4 Auto Equipment Stocks Effectively Navigating Industry Dynamics

Amid the ongoing United Auto Workers (UAW) strike, the prospects of the Zacks Automotive - Original Equipment industry appear uncertain. With no resolution in sight, concerns are rising for auto equipment providers. On the positive side, the industry sees fresh opportunities in new technologies and the increasing demand for electrified and autonomous vehicles. However, cost management is paramount for original equipment manufacturers (OEMs) in this dynamic landscape.

The development of new features and components necessitates substantial financial and labor resources, leading to increased R&D expenses. Thriving in this environment requires industry players to efficiently manage costs to ease pressure on profit margins. Companies like Magna International MGA, Gentex Corp GNTX, Allison Transmission Holdings ALSN, and Adient plc ADNT are better positioned to navigate the industry’s changing landscape.

Industry Overview

The Zacks Automotive - Original Equipment industry includes companies that engage in the designing, manufacture and distribution of automotive equipment components used for manufacturing vehicles. A few of the components manufactured by the participants include the drive axle, engine, gearbox parts, steering, and suspension, as well as brakes. Demand for original equipment depends directly on the sale of vehicles, which, in turn, is heavily reliant on economic growth and consumer confidence. Importantly, the rapidly globalizing world is opening up newer avenues for auto-equipment manufacturers who need to adapt to the changing dynamics through systematic research and development. From a future competitive standpoint, the industry players need to focus on technologies that offer the best value in a short span of time to the market.

Factors to Shape the Industry's Outlook

UAW Strike Sparks Disruptions: The UAW strike against Detroit's major automakers, General Motors, Ford, and Stellantis, now in its fifth week, poses challenges for auto equipment providers as their financial prospects are closely intertwined with the operations of these manufacturing giants. These suppliers heavily rely on the Detroit Three, accounting for 25-45% of their net sales. The strike threatens to disrupt the supply chain, leading to potential production cuts and furloughs among equipment providers, resulting in financial strain and operational challenges. One of the industry participants, BorgWarner, noted that while the strike's initial phase had a modest impact on sales due to its targeted nature, a prolonged strike or broader manufacturing disruptions, like engine and transmission plants, could severely undermine revenues.As the strike continues without a resolution in sight, the outlook for auto equipment providers remains uncertain.The longer the strike persists, the deeper and more lasting the impact will be on these suppliers.

Adapting to Tech Advancements: The auto equipment industry is undergoing a significant transformation, driven by rapid technological advancements and digitization in the automotive sector. Original equipment manufacturers (OEMs) are increasingly focusing on developing technologically advanced components to meet the demands of electric vehicles (EVs) and autonomous vehicles (AVs). Stringent emission regulations are pushing for high-quality, cost-effective auto components, creating opportunities for equipment providers. However, this technological shift poses challenges for OEMs as it requires substantial investments in research and development, leading to increased expenses. Efficient cost management is crucial to maintaining healthy profit margins. The performance of auto equipment providers will depend on their ability to absorb these expenses, adapt to evolving technologies, and capitalize on revenue opportunities.

Challenges Loom Amid High Interest Rates: While high interest rates haven't yet deterred consumer demand for vehicles, there's a growing concern about affordability that could potentially hinder future growth. Cox Automotive's chief economist, Jonathan Smoke, foresees a potential constraint on new vehicle demand due to elevated pricing and record-high interest rates. The cost of vehicle financing has risen significantly, with average interest rates for new-vehicle loans now hovering around 9%, marking a 23-year high. The rising cost of vehicle financing may lead less affluent buyers to delay their purchases. As such, the risk of slowing vehicle demand could adversely impact the industry participants. Furthermore, most industry participants have a global presence, exposing them to forex volatility, which can affect earnings and margins. Distribution inefficiencies, labor difficulties and global logistics issues are also putting pressure on industry players.

Zacks Industry Rank Paints a Somber Picture

The Zacks Automotive – Original Equipment industry is placed within the broader Zacks Auto-Tires-Trucks sector. The industry currently carries a Zacks Industry Rank #147, which places it in the bottom 41% of around 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence about this group’s earnings growth potential. Over the past year, the industry’s earnings estimates for 2023 have declined 29.5%.

Before we present a few stocks that you may invest in to cash in on the industry’s potential, it’s worth taking a look at the industry’s performance and current valuation.

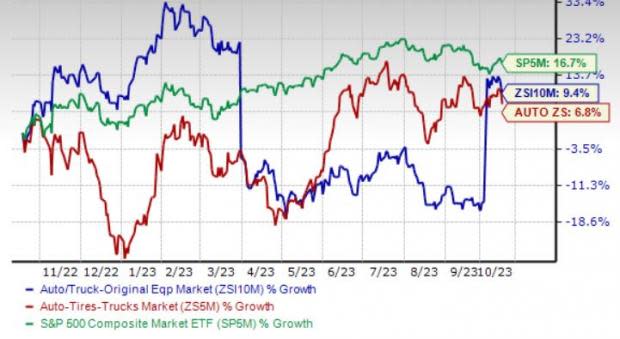

Industry Outperforms Sector but Lags S&P 500

Over the past year, the Zacks Original Equipment industry has outperformed the broader Auto sector but lagged the Zacks S&P 500 composite. The industry has gained 9.4% compared with the sector and S&P’s growth of 6.8% and 16.7%, respectively.

One-Year Price Performance

Industry's Current Valuation

Since automotive companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio.

On the basis of the trailing 12-month enterprise value to EBITDA (EV/EBITDA), the industry is currently trading at 16.2X compared with the S&P 500’s 12.94X and the sector’s 12.57X.

Over the past five years, the industry has traded as high as 19.59X, as low as 3.92X and at a median of 9.42X, as the chart below shows.

