3 Top Steel Producer Stocks to Buy From a Promising Industry

The Zacks Steel Producers industry is expected to benefit from a demand recovery in automotive, a major market, as the semiconductor crisis gradually eases and automakers ramp up production. A resilient non-residential construction market and healthy demand in the energy space also act as tailwinds for the industry.

The sizable infrastructure investment augurs well for the U.S. steel industry. Infrastructure spending and higher end-market demand are also expected to support steel prices. Players from the industry such as POSCO Holdings Inc. PKX, Commercial Metals Company CMC and L.B. Foster Company FSTR are set to gain from these trends.

About the Industry

The Zacks Steel Producers industry serves a vast spectrum of end-use industries such as automotive, construction, appliance, container, packaging, industrial machinery, mining equipment, transportation, and oil and gas with various steel products. These products include hot-rolled and cold-rolled coils and sheets, hot-dipped and galvanized coils and sheets, reinforcing bars, billets and blooms, wire rods, strip mill plates, standard and line pipe, and mechanical tubing products. Steel is primarily produced using two methods — Blast Furnace and Electric Arc Furnace. It is regarded as the backbone of the manufacturing industry. The automotive and construction markets have historically been the largest consumers of steel. Notably, the housing and construction sector is the biggest consumer of steel, accounting for roughly half of the world’s total consumption.

What's Shaping the Future of the Steel Producers' Industry?

Strong Demand in Major End-use Markets Bode Well: Steel producers are set to gain from strong demand across major steel end-use markets such as automotive, construction and machinery. They are expected to benefit from higher-order booking from the automotive market. Steel demand in automotive is expected to improve this year on the back of easing global shortage in semiconductor chips that weighed heavily on the automotive industry for nearly two years. Low dealer inventories and pent-up demand should also be supporting factors. Order activities in the non-residential construction market remain strong, underscoring the inherent strength of this industry. Demand in the energy sector has improved on the back of strength in oil and gas prices. Favorable trends across these markets augur well for the steel industry.

Auto Recovery, Infrastructure Spending to Aid Steel Prices: Steel prices witnessed a sharp correction globally in 2022 as the Russia-Ukraine conflict, skyrocketing energy costs in Europe, persistently high inflation, interest rate hikes and the slowdown in China due to new COVID-19 lockdowns dampened demand for steel across key end-use markets. Notably, U.S. steel prices tumbled after surging to roughly $1,500 per short ton in April 2022 due to supply concerns stemming from the Russia-Ukraine war. The benchmark hot-rolled coil ("HRC") prices cratered to near the $600 per short ton level in November 2022. The downward drift partly reflects weaker demand and fears of a recession. However, HRC prices have rebounded from that level this year, driven by U.S. steel mills’ price hike actions, low import levels, supply tightness partly due to mill outages and a recovery in demand. A recovery in automotive demand is also expected to support steel prices this year. The massive infrastructure development project should also act as a catalyst for the American steel industry and U.S. HRC prices in 2023. The sizable federal infrastructure spending should favor the U.S. steel industry, given the expected rise in consumption of the commodity. The Inflation Reduction Act and the CHIPS and Science Act will also spur demand for domestic steel in the United States.

Slowdown in China a Worry: Steel demand in China, the world’s top consumer of the commodity, has softened due to a slowdown in the country’s economy. A downturn in the country’s real estate sector contributed to the slowdown. The lingering impacts of new lockdowns are also taking a toll on the world’s second-largest economy. A slowdown in manufacturing activities has led to a contraction in demand for steel in China. The manufacturing sector has taken a beating as the virus resurgence has hurt demand for manufactured goods and supply chains. China has also seen a slowdown across the construction and property sectors. The country’s real estate sector has taken a hard hit from repeated lockdowns. The slowdown in these key steel-consuming sectors is expected to hurt demand for steel over the short term.

