3 Utilities to Strengthen Your Portfolio in 2024

Domestic-focused regulated Utilities continue to perform steadily as the demand for utility services hardly alters with fluctuations in the economy. Cost management, new electricity rates and customer growth continue to help the utility sector maintain operational stability.

Utility operations are capital-intensive, as consistent investments are required to upgrade, maintain and replace older wires, electric poles and power stations. Hence, apart from internal fund sources, utilities depend on the credit market for funds to carry on upgrades.

Utilities are traditionally averse to interest rate hikes. The Fed has raised the interest rate 11 times in the past two years, taking the interest rate to 5.25-5.50%. Undoubtedly, such high interest rates will have adverse impacts on capital-intensive utility stocks as capital servicing costs will increase. However, the Fed paused rate hikes at its last three meetings in 2023. There is a high probability of interest rate declines in 2024, which will benefit the utilities.

Defensive Utilities Offer a Safe Heaven

The rate-regulated utilities sector is less volatile than other sectors and the stocks generally have low beta, which indicates low volatility. Risk-averse investors can always bank on the utilities due to their ability to pay regular dividends and deliver consistent performances.

The United States continues to show strength and it is showing in job additions. Per a Trading Economies report, the unemployment rate at the end of November was 3.7%, improving sequentially from 3.9%. Meanwhile, GDP in 2023 is expected to improve 2.9% from 2.4% reported in the previous year. All these positive developments are expected to continue in 2024 and create fresh demand in the market.

Our weekly Earnings Trends report indicates 14.7% earnings growth for the utility space in fourth-quarter 2023 and this growth is expected to continue in the first three quarters of 2024.

Our Picks

We have picked stocks having a beta of less than 1 and a Zacks Rank #1 (Strong Buy) or #2 (Buy), paying regular dividends to shareholders, showing share price appreciations in the last 12 months, and having registered growth in 2024 earnings estimates.

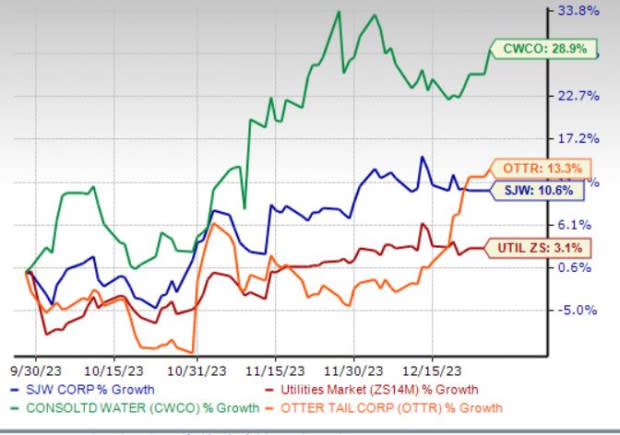

The chart below shows the price performances of our three picks in the last three months compared with its sector’s performance.

Price Performance

Image Source: Zacks Investment Research

Consolidated Water CWCO is benefiting from strategic acquisitions and expansions of operations in areas that have significant requirements for potable water. The company has a beta of 0.20 and currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Consolidated Water operates 11 water production plants, with a capacity of 25.5 million gallons per day, in 4 countries and is looking for opportunities in new markets to further expand drinking water and wastewater services.

The Zacks Consensus Estimate for Consolidated Water’s 2023 and 2034 earnings improved 19.9% and 4.2% over the last 60 days, respectively. CWCO’s current dividend yield is 1.07%. In the last three months, the stock rallied 28.9% compared with its sector’s rally of 3.1%.

Otter Tail Corporation OTTR provides attractive investment opportunities in the utility space, given its two-platform business model consisting of Electric and Manufacturing units. The company has a beta of 0.50 and currently flaunts a Zacks Rank #1.

OTTR makes consistent investments to upgrade and maintain its existing infrastructure to provide 24/7 reliable services to its customer base. The company has planned to invest $1.1 billion between 2023 and 2027 to strengthen its operations.

The Zacks Consensus Estimate for Otter Tail’s 2023 and 2034 earnings improved 16.5% and 7.9% over the last 60 days, respectively. OTTR’s current dividend yield is 2%. In the last three months, the stock gained 13.3%.

SJW Group SJW is benefiting from its strategic water and wastewater system acquisitions. Its strategic investments to strengthen its existing infrastructure and expand operations are expected to drive its performance. The company has a beta of 0.59 and currently carries a Zacks Rank #2.

SJW Group remains focused on investing in its operations and remaining actively engaged in its local communities. It plans to invest more than $1.6 billion over the next five years to build and maintain its water and wastewater operations.

The Zacks Consensus Estimate for SJW Group’s 2023 and 2034 earnings improved 8.1% and 2.2% over the last 60 days, respectively. SJW’s current dividend yield is 2.29%. In the last three months, the stock rose 10.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Otter Tail Corporation (OTTR) : Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO) : Free Stock Analysis Report

SJW Group (SJW) : Free Stock Analysis Report