3 Top-Rated Savings & Loan Stocks to Buy Amid High Rates

The Zacks Savings and Loan industry will benefit from a rise in net interest income (NII) supported by high interest rates. While increased funding costs are likely to impede margins, decent economic growth and deposit inflows will help tide through the waning lending scenario.

Also, business restructuring and digital ramp-ups will offer much-needed support. Hence, companies like Citizens Community Bancorp CZWI, First Savings Financial Group FSFG and Provident Financial Services, Inc. PROV are wise picks at present.

Industry Description

The Zacks Savings and Loan industry consists of specialized U.S. banks, which are generally locally owned, with a focus on extending residential mortgage finance. Companies in the industry provide residential mortgages, commercial and industrial mortgages, home equity loans, vehicle loans, and other business loans. The institutions fund mortgages with savings insured by Federal Deposit Insurance Corporation ("FDIC"). They offer high interest rates on savings to attract deposits, enhancing their ability to lend mortgages. Although the firms operate similarly to commercial banks by providing various banking services, such as checking and savings accounts, they were previously legally bound to invest at least 65% of their asset holdings in mortgages. Effective Jul 1, 2019, a ruling lifted the restriction for institutions insured by the FDIC.

3 Savings and Loan Industry Trends to Watch

High Rates to Support NII: The Fed’s aggressive monetary policy since March 2022 led the rates to touch a 22-year high of 5.25-5.5% as it continues to fight “sticky” inflation. With inflation gradually cooling down, market participants expect the central bank not to raise the rates any further.

Higher interest rates are a boon for industry players, and they reaped huge benefits in the form of higher net interest margin (NIM) and NII last year. While the faster pace of rate hikes has increased funding costs and put pressure on banks’ NIM this year, decent economic growth on the back of resilient consumers and deposit inflows have been supporting banks’ NII.

Digital Ramp-Ups to Come as a Breather: Numerous challenges, including legacy technologies and an unbalanced customer base, have cropped up for savings and loan associations. Thus, the companies have been trying to ramp up the transition to digitally focused, technology-driven and flexible operating institutions to remain competitive and reap profits in the rapidly evolving market. Though technology upgrades are expected to raise non-interest expenses in the near term, the same will support the industry participants' customer experience and operational efficiency over time.

Slowing Lending Activity: A high interest rate environment, along with inflationary pressures and supply-chain issues, will likely dampen loan demand. Particularly, the Fed’s aggressive monetary policy has intensified fears of an economic downturn. Summary of Economic Projections indicates that the U.S. economy will grow at a rate of 2.1% this year. Hence, economic growth is likely to slow down in 2024

Amid this, banks have tightened their lending standards for households and businesses, which can weigh on loan origination activities. Constrained funding for banks may also limit loan growth in the upcoming period.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Savings and Loan industry currently carries a Zacks Industry Rank #90, which places it in the top 36% of more than 250 Zacks industries.

The group's Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates attractive near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry's positioning in the top 50% of the Zacks-ranked industries is a result of encouraging earnings outlook for the constituent companies in aggregate.

Before we present a few stocks that you may want to consider for your portfolio, let's take a look at the industry's recent stock market performance and the valuation picture.

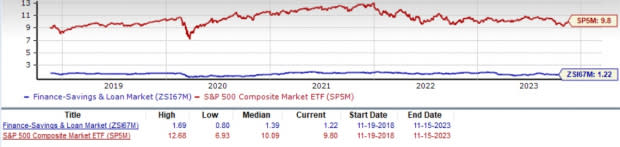

Industry Underperforms Sector and the S&P 500

The Zacks Savings and Loan Industry has widely underperformed both the Zacks Finance Sector and the S&P 500 composite over the past year.

The stocks in the industry have collectively lost 30.1%, whereas the S&P 500 Index has risen 14.1%. In the same period, the Zacks Finance Sector has increased 3.9%.

One-Year Price Performance

Image Source: Zacks Investment Research

Industry's Current Valuation

One might get a good sense of the industry's relative valuation by looking at its price-to-tangible book ratio (P/TBV), which is commonly used for valuing finance companies because of large variations in their earnings from one quarter to the next.

The industry currently has a trailing 12-month P/TBV of 1.22X, below the median level of 1.39X over the past five years.

However, the industry is trading at a discount compared with the S&P Index, as the trailing 12-month P/TBV ratio for the S&P 500 is 9.80X and the median level is 10.09X.

Price-to-Tangible Book Ratio (TTM)

Image Source: Zacks Investment Research

As finance stocks typically have a low P/TB ratio, comparing Savings and Loan providers with the S&P 500 might not make sense to many investors. But a comparison of the group's P/TB ratio with that of its broader sector ensures that the group is trading at a decent discount. The Zacks Finance sector's current trailing 12-month P/TBV of 4.01X is above the Zacks Savings and Loan industry's ratios.

