4 Deep Value Net-Net Stocks

- By Rupert Hargreaves

It may be hard to believe, but there are still some stocks out there that qualify as traditional value investments. With Goldman Sachs claiming "value investing is dead" and the market pushing to new all-time highs almost every week, you could be forgiven for thinking value no longer exists in the market.

Regardless, there are some opportunities out there that are currently trading below book value and may be potential Grahamesque buys.

Warning! GuruFocus has detected 4 Warning Signs with WLKR. Click here to check it out.

The intrinsic value of WLKR

Excluding early-stage pharmaceutical and biotechnology companies, a screen for companies trading at a price-to-net working capital ratio of less than one returns several impressive results, including investment manager Manning & Napier Inc. (MN), Support.com Inc.(SPRT), Surge Components Inc. (SPRS) and Walker Innovation Inc. (WLKR).

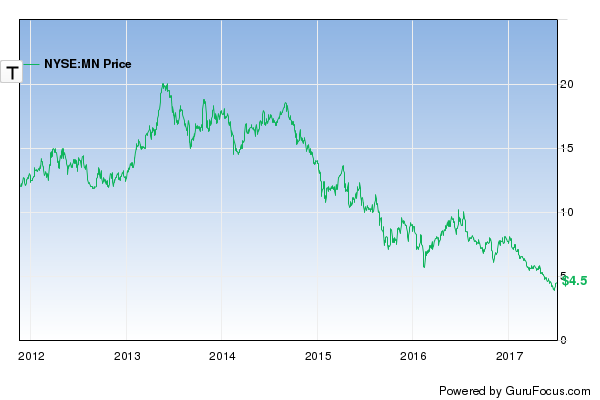

Falling income but strong balance sheet

Manning & Napier provides a range of investment solutions through separately managed accounts, mutual funds and collective investment trust funds, as well as a range of consultative services. The company has been under pressure in recent years with the shift away from active management toward passive management, hitting revenue. Revenue has declined from $392 million in 2014 to $250 million for 2016. Operating profit has fallen from $133 million to $89.4 million. Still, despite a decline in profitability, book value per share has remained relatively stable, falling from $12.3 to $10.9. With a current price of $4.5 per share, Manning & Napier trades with a price to tangible book value of 0.43, a forward price-earnings (P/E) ratio of 10.3 and a price-to-net working capital ratio of 0.7.

Steady growth

Support.com provides cloud-based software and services for technology support, offering outsourced support services for service providers, retailers, Internet of Things (IoT) solution providers and technology companies. Unfortunately, in recent years, the company has struggled to achieve steady revenue growth and profitability has remained elusive. Nonetheless, as a value investment, Support.com looks relatively attractive. The company's enterprise value is $-7.8 million, and a market capitalization of $43 million was eclipsed by a net cash balance of $53.4 million at the end of 2016. With total liabilities of $9.9 million at the end of 2016 and current liabilities of $64.2 million, the company is trading at a price to net current asset value ratio of 0.86.

Falling profits

Surge Components produces electronic products and components, including capacitors, semiconductor rectifiers, transistors and diodes, which are used in a variety of electronic equipment processes. Revenue has steadily risen over the past several years, growing from $23.2 million in 2011 to $29.6 million in 2016. On the other hand, operating profit has declined from $1.4 million to $-500,000 as margins have collapsed. Despite falling profits, the company has a robust balance sheet and currently trades at a price to tangible book ratio of 0.6. With over $7.1 million of cash at the end of 2016, total current assets of $16.1 million and total liabilities of $5.2 million, the company trades at a price-to-net working capital ratio of 0.9, once again appearing to offer deep value.

Lumpy income

Walker Innovation is an unusual company that is in the business of intellectual property management. The company seeks to develop, license and otherwise enforce patented technologies through its subsidiaries. It is also engaged in granting of intellectual property rights for the use of, or pertaining to, its patented technologies. Income from these businesses is unpredictable, which may have resulted in some degree of misunderstanding among investors. With a cash balance of $9.2 million the end of the first quarter, against a market capitalization of $8.3 million, the company's enterprise value is $-911,000 at the time of writing. Total liabilities at the end of 2016 were only $1 million, compared to total current assets of $10.7 million.

Disclosure: The author owns no stock mentioned.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with WLKR. Click here to check it out.

The intrinsic value of WLKR