4 Computer Peripheral Stocks to Watch Amid Industry Challenges

The Zacks Computer-Peripheral Equipment industry has been reeling under the effects of macroeconomic headwinds, including inflationary pressure and higher interest rates. These have induced sluggishness in IT spending, affecting the demand for computer peripherals. The industry is also showing signs of struggle as demand for remote working and online learning-related computer peripherals is declining with the post-pandemic reopening of economies. Also, as people stay less at home, the time spent playing video games has decreased significantly, hurting the demand for gaming accessories.

Nevertheless, Logitech International LOGI, Stratasys SSYS, Immersion IMMR and TransAct Technologies TACT are well poised to benefit from the growing demand for professional gaming accessories, touchscreen and wireless devices, smart glasses and RFID (Radio Frequency Identification) solutions. Moreover, the solid demand for 3D-printed health equipment like face shields, nasal swabs and ventilator parts has been a tailwind.

Industry Description

The Zacks Computer-Peripheral Equipment industry comprises companies offering computer input, output and storage devices. These include keyboards, mice, LCD panels, smart glass, analog to digital imaging solutions, touch sensors, 3D printers & additive manufacturing, and transaction-based printer products, among others. Moreover, video gaming accessories, including gaming mice, wired gaming headsets, in-ear gaming headphones and controllers for Xbox One and Playstation, are offered by these companies. Notably, the highly competitive nature of the industry is encouraging participants to come up with innovative and relevant products to meet the current demand trend. This is strengthening their product portfolios.

4 Trends Shaping the Future of the Computer-Peripheral Equipment Industry

Shift in Consumer Preference a Key Catalyst: The gradual shift in consumer preference from mobile gaming to a more professional gaming experience is a major growth driver. The launch of advanced gaming devices and the rising popularity of e-sports leagues are likely to boost prospects. Markedly, e-sports will also likely continue aiding the total addressable market in the gaming peripherals industry. In addition, the 3D printing market presents a favorable long-term investment opportunity, as a large number of engineers, designers, architects and entrepreneurs are resorting to 3D solutions for primary designing and product modeling. Also, the coronavirus outbreak is resulting in massive demand for gaming equipment and 3D-printed medical equipment, which is a major driving force for this industry during these trying times.

Expanding Global Footprint: The expansion of the total addressable market bodes well for the industry participants. Deepening penetration into price-sensitive regions like the Asia Pacific and the Middle East & Africa through low-cost quality products boosts growth prospects.

Macroeconomic Headwinds Might Hurt IT Spending: Rising interest rates and inflationary pressures are hurting consumer spending. On the other hand, enterprises are postponing their large IT spending plans due to a weakening global economy amid ongoing macroeconomic and geopolitical issues. This does not bode well for the Computer-Peripheral Equipment market’s prospects in the near term.

Elevated Operating Expenses to Hurt Profitability: To survive in the highly competitive computer peripheral market, each player is aggressively investing in research and development to enhance their product portfolio and broaden their capabilities. Moreover, companies are looking to improve their sales and marketing capabilities, particularly by increasing their sales force. Therefore, elevated operating expenses to capture more market share are likely to dent margins in the near term.

Zacks Industry Rank Indicates Bleak Prospects

The Zacks Computer-Peripheral Equipment industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #225, which places it in the bottom 10% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all member stocks, indicates dim near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

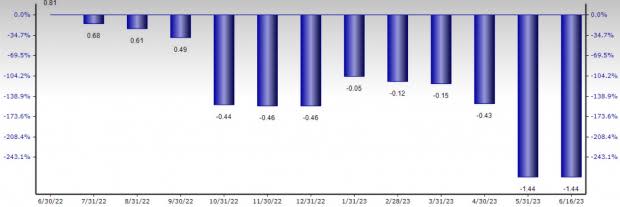

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of the negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic about this group’s earnings growth potential. The industry’s estimate for 2023 has moved down to a loss of $1.44 cents from earnings of 81 cents expected a year ago.

Industry Fiscal 2023 EPS Estimate Revision

Despite the gloomy industry outlook, a few stocks are worth buying in the market. But before we present the top industry picks, it is worth taking a look at the industry’s shareholder returns and current valuation first.

Industry Outperforms S&P 500 and Sector

The Zacks Computer-Peripheral Equipment industry has outperformed the S&P 500 composite and the broader Zacks Computer and Technology sector in the trailing 12 months.

The industry has rallied 60.7% during this period. The S&P 500 and the broader sector have gained 17.1% and 25.8%, respectively, over the same time frame.

One-Year Price Performance

Industry's Current Valuation

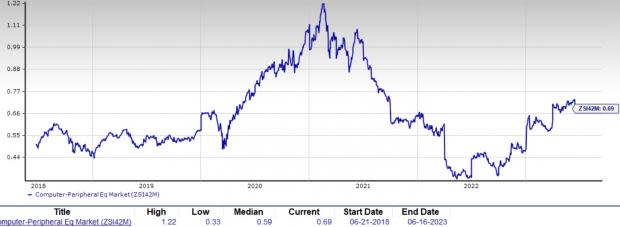

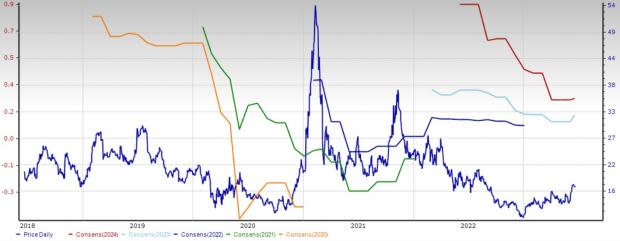

On the basis of the trailing 12-month P/S, which is a commonly-used multiple for valuing computer peripheral stocks, we see that the industry is currently trading at 0.69X compared with the S&P 500’s 3.83X and the Zacks Computer and Technology sector’s 4.28X.