Zacks Industry Rank Indicates Upbeat Prospects

The Zacks Steel Producers industry is part of the broader Zacks Basic Materials Sector. It carries a Zacks Industry Rank #112, which places it at the top 44% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

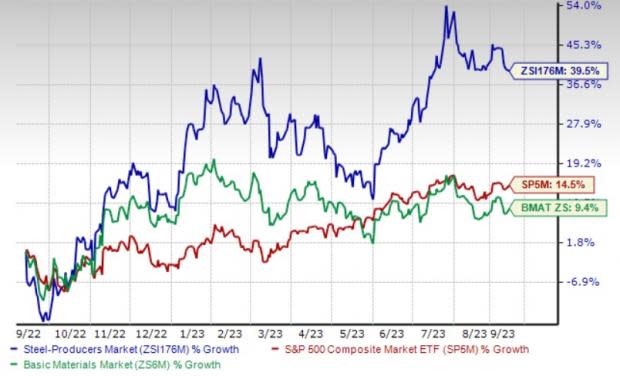

Industry Outperforms Sector and S&P 500

The Zacks Steel Producers industry has outperformed both the Zacks S&P 500 composite and the broader Zacks Basic Materials sector over the past year.

The industry has gained 39.5% over this period compared with the S&P 500’s rise of 14.5% and the broader sector’s increase of 9.4%.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, which is a commonly used multiple for valuing steel stocks, the industry is currently trading at 8.09X, below the S&P 500’s 13.4X and the sector’s 9.98X.

Over the past five years, the industry has traded as high as 11.81X, as low as 2.53X and at the median of 6.09X, as the chart below shows.

Enterprise Value/EBITDA (EV/EBITDA) Ratio

Enterprise Value/EBITDA (EV/EBITDA) Ratio

3 Steel Producers Stocks to Invest In

POSCO: South Korea-based POSCO manufactures and markets a wide range of steel products, including hot-rolled sheets, plate, wire rod, cold-rolled sheets, galvanized sheets and stainless steel globally. The company should benefit from a recovery in its steelmaking business and a rebound in demand in the automotive sector. The recovery of the Pohang steel mill from flooding is expected to drive its production. PKX should also gain from cash flow management and cost-cutting initiatives.

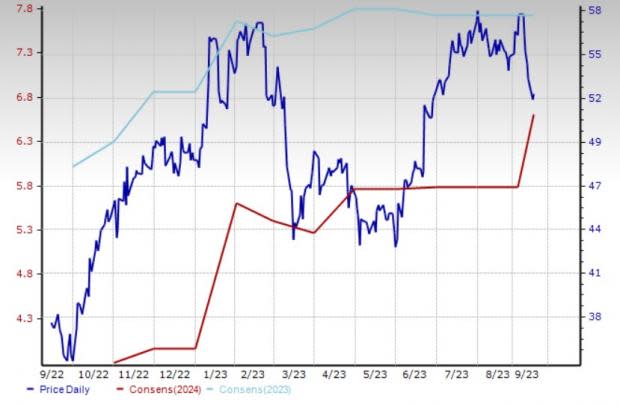

POSCO currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for the current year has been revised 12.8% upward over the last 60 days. PKX also has an estimated long-term earnings growth rate of 18%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: PKX

Commercial Metals: Texas-based Commercial Metals, carrying a Zacks Rank #2, manufactures, recycles and markets steel and metal products, related materials and services. Robust demand in North America for each of Commercial Metals’ major product lines is expected to be reflected in its results. Downstream bidding activity remains strong, indicating a strong pipeline of projects entering the market. CMC is also implementing price rises across its mill products in response to higher scrap costs, which will sustain margins. Moreover, it has solid liquidity and financial position, and remains focused on reducing debt.

The Zacks Consensus Estimate for the current fiscal-year earnings for Commercial Metals has been stable over the past 60 days. The company has also outpaced the Zacks Consensus Estimate in three of the trailing four quarters. In this time frame, it has delivered an average earnings surprise of roughly 6.6%.

Price and Consensus: CMC

L.B. Foster: Pennsylvania-based L.B. Foster provides innovative solutions to rail, construction and energy markets to build and maintain their critical infrastructure. The company is gaining from higher demand, higher prices, a favorable product mix and ongoing transformation initiatives. Its business portfolio actions and profitability initiatives are driving results across its business segments. Various government infrastructure investment programs have also led to higher orders and a backlog in most of its businesses.

L.B. Foster carries a Zacks Rank #2. It has an expected earnings growth rate of 112.5% for the current year. FSTR surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 134.5%.

Price and Consensus: FSTR

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

POSCO (PKX) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report