3 Top Ultra-Safe Stocks to Buy for a Notorious September

Fed Chair Jerome Powell’s plans to keep increasing interest rates did little to boost investors’ sentiment, with stocks closing broadly lower in August. To make matters worse, the stock market is now bracing for a historically unpleasant September.

However, investors shouldn’t shun equities completely. Instead, they should look out for low-risk stocks that can generate better returns in the near future. Notable among them are BCB Bancorp BCBP, Sonoco SON and Otter Tail OTTR.

Summer Market Bounce Back in Doubt

U.S. stocks did witness the sharpest first-half decline in more than 50 years. However, the major indexes started to gain momentum in July and picked up steam during the first half of August. This is because market pundits were expecting a limited increase in interest rates as inflation began to show signs of easing.

Regrettably, Powell’s recent hawkish speech sparked a fresh sell-off in stocks. In his Jackson Hole speech, Powell reaffirmed that the central bank remains committed to taming inflation, and will continue to hike interest rates despite concerns about a looming recession. In reality, a rate hike doesn’t bode well for the stock market as it raises borrowing costs, curtails consumer spending, and impacts economic growth.

Undoubtedly, stocks extended their losing streak for the fourth-straight trading session on Aug 31, following Fed Chair’s speech. In fact, for the month of August, the Dow, the S&P 500, and the Nasdaq posted a drop of 3.9%, 4.2%, and 4.6%, respectively, according to Dow Jones Market Data, citing a MarketWatch article.

September – An Ugly Month for Stocks

With the stock market ending August in the red, it is now headed for the historically worst month of the year. Typically, the three major indexes have given the poorest performance in September. To put things into perspective, the S&P 500 declined an average 1% in September from 1928 to 2021. Likewise, when the S&P 500 declined from the beginning of the year through the end of August, as it is this year, the broader index registered an average drop of 3.4% in September, per analysts at Bespoke Investment Group, quoting another MarketWatch article.

So, why is September a weak month for the stock market? It is mostly presumed that investors after returning from their summer vacations want to lock in gains by selling some of their stock holdings for the year in September. At the same time, it is believed that investors sell their stock holdings in order to pay for back-to-school items.

How to Play the Stock Market

With the stock market now historically entering its worst phase of the year after witnessing a pullback in August, it is prudent for investors to place bets on stocks that provide risk-adjusted returns. Thus, it’s imperative to invest in low-beta stocks. These stocks are comparatively less volatile than the markets they trade in. Low beta, by the way, ranges from 0 to 1.

To top it off, these stocks are high dividend payers. Thus, they not only provide a steady flow of income but also are immune to market vagaries due to their healthy financial structure and, of course, a better-quality business. Further, they flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

BCB Bancorp operates as the holding company for BCB Community Bank, a state-chartered commercial bank. BCBP has a beta of 0.58. It has a dividend yield of 3.5%. Over the past 5 years, BCBP has increased its dividend once, and its payout ratio presently sits at 29% of earnings. Check BCB Bancorp’s dividend history here.

BCB Bancorp, Inc. NJ Dividend Yield (TTM)

BCB Bancorp, Inc. NJ dividend-yield-ttm | BCB Bancorp, Inc. NJ Quote

The Zacks Consensus Estimate for its current-year earnings has moved 15.1% north over the past 60 days. BCBP’s shares have gained 17.6% year to date. It’s expected earnings growth rate for the current year is 34.9%.

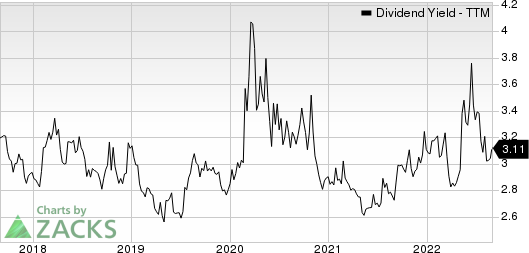

Sonoco is a leading provider of consumer packaging, industrial products, protective packaging, and packaging supply-chain services. SON has a beta of 0.73. It has a dividend yield of 3.1%. Over the past 5 years, SON has increased its dividend four times, and its payout ratio presently sits at 36% of earnings. Check Sonoco’s dividend history here.

Sonoco Products Company Dividend Yield (TTM)

Sonoco Products Company dividend-yield-ttm | Sonoco Products Company Quote

The Zacks Consensus Estimate for its current-year earnings has moved 13.2% north over the past 60 days. Sonoco’s shares have gained 10.8% so far this year. It’s expected earnings growth rate for the current year is 78.3%.

Otter Tail is involved in the production, transmission, distribution and sale of electric energy. OTTR has a beta of 0.46. It has a dividend yield of 2.2%. Over the past 5 years, OTTR has increased its dividend five times, and its payout ratio presently sits at 26% of earnings. Check Otter Tail’s dividend history here.

Otter Tail Corporation Dividend Yield (TTM)

Otter Tail Corporation dividend-yield-ttm | Otter Tail Corporation Quote

The Zacks Consensus Estimate for its current-year earnings has moved 31.8% north over the past 60 days. Otter Tail’s shares have gained 6% year to date. It’s expected earnings growth rate for the current year is 67.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sonoco Products Company (SON) : Free Stock Analysis Report

Otter Tail Corporation (OTTR) : Free Stock Analysis Report

BCB Bancorp, Inc. NJ (BCBP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research