4 Dividend-Paying Stocks to Watch Amid Market Uncertainties

Tech stocks have made a remarkable comeback in the first half of 2023 after a massive sell-off in 2022 on recession concerns, inflationary pressure, increased oil prices and higher interest rates. With a year-to-date (YTD) rise of 30.7%, the tech-laden Nasdaq Composite has outperformed The Dow Jones Industrial Average and the S&P 500 index’s increase of 2.3% and 14.9%, respectively.

Technology stocks have more than 50% of weightage in the Nasdaq Composite index. Technology Select Sector SPDR (XLK), the most important component of the broad market index, has returned 38.2% YTD.

However, with persistent inflationary pressure and softening demand, the fears of recession have not subsided yet. Tech companies are witnessing lower demand for their products and solutions as organizations are postponing their large IT spending plans due to a weakening global economy amid ongoing macroeconomic and geopolitical issues.

This may negatively impact the overall financial performances of tech companies. Therefore, we believe that investing in high-quality dividend-paying tech stocks like — Broadcom AVGO, Avnet AVT, Texas Instruments TXN and Corning GLW — amid the ongoing macroeconomic headwinds and the highly volatile market scenario might fetch handsome returns.

A stock with a history of increasing dividends is considered healthy and offers a capital appreciation opportunity irrespective of stock market movements. Dividend growth stocks generally act as a hedge against economic uncertainty and offer downside protection, with a consistent increase in payouts.

How to Identify Stocks?

We ran the Zacks Stocks Screener to identify stocks that have a dividend yield of more than 2%, with five-year historical dividend growth of more than 0.1%. Furthermore, we have narrowed down our search by considering stocks with a Zacks Rank #3 (Hold) and a dividend payout ratio of less than 60%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s discuss the abovementioned tech stocks in detail:

Broadcom is a premier designer, developer and global supplier of a broad range of semiconductor devices with a focus on complex digital and mixed-signal complementary metal oxide semiconductor-based devices and analog III-V-based products.

Broadcom is benefiting from the strong demand for its networking solutions, PON fiber and cable modems. The strong adoption of Broadcom’s server storage solutions by hyperscalers, acceleration in 5G deployment, production ramp-up and an increase in radio frequency content are driving top-line growth.

The company is also benefiting from the strong deployment of generative AI by hyperscalers, service providers and enterprises. Additionally, the robust adoption of Wi-Fi 6 and Wi-Fi 6E for access gateways due to solid demand from homes, enterprises, telcos and other service providers is expected to continue driving revenue growth in the broadband end market.

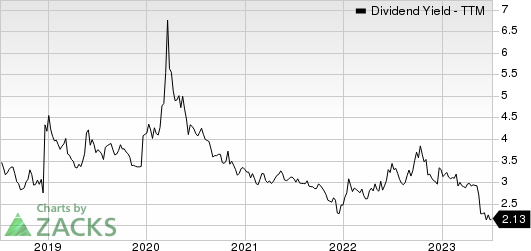

The stock has a dividend yield of 2.1% and five-year historical dividend growth of 20.4%. Further, AVGO's payout ratio is 48% of earnings at present. Check Broadcom’s dividend history here.

Broadcom Inc. Dividend Yield (TTM)

Broadcom Inc. dividend-yield-ttm | Broadcom Inc. Quote

Avnet is one of the world’s largest distributors of electronic components and computer products. The company’s customer base includes original equipment manufacturers, electronic manufacturing services providers, original design manufacturers and value-added resellers. Avnet maintains an extensive inventory, including electronic products from more than 300 component and system manufacturers, which it distributes to customers worldwide.

Avnet is benefiting from the robust demand for its products in the communication and defense market. Strong growth across all markets is an upside. Its continued focus on boosting the Internet of Things capabilities is helping it expand in newer markets and gain customers.

Avnet’s expanding partner base and acquisitions are likely to boost top-line growth. Moreover, cost-saving efforts are aiding profitability.

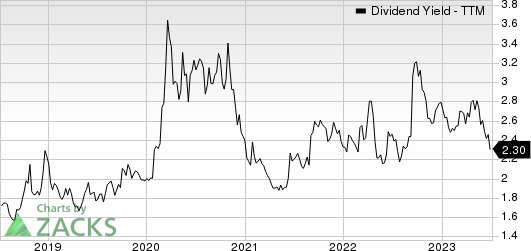

The company has a dividend yield of 2.3% and five-year annualized dividend growth of approximately 9%. Its dividend payout ratio is 14% of earnings. Check Avnet’s dividend history here.

Avnet, Inc. Dividend Yield (TTM)

Avnet, Inc. dividend-yield-ttm | Avnet, Inc. Quote

Texas Instruments is an original equipment manufacturer of analog, mixed-signal and digital signal-processing integrated circuits. The company has manufacturing and design facilities, including wafer fabrication and assembly/test operations in North America, Asia and Europe.

Texas Instruments is benefiting from a solid rebound in the automotive market. Further, a solid demand environment in the industrial, communication equipment and enterprise system markets is a major upside.

Additionally, solid momentum across the Analog segment due to a robust signal chain and power product lines is contributing well to the top line. Also, the robust Embedded Processing segment is performing well.

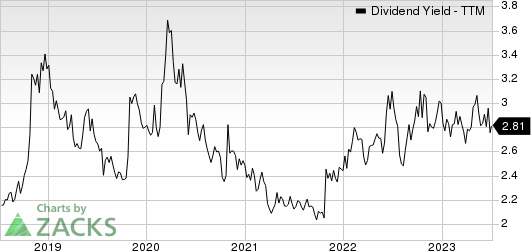

The company has a dividend yield of 2.8% and five-year annualized dividend growth of approximately 14.9%. Its dividend payout ratio is 56% of earnings. Check Texas Instruments’ dividend history here.

Texas Instruments Incorporated Dividend Yield (TTM)

Texas Instruments Incorporated dividend-yield-ttm | Texas Instruments Incorporated Quote

Corning started as a glass business in 1851, and since then, it has developed its glass technologies to produce advanced glass substrates used in a large number of applications across multiple markets, including display technologies, optical communications, environmental technologies, specialty materials and life sciences.

Corning is well-positioned to address the growing customer demand and enhance shareholder value, driven by its portfolio strength. Improved market conditions in China and the signs of the recovery of panel maker utilization are tailwinds.

Moreover, 5G, broadband and cloud computing continue to drive strong growth, while Corning’s ability to better serve the secular increase in the demand for LCD and OLED panels is laudable. The initiative to optimize the cost structure while maintaining the flexibility to address evolving market conditions is an upside.

GLW has a dividend yield of 3.2% and five-year annualized dividend growth of 10.2%. Also, the company's payout ratio is 57% of earnings at present. Check Corning’s dividend history here.

Corning Incorporated Dividend Yield (TTM)

Corning Incorporated dividend-yield-ttm | Corning Incorporated Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Avnet, Inc. (AVT) : Free Stock Analysis Report

Corning Incorporated (GLW) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report