3 Top Stocks Currently Yielding More Than 10%

When selecting dividend-paying stocks, one of the first things that investors look at is, of course, the annual yield.

It’s common for companies to increase their payouts when business is fruitful, making them enticing investments for income-focused investors from a shorter-term perspective.

Three high-yield stocks – Sociedad Quimica Y Minera SQM, Horizon Technology Finance HRZN, and Capital Southwest CSWC – could all be considerations for those with an appetite for income. Let’s take a closer look at each.

Sociedad Quimica Y Minera

Sociedad Quimica Y Minera, a current Zacks Rank #2 (Buy), is one of the world's largest lithium producers, with one of the industry's least impactful water, carbon, and energy footprints.

The company’s annual dividend presently yields a sizable 11.5%, crushing the Zacks Basic Materials sector average. SQM has grown its dividend payout by nearly 60% over the last five years, undeniably a major positive.

Image Source: Zacks Investment Research

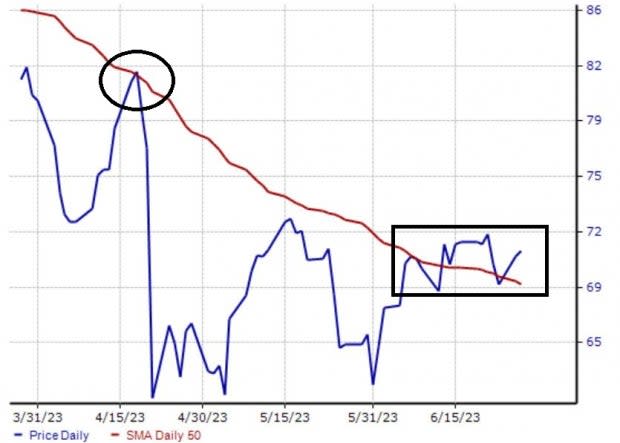

SQM shares have recently seen buyers step up near the 50-day moving average, a level they previously failed to hurdle. This is illustrated in the chart below.

Image Source: Zacks Investment Research

Horizon Technology Finance

Horizon Technology Finance makes secured loans to development-stage companies in the technology, life science, healthcare information and services, and cleantech industries. The stock sports the highly-coveted Zacks Rank #1 (Strong Buy), with the revisions trend particularly noteworthy for its current fiscal year.

Image Source: Zacks Investment Research

Horizon Technology shares currently yield 11.1% annually, with the payout growing modestly over the last five years. As we can see below, the current yield is far from the Zacks Finance sector average.

Image Source: Zacks Investment Research

In addition, the company has been a consistent earnings performer, exceeding earnings and revenue expectations in each of its last four quarters. Just in its latest release, the company delivered an 18% EPS beat and a 12.5% revenue surprise.

Image Source: Zacks Investment Research

Capital Southwest

Capital Southwest is focused on early-stage financings, expansion financings, management buyouts, and recapitalizations in a broad range of industry segments. The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations increasing across the board.

Image Source: Zacks Investment Research

Similar to the stocks above, CSWC shares currently yield a sizable 11.4% annually paired with a 10% five-year annualized dividend growth rate. Still, the company’s 93% payout ratio does raise concerns, residing on the high end of the spectrum.

Image Source: Zacks Investment Research

Keep an eye out for the company’s upcoming quarterly release expected on August 7th; the Zacks Consensus EPS estimate of $0.64 suggests a 30% improvement from the year-ago quarter.

Bottom Line

While high-yielding stocks can allow investors to build up a cash pile quickly, the sustainability of the increased yield, thanks to flourishing business conditions, can be vulnerable when things aren’t going so smoothly.

Instead, for those who seek reliability, targeting companies that are considered Dividend Aristocrats provides precisely that.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Horizon Technology Finance Corporation (HRZN) : Free Stock Analysis Report

Capital Southwest Corporation (CSWC) : Free Stock Analysis Report