3 Transportation Stocks Likely to Surpass Q3 Earnings Estimates

The majority of the players in the Zacks Transportation sector have already released third-quarter 2023 results. While the picture with respect to earnings growth remains dull, as expected, the percentage of companies beating earnings estimates is impressive.

Among transportation companies yet to report third-quarter results, we expect the likes of Ardmore Shipping ASC, DHT Holdings DHT and GXO Logistics GXO to report better-than-expected earnings per share despite headwinds like high fuel costs, supply-chain woes and high inflation-induced economic uncertainty.

Let’s delve into the factors that are likely to boost the third-quarter results of the sector participants who are yet to announce earnings.

With most yet-to-report companies in the sector belonging to the shipping sub-group, improvement in the demand scenario from the pandemic lows is a major positive. The uptick in trading volumes is likely to have aided the performance of shipping companies in the soon-to-be-reported quarter, as the industry is responsible for transporting the bulk of the goods involved in global trade.

Upbeat demand for liquefied natural gas (LNG) represents a huge positive for shipping stocks. The elevated levels of inflation raised oil and natural gas prices. Moreover, amid the prolonged Russia-Ukraine war, Europe is likely to seek gas supplies outside Russia. This is expected to have driven demand for LNG vessels in the September quarter.

Efforts to control costs for bottom-line growth amid the prevalent demand weakness are also likely to have aided the performance of the companies that are yet to report. Moreover, the fact that e-commerce is still a force to reckon with bodes well.

It is hardly surprising that the pace of growth of e-commerce demand has slowed from the levels witnessed at the peak of the pandemic with the reopening of economies. However, it remains impressive, driven by the convenience associated with online shopping. The race to digitization also supports the momentum in e-commerce growth. E-commerce demand strength should aid the results of the sector participants.

Here’s How to Pick the Right Stocks

Quite a few transportation stocks are likely to report earnings shortly. It is always a daunting task for investors to pick a winning basket of stocks with the potential to deliver better-than-expected earnings.

While there is no foolproof method of choosing outperformers, our proprietary methodology — the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — helps identify stocks with high chances of delivering a positive surprise in their upcoming earnings announcement. Our research shows that for stocks with this perfect mix of elements, the odds of an earnings beat are as high as 70%.

Earnings ESP shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Our Choices

Ardmore Shipping currently has an Earnings ESP of +4.65% and a Zacks Rank of 1. ASC is slated to report third-quarter 2023 results on Nov 7.

We expect Ardmore Shipping’s results to reflect the bullishness surrounding the tanker market, as product tanker rates are currently at healthy levels despite minor hiccups. Also, the normalization of economic activities and an uptick in world trade following the removal of COVID-19-induced restrictions are expected to have boosted ASC’s performance.

ASC beat the Zacks Consensus Estimate in three of the last four quarters and matched once, the average beat being 3.34%.

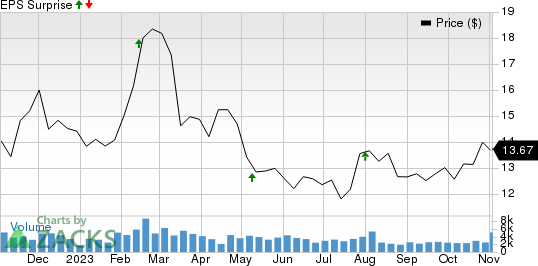

Ardmore Shipping Corporation Price and EPS Surprise

Ardmore Shipping Corporation price-eps-surprise | Ardmore Shipping Corporation Quote

DHT Holdings has an Earnings ESP of +4.76% and a Zacks Rank #3. DHT will release results on Nov 6. You can see the complete list of today’s Zacks #1 Rank stocks here.

We expect the company’s performance to have been aided by the optimism surrounding LNG charter rates. Efforts to modernize its fleet also bode well. High fuel costs are, however, likely to hurt results.

DHT beat the Zacks Consensus Estimate in one of the last four quarters and missed thrice, the average miss being 14.35%.

DHT Holdings, Inc. Price and EPS Surprise

DHT Holdings, Inc. price-eps-surprise | DHT Holdings, Inc. Quote

GXO Logistics currently has an Earnings ESP of +0.02% and a Zacks Rank #3. GXO will release results on Nov 7.

The rapid growth of e-commerce, automation and outsourcing should aid GXO’s third-quarter results. The company’s efforts to strengthen its logistics capabilities also bode well.

GXO beat the Zacks Consensus Estimate in each of the last four quarters, the average beat being 11.26%.

GXO Logistics, Inc. Price and EPS Surprise

GXO Logistics, Inc. price-eps-surprise | GXO Logistics, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DHT Holdings, Inc. (DHT) : Free Stock Analysis Report

Ardmore Shipping Corporation (ASC) : Free Stock Analysis Report

GXO Logistics, Inc. (GXO) : Free Stock Analysis Report