3 Winners as Cooling Jobs Market Lifts Rate Hike Pause Hopes

Stock investors, lately, have been focusing on the latest economic reports to ascertain the Federal Reserve’s near-term monetary policy pronouncements.

Fed Chair Jerome Powell, at the conference in Jackson Hole held in late August, said that price pressures may have lessened, but it is not yet at a satisfactory level. After all, the Fed’s preferred gauge of inflation remains higher than its desired target of 2%.

However, it seems the Fed is largely done with hiking interest rates as the labor market cools down in August. The jobless rate edged up to 3.8% in August, more than analysts’ forecast that it will remain at a multi-decade low at 3.5%, added the Bureau of Labor Statistics. Additionally, the real unemployment rate, which includes discouraged and part-time workers, jumped to 7.1%, the highest since May 2022.

Job additions, by the way, have continued to slow down since the beginning of the year. The U.S. economy added 187,000 new jobs in August, but that’s below the coveted 200,000 mark for the third successive month. Increases in nonfarm payrolls, in reality, were revised substantially lower for June and July.

Average hourly earnings may have increased 0.2% month over month in August and 4.3% from a year ago, but remain less than analysts’ estimate of 0.3% and 4.4%, respectively, a tell-tale sign that inflationary pressures are certainly poised to diminish further.

Softening labor market data coupled with ebbing inflation, thus, signifies that the Fed has successfully orchestrated a soft landing. Around 93% of market participants expect the central bank to keep interest rates unchanged in the September meeting. Similarly, 62% expect rates to remain unaltered in November, per the CME FedWatch Tool.

Hence, from an investment perspective, utility companies like Atmos Energy ATO are well-positioned to gain from a rate hike pause. Being capital-intensive, utility companies need funding from external sources, leading to higher levels of debt. So, a lower interest rate environment reduces their debt levels. This, in turn, helps them pay off liabilities and register profits.

Encouraging regulatory outcomes and steady customer additions, in the interim, are helping Atmos Energy’s performance. The natural gas distributor presently has a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for its current-year earnings has moved up 0.3% over the past 60 days. ATO’s expected earnings growth rate for the current year is 8%. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

The borrowing costs of real estate projects increase along with higher interest rates. Therefore, a rate hike pause bodes well for real estate activities and benefits stocks such as TopBuild BLD.

TopBuild, known for providing various building products to the construction industry in the United States, currently has a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has moved up 11% over the past 60 days. BLD’s expected earnings growth rate for the current year is 6.1%.

Lastly, tech companies like NVIDIA NVDA gain from rate hike pauses since their future cash inflows get disrupted if interest rates edge up. Recently, the chipmaker posted blowout quarterly earnings banking on the stupendous growth in the artificial intelligence field (read more: Nvidia & 2 Other AI Stocks You'll Regret Not Buying Soon).

NVIDIA, at present, has a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has moved up 36.6% over the past 60 days. NVDA’s expected earnings growth rate for the current year is 213.2%.

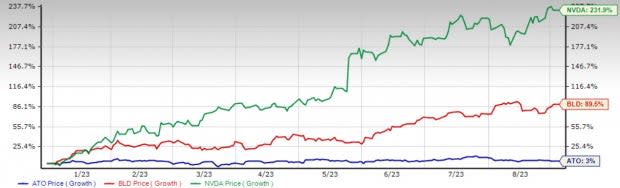

Shares of Atmos Energy, TopBuild and NVIDIA have gained 3%, 89.5%, and 231.9%, respectively, so far this year.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report