3 Value Medical Stocks to Buy for Safety Amid Market Volatility

We are approaching the end of third-quarter 2023. The U.S. stock markets rallied for the first seven months this year. However, the markets have started to decline since August, raising apprehension of a volatile market in the last three months of 2023. Although the inflation rate came down significantly from the 2022 level, it has increased 70 basis points in the past two months, after hitting a low of 3% in June.

In its September FOMC meeting, the Fed maintained the benchmark interest rate in the range of 5.25-5.5%. This is the highest level of the Fed fund rate since late 2007. Fed has raised rates 11 times since March 2022, to contain spiraling prices. Meanwhile, the recent rise in crude oil prices may lead to further inflationary pressure leading to continued rate hikes. Per a Bloomberg article, JPMorgan CEO has warned about a 7% Fed rate, which can lead to heightened volatility going forward.

Market participants are highly concerned about a recession in the near term. The recent turmoil in the banking sectors in the United States and Eurozone has significantly dented investors’ sentiment, highlighting concerns about a global liquidity crunch.

On Sep 26, the Conference Board released the U.S. consumer confidence Index for September 2023, that sank below the recession threshold. The Expectations Index — based on consumers’ short-term outlook for income, business and labor market conditions — came in at below 80, a trend that continued in 2023, except for a couple of months.

At this stage, investors should be prepared to minimize fluctuations in their portfolio and consequently rebalance it with suitable financial assets to maintain stability. It would be prudent to pick value stocks with a favorable Zacks Rank to cushion the portfolio as well as make some gains from the upside potential. These stocks could prove to be valuable once the rally resumes.

Our Top Picks

We have narrowed our search to three value stocks. Each of our picks sports a Zacks Rank #1 (Strong Buy) and has a Value Score of A or B. You can see the complete list of today’s Zacks #1 Rank stocks here.

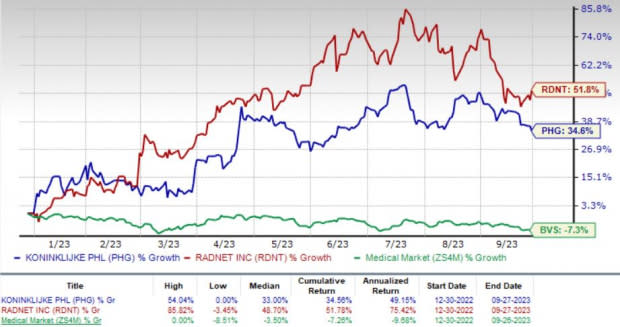

The chart below shows the price performance of our three picks year to date.

Image Source: Zacks Investment Research

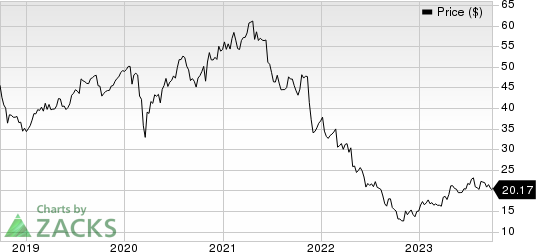

Koninklijke Philips PHG reports under three operational segments — Diagnosis & Treatment business, Connected Care business and Personal Health business. Enhancing patient safety and quality, strengthening supply-chain reliability, and establishing a simplified, more agile operating model are benefiting the company’s productivity initiatives. PHG expects an improvement in cost inflation and staff shortages in hospitals over 2022. The company’s top line is expected to benefit in the coming quarters, driven by its AI-supported solutions that will aid in providing diagnosis faster and virtually.

The forward P/E of Koninklijke Philips for the next 12 months is 14.22X, lower than the industry’s average of 19.31X. PHG has a cash flow per share of $4.51, higher than the industry’s negative average of 4 cents. The Zacks Consensus Estimate for current-year earnings has improved 6.7% over the past 60 days. PHG’s earnings are likely to improve 41% in 2024.

Koninklijke Philips N.V. Price

Koninklijke Philips N.V. price | Koninklijke Philips N.V. Quote

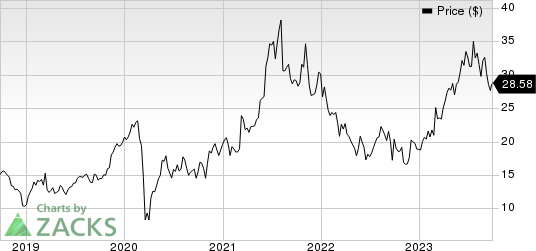

RadNet RDNT is a national market leader providing high-quality, cost-effective diagnostic imaging services through a network of fully-owned and operated outpatient imaging centers. Strength in its core imaging center business will be a key driver for its top line in the upcoming quarters. Ongoing recovery in the broader medical sector bodes well for the company. An accelerating shift from hospital-based procedures to lower-cost, more convenient freestanding centers will a key long-term driver for RDNT. Moreover, its focus on building AI-enabled services looks promising. The company’s AI segment’s sales more than doubled in the first half of 2023.

The forward P/E of RadNet for the next 12 months is 68.78X, higher than the industry’s average of 18.14X. RDNT has a cash flow per share of $3.54, higher than the industry’s average of $2.59. The Zacks Consensus Estimate for current-year earnings has improved 123.5% over the past 60 days. RDNT’s earnings are likely to improve 8.8% in 2024.

RadNet, Inc. Price

RadNet, Inc. price | RadNet, Inc. Quote

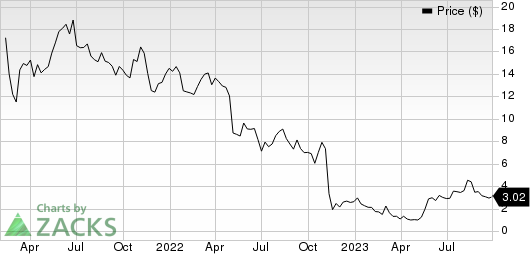

Bioventus BVS delivers clinically proven, cost-effective products for osteoarthritis, surgical and non-surgical bone healing. Strong demand for its Surgical Solutions amid improving healthcare activities will be a key driver for its top line in the upcoming quarters. Strong growth in international markets is an added benefit. The divesture of its Wound business helped BVS to repay a portion of its debt. However, lower pricing for pain treatments will continue to impede sales growth.

The forward P/E of Bioventus for the next 12 months is 33.69X, higher than the industry’s average of (327.62X). BVS has a cash flow per share of $1.66, higher than the industry’s negative average of $1.06. The Zacks Consensus Estimate for current-year earnings has improved 14.4% over the past 60 days. The company’s earnings are likely to improve 149.4% in 2024.

Bioventus Inc. Price

Bioventus Inc. price | Bioventus Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Koninklijke Philips N.V. (PHG) : Free Stock Analysis Report

RadNet, Inc. (RDNT) : Free Stock Analysis Report

Bioventus Inc. (BVS) : Free Stock Analysis Report