3D Systems Corp (DDD) Faces Headwinds: A Look at the 2023 Earnings Report

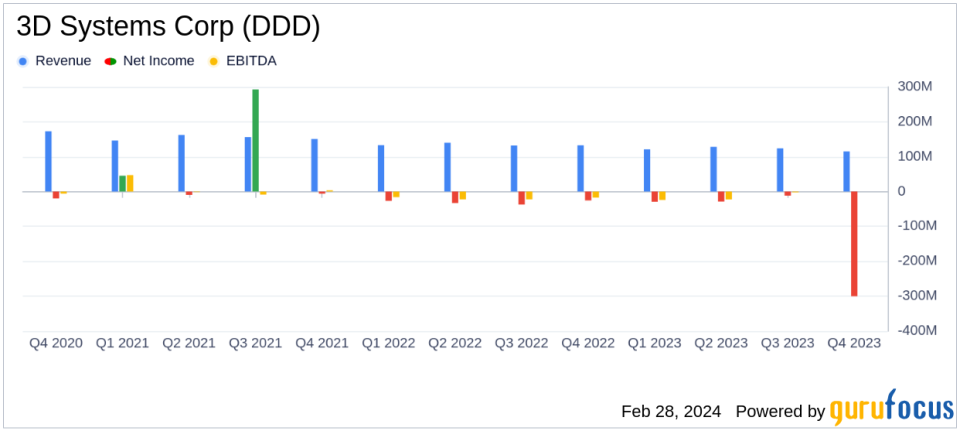

Revenue: Decreased by 9.3% to $488.1 million in 2023 from $538.0 million in 2022.

Gross Profit Margin: Improved to 40.7% in 2023 from 39.8% in 2022.

Net Loss: Widened to $370.4 million in 2023 from $122.7 million in 2022, primarily due to impairment charges.

Diluted Loss Per Share: Increased to $2.85 in 2023 from $0.96 in 2022.

Adjusted EBITDA: Decreased to a loss of $24.5 million in 2023 from a loss of $5.8 million in 2022.

2024 Outlook: Revenue expected to be between $475 million and $505 million with a non-GAAP gross profit margin of 42%-44%.

Financial Liquidity: Cash and cash equivalents totaled $331.5 million as of December 31, 2023.

On February 27, 2024, 3D Systems Corp (NYSE:DDD) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, a leader in comprehensive 3D printing and digital manufacturing solutions, reported a decrease in annual revenue and a significant net loss, largely attributed to impairment charges and ongoing macroeconomic and geopolitical volatility.

Company Overview

3D Systems Corp provides a broad range of 3D printing solutions, including hardware, software, materials, and services. The company operates through two segments: Healthcare Solutions and Industrial Solutions, with the latter generating the majority of revenue. 3D Systems serves a global market, with a significant portion of its revenue coming from the Americas.

Performance and Challenges

The company's revenue for the fourth quarter of 2023 decreased by 13.5% to $114.8 million compared to the same period last year. The full-year revenue saw a 9.3% decrease to $488.1 million from $538.0 million in 2022. The decline was primarily due to lower sales in the dental orthodontic product line and a general slowdown in capital expenditure on new production capacity across Healthcare and Industrial customers.

Despite the revenue headwinds, 3D Systems reported an improved gross profit margin for the full year, rising from 39.8% in 2022 to 40.7% in 2023. This increase was attributed to improved operational efficiencies and a favorable mix. However, the net loss attributable to 3D Systems Corporation widened significantly to $370.4 million in 2023 from $122.7 million in 2022, mainly due to a $297.7 million impairment of goodwill and other intangible assets.

Financial Achievements and Importance

The rise in gross profit margin, even amidst declining volumes, is a testament to the company's ability to enhance operational efficiency. This is particularly important in the hardware industry, where margins can be heavily impacted by production costs and sales volume. The company's restructuring initiative aimed at cost reduction and margin improvement is a critical step towards achieving sustained profitability and positive cash flow.

Key Financial Metrics

Important metrics from the financial statements include:

"Our fourth quarter revenue results reflect the significant headwinds created by ongoing macroeconomic and geopolitical volatility... Fortunately, based upon customer feedback, we view this as a market timing issue rather than any permanent trend in customer adoption rates for additive manufacturing, or a loss of market share for 3D Systems," said Dr. Jeffrey Graves, president and CEO of 3D Systems.

Adjusted EBITDA for the year decreased to a loss of $24.5 million, compared to a loss of $5.8 million in the previous year. The non-GAAP diluted loss per share was $0.26 for 2023, compared to $0.23 in 2022. The company's financial liquidity remains strong, with cash and cash equivalents totaling $331.5 million as of December 31, 2023.

Analysis and Outlook

3D Systems anticipates flat top-line revenue for 2024, with a focus on completing its restructuring program, which includes headcount reductions, site consolidations, and a reduction in external spending. These efforts are expected to improve gross margins and deliver positive adjusted EBITDA performance and operating cash flow for the full year. The company also plans to continue key development programs that are expected to contribute to top-line revenue growth in the future.

For the full year 2024, 3D Systems has provided financial guidance with revenue expectations between $475 million and $505 million, a non-GAAP gross profit margin of 42%-44%, and non-GAAP operating expenses between $223 million and $238 million. The company aims for breakeven or better adjusted EBITDA.

The company's 10-K filing has been delayed due to additional time required to complete financial reporting procedures. However, this delay does not impact the company's operations or its ability to discuss anticipated results and outlook for 2024.

For more detailed information and to participate in the earnings discussion, investors and analysts can access the conference call and webcast hosted by 3D Systems on February 28, 2024.

Value investors and potential GuruFocus.com members interested in the 3D printing industry and 3D Systems Corp's financial trajectory can find comprehensive data and analysis on GuruFocus.com.

Explore the complete 8-K earnings release (here) from 3D Systems Corp for further details.

This article first appeared on GuruFocus.