Price-to-Tangible Book Ratio (TTM)

Image Source: Zacks Investment Research

3 Savings and Loan Stocks to Buy

Citizens Community: This is the holding company of Citizens Community Federal N.A, a national bank based in Altoona, WI, with 23 branch locations in Wisconsin and Minnesota. It offers traditional community banking services to businesses, agriculture operators and consumers, including residential mortgage loans. Its strategy is to focus on organic growth and the buyout of smaller community banks in its markets.

The company’s revenues have increased at a compound annual growth rate (CAGR) of 19.8% over the last five years (ended 2022). The increasing trend continued in the first nine months of 2023. This was supported by a rise in NII and fee income.

Moreover, the company has transformed its loan portfolio on the back of buyouts and organic growth. In fact, commercial and agriculture loans have increased at a CAGR of 31% from September 2016 to September 2023. This, along with a favorable deposit mix, strengthens its balance sheet.

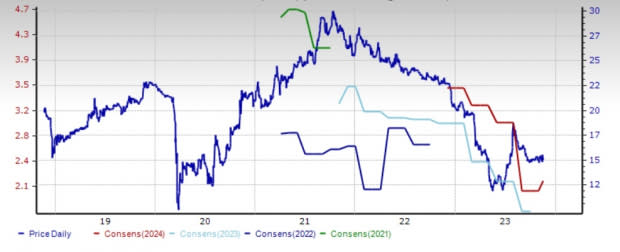

CZWI presently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for its 2023 earnings is pegged at $1.15, indicating marginal upward revision. Revenue estimates for 2023 are pegged at $58 million, indicating a year-over-year decline of 13.2%. Shares of the company have lost 28.6% in the past year.

You can see the complete list of today's Zacks #1 Rank stocks here.

Price and Consensus: CZWI

Image Source: Zacks Investment Research

First Savings Financial: This is the holding company for First Savings Bank, with a presence in the six southern Indiana counties of Clark, Crawford, Daviess, Floyd, Harrison and Washington.

The company’s balance sheet strength reflects its organic growth. Net loans have increased at a CAGR of 19% from 2019-2023. Over the same time period, deposits have increased at a CAGR of 19.3%.

The company has been prudently managing the rise in funding costs. In the quarter ended June quarter, it used gain on repurchase of subordinated debt to sell $78.5 million of available-for-sale securities that were yielding less than the marginal cost of funding.

In September 2023,First Savings Financial entered into a letter of intent to sell its residential mortgage servicing rights portfolio. Moreover, in October, FSFG started ceasing national originate-to-sell mortgage banking operations.

FSFG presently sports a Zacks Rank of 1. The Zacks Consensus Estimate for fiscal 2024 earnings is pegged at $2.15, indicating 16.2% year-over-year growth. Fiscal 2024 revenues are expected to decline 7.8%. Shares of the company have gained 10.4% in the past year.

Price and Consensus: FSFG

Image Source: Zacks Investment Research

Provident Financial: The companyoffers deposit, loan and investment products, as well as wealth management, fiduciary and trust services through its wholly owned subsidiary, Beacon Trust Company, and insurance services through its wholly owned subsidiary, Provident Protection Plus.

The company’s loans and deposits have increased at a CAGR of 11.8% and 14.1% from 2019 to 2022, with the rising trend continuing in the first nine months of 2023. Moreover, high interest rates have supported NII, which increased at a CAGR of 11.9% over the same time.

Encouragingly, in October the company announced a share repurchase plan. Under the plan, the company’s board of directors authorized to buy back up to 350,353 shares or nearly 5% of its outstanding shares. Additionally, the company has been paying regular quarterly cash dividends since September 2002.

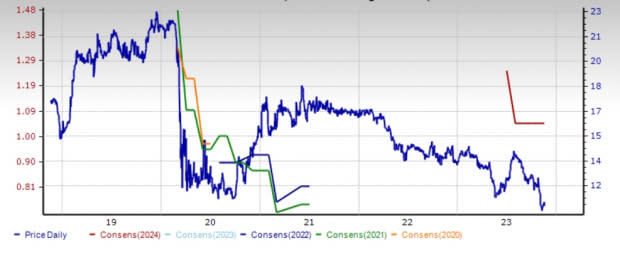

Provident Financial presently carries a Zacks Rank of 2 (Buy). The Zacks Consensus Estimate for PROV’s current year earnings is pegged at $1.05, indicating an 11.7% year-over-year decline. Nonetheless, earnings for the next year are expected to rebound 28.6%. Shares of the company have gained 9% in the past year.

Price and Consensus: PROV

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citizens Community Bancorp, Inc. (CZWI) : Free Stock Analysis Report

Provident Financial Holdings, Inc. (PROV) : Free Stock Analysis Report

First Savings Financial Group, Inc. (FSFG) : Free Stock Analysis Report