4 Dow Titans Ready to Topple Over At Any Moment

All eyes are on upcoming U.S.-China trade talks next week. Hopes were initially high that it could represent the first step in deescalation, but those hopes were dashed when another tit-for-tat round of tariffs hit. This time the dispute featured $16 billion in new import charges.

Adding to the pressure on prices, despite the current bull market recently passing into “longest ever” territory, are ongoing headlines concerning President Trump and his one-time associates. Trump himself tweeted that if he is impeached the stock market would crash and everyone would be poorer.

In light of all these headwinds, a number of blue chip large-cap stocks are rolling over. Here are four Dow Jones Industrial Average components that are looking ready to move lower:

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

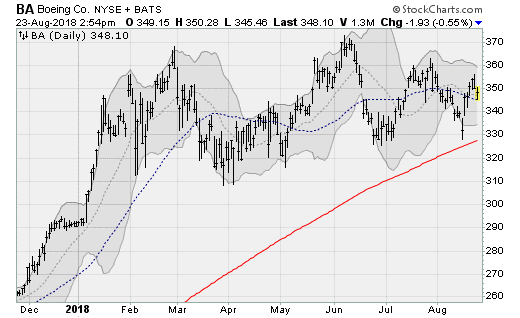

Dow Titans at Risk: Boeing (BA)

Boeing (NYSE:BA) shares are threatening to fall back below their 50-day moving average as a year-to-date consolidation continues to weigh on sentiment. Watch for a break of the 200-day moving average as trade tensions worsen, something that hasn’t happened since the middle of 2016 when shares were trading for around $120.

The company will next report results on Oct. 24, before the bell. Analysts are looking for earnings of $3.65-per-share on revenues of $24.9 billion. When the company last reported on July 25, earnings of $3.33-per-share beat estimates by 8 cents on a 5.2% rise in revenues.

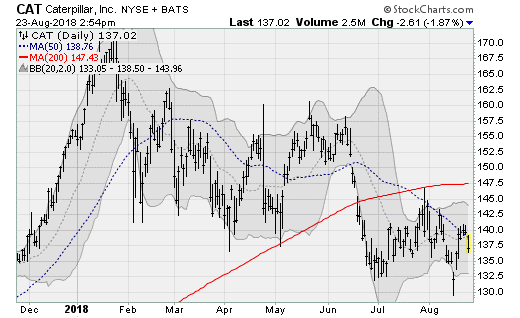

Dow Titans at Risk: Caterpillar (CAT)

Caterpillar (NYSE:CAT) shares are being turned away from a test of the 50-day moving average and remain below their 200-day average. CAT stock recently suffered a “death cross” for the first time since 2014 after the 50-day average crossed below the 200-day average. Again, trade tensions are in play as the company is vulnerable to a closing of access to Chinese markets and suppliers.

The company will next report results on Oct. 29, before the bell. Analysts are looking for earnings of $2.76-per-share on revenues of $13.13 billion. When the company last reported on July 30, earnings of $2.97-beat-estimates by 23 cents on a 23.7% rise in revenues.

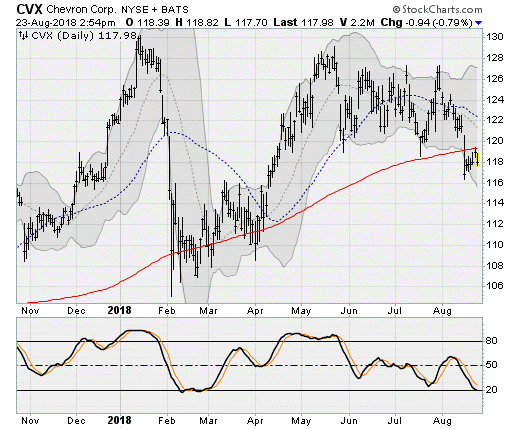

Dow Titans at Risk: Chevron (CVX)

Chevron (NYSE:CVX) shares have fallen back below their 200-day moving average, down more than 9% from their January high as double-top resistance proves intractable. Crude oil prices have settled back below the $70-a-barrel level on ongoing pressure from a strengthening dollar and concerns about a surge in U.S. production.

The company will next report results on Oct. 26, before the bell. Analysts are looking for earnings of $2.28-per-share on revenues of $47.5 billion. When the company last reported on July 27, earnings of $1.78 missed estimates by 31 cents on a 22.5% rise in revenues.

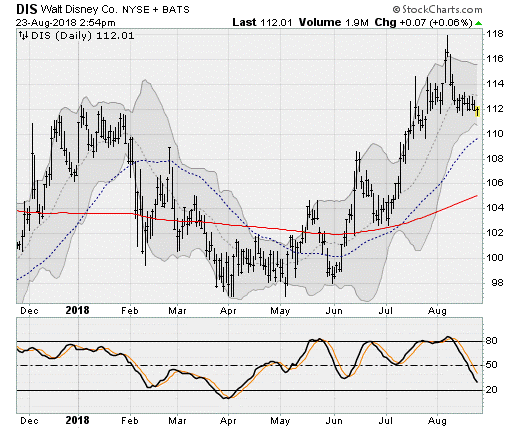

Dow Titans at Risk: Disney (DIS)

Disney (NYSE:DIS) shares are struggling, threatening to fall below a two-month support zone near $112 after the 20% uptrend off of the April-May lows stalled out near the January highs. Recently, quarterly numbers were disappointing as the latest Star Wars move floundered, doubts grow about its purchase of Twenty-First Century Fox (NASDAQ:FOXA) and the looming launch of its own streaming service.

The company will next report results on Nov. 6, after the close. Analysts are looking for earnings of $1.31-per-share on revenues of $13.84 billion. When the company last reported on Aug. 7, earnings of $1.87 missed estimates by 8 cents on a 7% rise in revenues.

Anthony Mirhaydari is the founder of the Edge (ETFs) and Edge Pro (Options) investment advisory newsletters. Free two- and four-week trial offers have been extended to InvestorPlace readers.

The post 4 Dow Titans Ready to Topple Over At Any Moment appeared first on InvestorPlace.