3 Top-Rated Technology Stocks That Still Have Room to Run

Technology companies in the United States have seen a massive bull run from the beginning of 2023. In comparison to the S&P 500 and the Dow, which posted returns of 14.9% and 2.4%, respectively, the tech-heavy NASDAQ composite and the NASDAQ 100 Technology Sector Index have gained a respective 30.7% and 37.0% in the year-to-date period.

Federal Reserve’s hawkish stance to counter multi-decade high inflation caused technology companies to bleed in 2022. These companies are sensitive to interest rates due to high expenditures in research and development, hiring and other related expenditures. During a high interest rate regime, borrowing costs increase, which impacts the profitability of the companies.

Currently, the consumer price index, the most accepted measure of inflation, is at a two-year low, increasing 4% in the 12 months ended May. As inflation rates move toward a more favorable direction, interest rates are expected to be stable in the days ahead. These aspects along with a new wave of artificial intelligence, cloud computing, advanced technologies like machine learning, the Internet of Things, robotics and autonomous vehicles, will revolutionize the technology landsape.

All these critical technologies will increase productivity many folds and thereby increase profitability. Since investors have already factored in these aspects, we have identified three top-rated stocks like Thermon THR, Vipshop VIPS and Veeco Instruments VECO that have a low price-to-earnings ratio (P/E) compared to the industry and have outperformed the S&P 500 Index.

On that note, let us look at the companies

Thermon is headquartered in San Marcos, TX. This Zacks Rank #1 (Strong Buy) company is engaged in providing engineered thermal solutions, known as heat tracing, for process industries, including energy, chemical processing and power generation. You can see the complete list of today's Zacks #1 Rank stocks here.

Thermon has a price-to-earnings ratio (P/E) of 14.81 compared with 30.00 for the industry.

THR’s shares have gained 81.3% over the past year compared with the S&P 500’s rise of 14.7%.

Image Source: Zacks Investment Research

Vipshop is an online discount retailer for brands in the People's Republic of China. This Zacks Rank #1 company offers a wide selection of various famous branded discount products, including apparel for women, men and children, fashion goods, cosmetics, home goods and other lifestyle products, through its website.

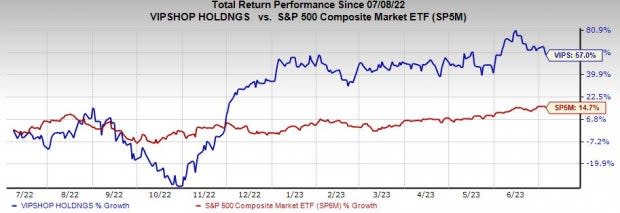

Vipshop has a P/E of 8.41 compared with 36.60 for the industry. VIPS shares have gained 57% over the past year.

Image Source: Zacks Investment Research

Veeco Instruments is headquartered in Plainview, NY. This Zacks Rank #1 company is engaged in the design, development, manufacture and support of thin film process equipment, primarily sold to make electronic devices.

Veeco Instruments has a P/E of 18.89 compared with 22.30 for the industry. VECO’s shares have surged 32.6% over the past year.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Veeco Instruments Inc. (VECO) : Free Stock Analysis Report

Thermon Group Holdings, Inc. (THR) : Free Stock Analysis Report

Vipshop Holdings Limited (VIPS) : Free Stock Analysis Report