyed positive earnings estimate revisions across nearly all timeframes, with the trend particularly noteworthy for its current fiscal year, up 16% across the last two months.

The company’s revenue has recovered nicely from pandemic lows and has seen a recent acceleration. Live Nation Entertainment reported $5.6 billion in sales in its latest quarterly release, improving 27% from the year-ago period.

Image Source: Zacks Investment Research

And the growth is slated to continue, with earnings forecasted to climb 57% in its current year on 21% higher sales. Looking ahead to FY24, expectations allude to a further 70% jump in earnings paired with a 7% revenue increase.

HSBC

HSBC Holdings is a major global banking and financial services firm operating through an international network of offices in Europe, North America, the Middle East, and several other locations. HSBC rocks a Zacks Rank #2 (Buy), with earnings expectations increasing for its current and next fiscal years.

It’s hard to ignore HSBC’s dividend metrics, with shares currently yielding an attractive 4.9%, nearly double its Zacks Finance Sector average. Further, the company sports a sustainable payout ratio sitting at 37% of its earnings.

Image Source: Zacks Investment Research

In addition, value-conscious investors could be attracted to shares, further reflected by its Style Score of “A” for Value. Shares currently trade at a small 5.2X forward 12-month earnings multiple, half of its 10.2X five-year median.

Super Micro Computer

Super Micro Computer designs, develops, manufactures, and sells energy-efficient, application-optimized server solutions. The stock sports a favorable Zacks Rank #1 (Strong Buy), with expectations increasing across the board in a big way.

Image Source: Zacks Investment Research

Super Micro Computer’s growth has been blistering-hot, with FY23 sales of $7.1 billion 113% higher since FY20. The company generated $2.2 billion in quarterly revenue throughout its latest quarter, improving 33% year-over-year and 70% sequentially.

In addition, shares aren’t valuation stretched given the company’s growth trajectory, currently trading at a 17.8X forward 12-month earnings multiple. The company is expected to enjoy 31% EPS growth paired with a 50% revenue bump in its current year (FY24).

Bottom Line

Stocks displaying relative strength are common targets of investors who like to ride momentum, inserting themselves into favorable market trends where buyers are in control.

And over the last month, all three stocks above – HSBC HSBC, Live Nation Entertainment LYV, and Super Micro Computer SMCI – have provided market-beating returns.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report