4 Defensive Stocks to Ride Out Volatility on Wall Street

A sharp rise in the long-dated treasury yield and China’s economic distress dented investors’ confidence, leading to volatility in the stock market this month. August, traditionally, has also been a volatile month for the stock market.

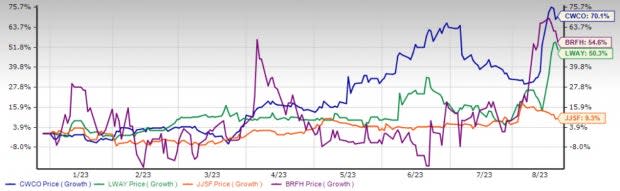

Hence, astute investors should place their bets on defensive stocks like Consolidated Water CWCO, Lifeway Foods LWAY, J & J Snack Foods JJSF and Barfresh Food Group BRFH to safeguard their portfolio returns.

A Choppy Wall Street

The Dow may have snapped a three-day losing streak and gained slightly on Aug 18, but it still ended in the red for the week. While the Dow slipped 2.2% last week, the S&P 500 and the Nasdaq dropped 2.1% and 2.6%, respectively.

Per the Dow Jones Market Data, both the S&P 500 and the Nasdaq registered their third consecutive week of declines. Meanwhile, the CBOE Volatility Index has touched its highest level in almost three months, indicating an uptick in investor anxiety.

Treasury Yields Surge

The current rise in treasury yields adversely impacted the stock market. After all, the value of stocks’ future earnings looks less appealing than bonds amid an increase in bond yields.

So, what is leading to the rise in treasury yields? Most of the Fed officials remained hawkish in the July meeting, thanks to persistent inflationary concerns. Most of them agreed that “further tightening of monetary policy” is required to tame price pressures, thereby signaling more interest rate hikes soon (read more: 3 Stocks to Gain as Fed Hints at Further Higher Rates).

Now, when interest rates increase, prices of bonds decline, and yields go up. Dow Jones Market Data added that the 10-year Treasury Yield surged for the fifth successive week to finish at 4.251% on Aug 18. The 10-year Treasury Yield has now touched its highest level in more than 15 years.

China Woes Bite

Investors are also grappling with the deepening slowdown in China’s economy. Subdued demand for goods across the globe curtailed the second-largest economy’s exports and imports. China, in reality, is facing deflation.

The country’s wholesale prices fell as consumers are not willing to spend, while consumer prices have barely ticked up. China is at the moment in high debt, and that could easily have a spiraling impact globally.

In the meantime, in the U.S. courts, Evergrande has filed for bankruptcy protection. This has raised concerns about the credibility of China’s real estate market, and its implications on the rest of the economies across the globe including the United States.

August a Notorious Month for the Stock Market

The month of August is undoubtedly living up to its reputation of being an ugly month for the equity market. Anyhow, this month is expected to be volatile due to lesser trading volumes.

According to Morningstar, August has been the worst-performing month for stocks since 1986. The popular adage, “sell in May and go away” is mostly due to the significant gyration that stocks face in August (read more: 3 Top Dividend Stocks to Sail Through a Choppy August).

Why Buy Defensive Stocks Now?

As Wall Street is plagued with an array of uncertainties, from an investment standpoint, defensive stocks seem to be the safest option. These companies are generally non-cyclical in nature, or whose businesses are not involved with activities in the broader market.

The demand for their products, and services is always constant despite market upheaval, and they belong to the utility and consumer staples sectors. This is because people can’t live without electricity, water, gas and food.

4 Solid Choices

We have, thus, selected four solid stocks from the aforesaid defensive sectors that boast a Zacks Rank #1 (Strong Buy) or 2 (Buy) and a VGM Score of ‘A’ or ‘B’. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three metrics. Such a score allows you to eliminate the negative aspects of stocks and select winners.

Consolidated Water is involved in the development and operation of seawater desalination plants and water distribution systems. CWCO currently has a Zacks Rank #2 and a VGM Score of B. The Zacks Consensus Estimate for its current-year earnings has increased 36.1% over the past 60 days. The company’s expected earnings growth for the current year is 144.4%.

Lifeway Foods produces Kefir, a drinkable product similar to, but distinct from yogurt. LWAY currently has a Zacks Rank #1 and a VGM Score of B. The Zacks Consensus Estimate for its current-year earnings has increased 76.5% over the past 60 days. The company’s expected earnings growth for the current year is 900%.

J & J Snack Foods manufactures branded niche snack foods and frozen beverages. JJSF currently has a Zacks Rank #1 and a VGM Score of B. The Zacks Consensus Estimate for its current-year earnings has increased 16.4% over the past 60 days. The company’s expected earnings growth for the current year is 62.3%.

Barfresh Food Group is a manufacturer of ready-to-blend beverages. BRFH currently has a Zacks Rank #2 and a VGM Score of B. The Zacks Consensus Estimate for its current-year earnings has increased 26.3% over the past 60 days. The company’s expected earnings growth for the current year is 65.9%.

Shares of Consolidated Water, Lifeway Foods, J & J Snack Foods and Barfresh Food Group have gained 70.1%, 50.3%, 9.3% and 54.6%, individually, so far this year.

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lifeway Foods, Inc. (LWAY) : Free Stock Analysis Report

J & J Snack Foods Corp. (JJSF) : Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO) : Free Stock Analysis Report

Barfresh Food Group Inc. (BRFH) : Free Stock Analysis Report