Over the last five years, the industry has traded as high as 1.22X, as low as 0.33X and at the median of 0.59X, as the chart below shows.

Trailing 12-Month Price-to-Sales (P/S) Ratio

4 Stocks to Watch

TransAct Technologies: The company designs, develops, manufactures and markets transaction-based printers and related products under the ITHACA and MAGNETEC and TRANSACT.COM brand names. This Zacks Rank #2 (Buy) company focuses on five vertical markets: point-of-sale (POS), gaming and lottery, financial services, kiosk and the Internet.

TransAct Technologies is benefiting from growing demand for its products and services amid accelerated digital transformation and business automation across organizations. The company's printers are trusted worldwide to provide crisp, clean transaction records from receipts, tickets and coupons, register journals and other documents.

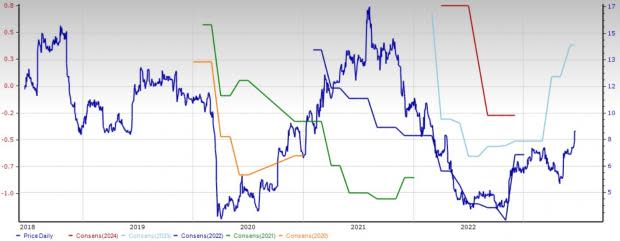

The Zacks Consensus Estimate for 2023 earnings has been revised upward to 43 per share from 13 cents projected 60 days ago. Shares of this Zacks Rank #1 (Strong Buy) company have rallied 122.4% over the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: TACT

Immersion: The company develops hardware and software technologies that enable users to interact with computers using their sense of touch. Their patented technologies, which are branded TouchSense, enable devices such as mice, joysticks, knobs and medical simulation products to deliver tactile sensations that correspond to on-screen events.

Immersion is a small company with a market cap of around $237 million. But it is seeing some very strong growth because of its innovative technology and new customer wins. This Zacks Rank #2 company focuses on four application areas — computing and entertainment, medical simulation, professional and industrial, and three-dimensional capture and interaction.

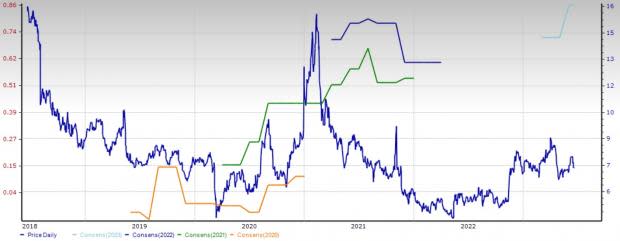

The Zacks Consensus Estimate for 2023 earnings has been revised upward by 14 cents in the last 60 days to 86 cents per share. IMMR stock has gained 23.1% in the past 12 months.

Price and Consensus: IMMR

Logitech: It is a global leader in peripherals for personal computers and other digital platforms. This Zacks Rank #3 (Hold) company develops and markets innovative products in PC navigation, Internet communications, digital music, home-entertainment control, video security, interactive gaming and wireless devices.

Logitech’s stronger-than-expected fourth-quarter fiscal 2023 results have boosted confidence about its recovery from the post-pandemic downturn. Heightening hybrid work trends are likely to boost demand for the company’s video collaboration, keyboards & combos and pointing device tools. The thriving cloud-based video conferencing services continue to be the key catalyst. The rising adoption of new mobile platforms in both mature and emerging markets will fuel demand for its peripherals and accessories. Its partnerships with cloud providers like Zoom Video, Microsoft and Google are major positives.

The Zacks Consensus Estimate for fiscal 2024 earnings has been revised downward by 23 cents in the past 60 days to $3.08 per share. The stock has appreciated 5.7% in a year’s time.

Price and Consensus: LOGI

Stratasys: This Eden Prairie, MN-based company is benefiting from an increase in demand for 3D-printed medical equipment. Notably, the adoption of PolyJet and FDM printers has been encouraging. Markedly, Stratasys’ machines facilitate prototyping within a few hours, reducing development time and upfront costs. Also, the company’s spool-based system compares favorably with UV polymer systems. For these reasons, we think the company maintains a leading position in rapid prototyping machines. Apart from these, the company’s RedEye RPM is the world's largest RP and part-building service.

This 3D printing company has recently made strategic partnerships with the likes of Schneider Electric, Boeing, Ford Motor, Siemens, Boom Supersonic and United Launch Alliance. These collaborations are aimed at introducing advanced 3D printing technologies in the aerospace and automotive industries. Additionally, this Zacks Rank #3 company’s cost-control initiatives are anticipated to reflect positively on the bottom line.

The consensus mark for 2023 earnings has been revised upward by 5 cents in the past 30 days to 19 cents per share. The stock has depreciated 7.5% in a year’s time.

Price and Consensus: SSYS

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Logitech International S.A. (LOGI) : Free Stock Analysis Report

Stratasys, Ltd. (SSYS) : Free Stock Analysis Report

Immersion Corporation (IMMR) : Free Stock Analysis Report

TransAct Technologies Incorporated (TACT) : Free Stock Analysis Report