3 Zacks Computer & Technology Stocks to Buy for Value

Several computer companies are attractive at the moment with their stocks still appearing to be undervalued despite the magnificent rally among tech stocks this year.

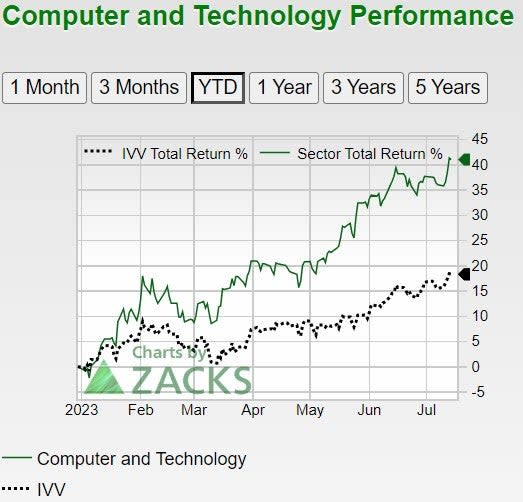

With the Nasdaq’s total return including dividends at +39% year to date and the broader Zacks Computer and Technology sector soaring +41% these tech stocks could have more upside and their attractive valuations are more reassuring.

Image Source: Zacks Investment Research

NCR (NCR)

We will start with NCR Corporation which stock boasts a Zacks Rank #1 (Strong Buy) and belongs to the Zacks Computer-Integrated Systems Industry, currently in the top 31% of over 250 Zacks industries.

NCR offers payment processing, multi-vendor connected-device services, automated teller machines (ATMs), point of sale (POS) terminals, and self-service technologies.

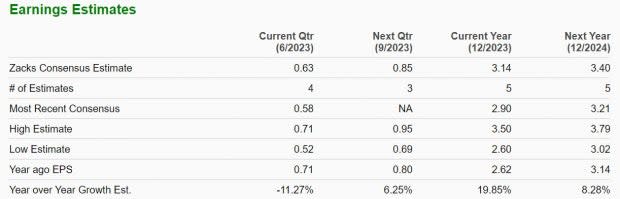

With earnings estimates on the rise, NCR is expecting solid bottom-line growth and is starting to stand out in terms of price-to-earnings valuation. Annual earnings are now forecasted to climb 20% this year at $3.14 per share compared to EPS of $2.62 in 2022. Plus, fiscal 2024 earnings are expected to rise another 8%.

Image Source: Zacks Investment Research

Even better, NCR stock is making the case for being vastly undervalued at $26 a share and just 8.2X forward earnings. NCR trades well below the S&P 500’s 21.8X and at a considerable discount to its industry average of 15X.

NCR stock also trades 61% below its decade-long high of 21.3X and offers a 25% discount to the median of 11X.

Image Source: Zacks Investment Research

Dell Technologies (DELL)

Among the Zacks Computers-IT Services Industry, Dell Technologies is worthy of consideration with its stock sporting a Zacks Rank #2 (Buy).

The Computers-IT Services Industry is in Zacks top 41% with Dell standing out as a leading provider of information technology solutions. Notably, Dell’s enterprise solutions and software solutions should receive a boost from Artificial Intelligence (AI).

Dell’s P/E valuation is very intriguing considering the company offers exposure to the future growth of generative AI capabilities through its joint venture Project Helix with Nvidia (NVDA).

Announced in May, Project Helix is a joint initiative to make it easier for businesses to build and use generative AI models on-premises to quickly and securely deliver better customer service, market intelligence, enterprise search, and a range of other capabilities.

Image Source: Zacks Investment Research

It’s noteworthy that Dell’s stock appears to be a cheaper option regarding AI prospects. To that point, Dell’s 9.9X forward earnings is intriguingly below its collaborator Nvidia’s 58.5X.

Furthermore, Dell stock trades at a very attractive discount to the benchmark and its industry average of 34.6X. After a very tough to-compete-against year, Dell’s earnings are expected to dip -27% this year but rebound and rise 11% in fiscal 2024 at $6.15 per share.

Earnings estimates for both fiscal 2023 and FY24 have remained higher over the last 60 days offering further support to Dell’s attractive P/E valuation and the case that shares of DELL may be undervalued at $55 a share.

Image Source: Zacks Investment Research

Hewlett Packard (HPE)

Rounding out the list is Hewlett Packard which sports a Zacks Rank #2 (Buy) and belongs to the top-rated Computer-Integrated Systems Industry.

Intriguingly, Hewlett Packard is another company with AI offerings and potential that looks undervalued at current levels. Earlier in the year Hewlett Packard announced its expansion into AI-at-scale by acquiring Pachyderm, a startup that delivers software based on open-source technology to automate reproducible machine learning pipelines that target large-scale AI applications.

Hewlett Packard has stated aerospace and defense giant Lockheed Martin (LMT) is already demonstrating AI at-scale for mission-critical security and aerospace applications using combined HPE and Pachyderm solutions.

Hewlett Packard’s earnings are now expected to rise 4% this year at $2.11 per share and then dip by rougly -1% in FY24. Still, trading at $17 a share and 8X forward earnings makes Hewlett Packard stock look undervalued with the industry average at 15X and the S&P 500 at 21.8X.

Image Source: Zacks Investment Research

Bottom Line

These top-rated Zacks Computer & Technology sector stocks have an “A” Zacks Style Scores grade for Value. With the Nasdaq continuing its bullish upward trend, NCR, Dell, and Hewlett Packard are three tech stocks that should have more upside as they look undervalued at their current levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

NCR Corporation (NCR) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report