EV/EBITDA Ratio (Past Five Years)

Stocks to Buy

Adient is one of the world’s largest automotive seating suppliers. A diverse customer base and international presence have helped the company to create a strong market position. Frequent EV program wins, including platforms introduced by legacy OEMs and new entrants, are set to boost top-line growth. Its strong liquidity profile and share buyback initiative instill confidence. Adient's China operations play a crucial role in driving the company's growth. With a strong presence throughout the country and robust internal engineering capabilities, Adient maintains a prominent position in the Chinese market.

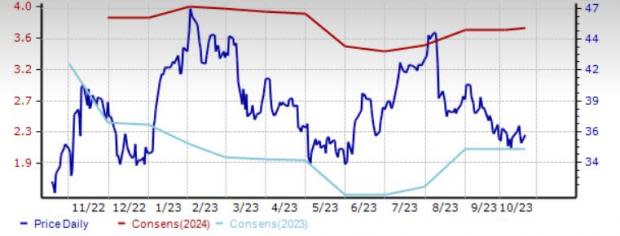

Adient currently holds a Zacks Rank #1 (Strong Buy) and has a VGM Score of A. The Zacks Consensus Estimate for fiscal 2023 top and bottom lines implies year-over-year growth of 9.1% and 1,790.9%, respectively. The consensus mark for 2023 EPS has moved up 15 cents over the past 60 days.

You can see the complete list of today’s Zacks #1 Rank stocks here.

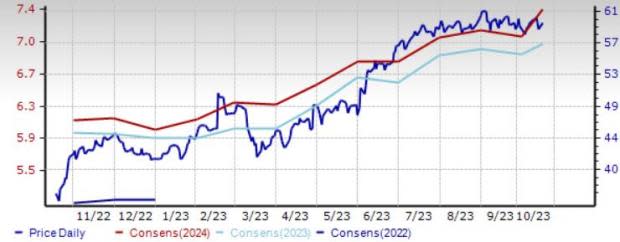

Price & Consensus: ADNT

Magna is a manufacturer and supplier of body exteriors, chassis structures, transmissions, lighting, seating, and fuel systems. It actively focuses on innovation and technology development and stands to benefit from key emerging trends, including electrification and autonomous driving. MGA expects sales from these megatrend product areas to double this year to around $2 billion. Magna’s electrification portfolio includes EtelligentEco, EtelligentForce and EtelligentReach, all of which are aiding top-line growth. The acquisition of the Veoneer Active Safety business has solidified Magna’s position as a global leader in active safety, revving up its ADAS business.

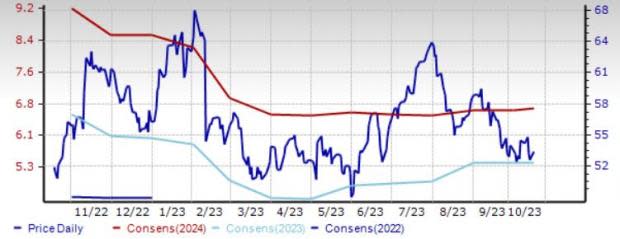

Magna currently holds a Zacks Rank #2 (Buy) and has a VGM Score of A. The Zacks Consensus Estimate for 2023 top and bottom lines implies year-over-year growth of 13% and 31.5%, respectively. The consensus mark for 2023 EPS has moved up 9 cents over the past 60 days.

Price & Consensus: MGA

Gentex supplies auto-dimming mirrors, electronics to autos, fire protection products, and dimmable aircraft windows. Gentex aims at generating meaningful growth driven by product launches, improved product mix and unique technology platforms. The company's industry-leading Full Display Mirror (FDM) is likely to boost its top-line growth trajectory. GNTX expects FDM unit volumes in 2023 to be at least 500,000 units higher than 2022 levels. Gentex’s Integrated Tool Module and HomeLink offer significant growth opportunities. High liquidity and an unlevered balance sheet increase financial flexibility.

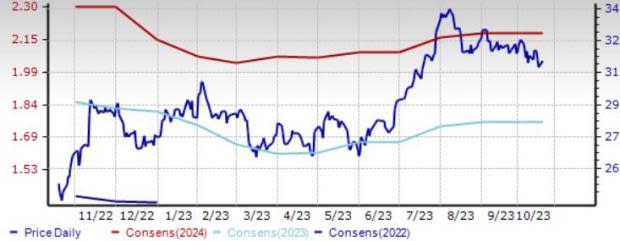

Gentex currently holds a Zacks Rank #2 and has a VGM Score of B. The Zacks Consensus Estimate for 2023 top and bottom lines implies year-over-year growth of 17.3% and 29.4%, respectively. The consensus mark for 2023 EPS has moved up 9 cents over the past 90 days.

Price & Consensus: GNTX

Allison is a manufacturer of fully automatic transmissions for medium and heavy-duty commercial and heavy-tactical U.S. defense vehicles. The strategic buyouts of Walker Die, C&R Tool & Engineering, Vantage Power, the Off-Highway transmission portfolio of AVTEC and AxleTech’s EV systems division are set to boost Allison’s prospects. Regular product launches, including FracTran, TerraTran and the 3414 Regional Haul Series fully automatic transmission, bode well. The company's electric solutions promise growth opportunities. The eGen Flex portfolio and the eGen Force portfolio demonstrate its ability to adapt to the changing dynamics of the auto industry.

Allison currently holds a Zacks Rank #2 and has a VGM Score of B. The Zacks Consensus Estimate for 2023 top and bottom lines implies year-over-year growth of 9.3% and 26.4%, respectively. The consensus mark for 2023 EPS has moved up 6 cents over the past 30 days.

Price & Consensus: ALSN

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Magna International Inc. (MGA) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report

Adient (ADNT) : Free Stock Analysis Report