4 Biotech Stocks Likely to Outpace Q3 Earnings Estimates

As we near the end of the ongoing earnings season, the scorecard for the Medical sector appears pretty decent. The sector primarily comprises pharma/biotech and medical device companies.

Per the Earnings Trends report, as of Nov 8, 88.3% of the companies in the Medical sector, constituting nearly 94.9% of the sector’s market capitalization, reported earnings. While 84.9% beat estimates on earnings, 67.9% beat the same for sales. Earnings declined 17.7% year over year but revenues increased 6.6%. Overall, third-quarter earnings of the Medical sector are expected to decline 16.9% despite a 6.5% sales increase.

Almost all the large biotech companies have already reported their third-quarter results. The picture looks reasonably good. Gilead Sciences, Inc. GILD topped earnings and sales estimates for the third quarter as lower tax expenses boosted the bottom line. The company also raised its annual guidance. Biogen’s third-quarter results were better than expected as it beat estimates on both counts. Biogen also raised its revenue guidance but lowered its guidance for the bottom line to include the impact of dilution from the recent Reata acquisition. Amgen's third-quarter performance was mixed as it beat estimates for earnings but missed the mark for sales.

Zeroing in on Winners

Even though most of the companies from the biotech sector have already announced results, there are a few due to report. Some of them seem poised to surpass estimates for the quarter. Here we have highlighted four biotech companies, Arcellx, Inc. ACLX, Legend Biotech Corporation LEGN, Gracell Biotechnologies Inc. GRCL and Eyenovia EYEN, which are expected to deliver an earnings surprise in their upcoming quarterly results.

Earnings ESP is our proprietary methodology for determining the stocks with the best chance to deliver an earnings surprise. Earnings ESP shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate.

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. The selection can be made with the help of the Zacks Stock Screener.

Our research shows that for stocks with this combination, the chance of an earnings surprise is as high as 70%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

4 Biotech Stocks That Match the Criteria

Arcellx

Arcellx, a clinical-stage biotechnology company, is engineering innovative immunotherapies for cancer and other incurable diseases. Its lead product candidate, CART-ddBCMA, is being developed to treat relapsed or refractory multiple myeloma (rrMM). Arcellx is also advancing its dosable and controllable CAR-T therapy, ARC-SparX, through two clinical-stage programs —ACLX-001 for rrMM, initiated in the second quarter of 2022, and ACLX-002 for relapsed or refractory acute myeloid leukemia and high-risk myelodysplastic syndrome. The company also has a partnership agreement with Kite, a Gilead company for CART-ddBCMA.

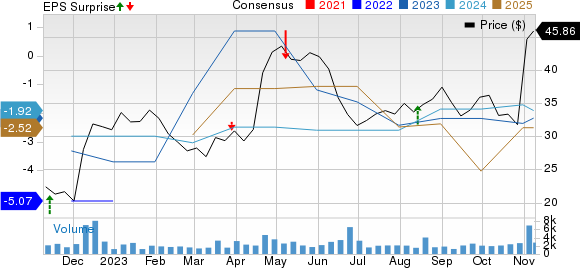

Arcellx has an Earnings ESP of +19.40% and a Zacks Rank #2. The Zacks Consensus Estimate for the third quarter stands at a loss of 56 cents per share. ACLX beat estimates in the last reported quarter by 26.47%.

Arcellx, Inc. Price, Consensus and EPS Surprise

Arcellx, Inc. price-consensus-eps-surprise-chart | Arcellx, Inc. Quote

Legend Biotech

The company develops advanced cell therapies across a diverse array of technology platforms, including autologous and allogeneic chimeric antigen receptor T-cell and natural killer (NK) cell-based immunotherapy. The company’s top line primarily consists of license revenues pursuant to the upfront payments and milestone payments received under its agreement with Janssen Biotech. It also earns collaboration revenues on product sales of Carvykti from Janssen.

Legend Biotech has an Earnings ESP of +18.29% and a Zacks Rank #2. The Zacks Consensus Estimate for the third quarter stands at a loss of 58 cents per share.

LEGN beat estimates in the last reported quarter by 60.87%. The company is scheduled to report third-quarter results on Nov 20.

Legend Biotech Corporation Sponsored ADR Price, Consensus and EPS Surprise

Legend Biotech Corporation Sponsored ADR price-consensus-eps-surprise-chart | Legend Biotech Corporation Sponsored ADR Quote

Gracell Biotechnologies

Gracell has an Earnings ESP of +2.91% and a Zacks Rank #3. The Zacks Consensus Estimate for the third quarter stands at a loss of 26 cents per share. The company is scheduled to report third-quarter results on Nov 13.

Gracell beat estimates in the last reported quarter by 18.92%.

Gracell is developing innovative and highly efficacious cell therapies for the treatment of cancer and autoimmune diseases. The lead candidate GC012F is currently being evaluated in clinical studies for the treatment of multiple myeloma, B-NHL and systemic lupus erythematosus.

Gracell Biotechnologies Inc. Sponsored ADR Price, Consensus and EPS Surprise

Gracell Biotechnologies Inc. Sponsored ADR price-consensus-eps-surprise-chart | Gracell Biotechnologies Inc. Sponsored ADR Quote

Eyenovia

Eyenovia, a commercial-stage ophthalmic pharmaceutical technology company, is focused on commercializing Mydcombi for mydriasis. Eyenovia recently acquired the U.S. commercial rights to APP13007 (clobetasol propionate ophthalmic nanosuspension, 0.05%) from Formosa Pharmaceuticals. The candidate is under review in the United States for the reduction of pain and inflammation following ocular surgery.

Eyenovia, Inc. Price, Consensus and EPS Surprise

Eyenovia, Inc. price-consensus-eps-surprise-chart | Eyenovia, Inc. Quote

Eyenovia has an Earnings ESP of +2.63% and a Zacks Rank #3. The Zacks Consensus Estimate for the third quarter stands at a loss of 19 cents per share. Eyenovia beat estimates in three of the last four quarters and missed in the remaining one, delivering an average earnings surprise of 13.78%.

The company is scheduled to report third-quarter results on Nov 13.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Gilead Sciences, Inc. (GILD) : Free Stock Analysis Report

Eyenovia, Inc. (EYEN) : Free Stock Analysis Report

Legend Biotech Corporation Sponsored ADR (LEGN) : Free Stock Analysis Report

Gracell Biotechnologies Inc. Sponsored ADR (GRCL) : Free Stock Analysis Report

Arcellx, Inc. (ACLX) : Free Stock Analysis Report